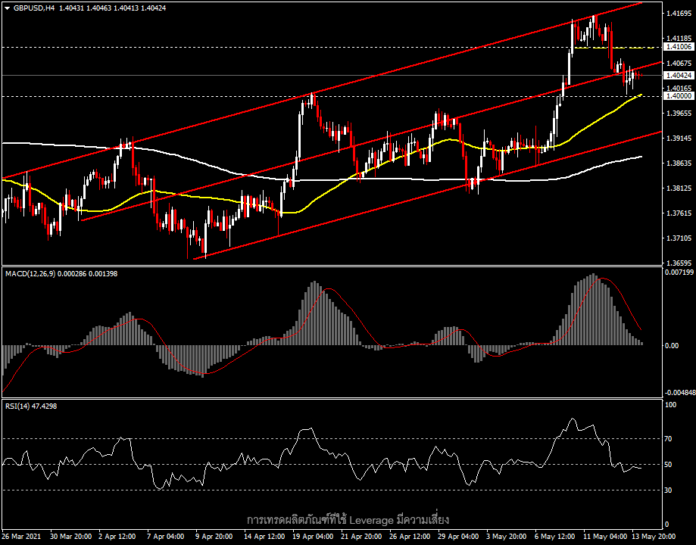

GBPUSD, H4

Last week the Bank of England (BoE) was the second central bank after the Bank of Canada (BoC) to have signaled a quantitative easing of its bond purchase limit (QE), from £4.4 billion pounds a week to 3.4 billion. There was no change in the total bond purchase target of £895 billion, although the vote on this was not unanimous as one of the nine members of the MPC voted to reduce it to just £845 billion.

Britain’s March inflation came out at 0.7% per month, higher than the 0.4% in February but slightly shy of the median forecast for 0.8%. Core CPI rose to 1.1% y/y from 0.9% y/y in February, as had been expected. While April’s inflation report comes out next week (19 May), the latest UK GDP report came out at -1.5% per quarter after two previous expansion quarters. The annual rate of -6.1% marks the fifth consecutive quarter contraction.

This week the GBPUSD pair moved again into the multi-year high zone at 1.4160 as the Dollar continued to weaken from the Non-Farm figures announced on Friday. The announcement of the US inflation figure, which came out higher than expected, caused the Dollar to strengthen and press this pair down to the psychological support 1.4000 around the MA50 line, which is now trading at 1.4040.

Technically today, H4 has no clear direction. With the price narrowed above the MA50, the MACD moved lower near the 0 line, while the RSI flattened at 47. However, with US Retail Sales & the UoM Sentiment Index plus UK CB Index, later today, the pair could fluctuate to close the week. The key support is at 1.4000, while the first resistance is at 1.4100, the 61.8 Fibo level from the May 11 high to the May 13 low.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.