Walmart Inc (#Walmart) is the United States’ largest retailer, with more than 11,400 storefronts selling general merchandise and many other consumer goods. The 2021 the company accounted for 78% of sales in the US, 6% from Mexico and Central America, and 4% from Canada for the quarter-ended April 2021 which will be released Tuesday, May 18, before the US market opens. Zacks is forecasting a $1.21 return per share of the company, lower than the previous quarter’s $1.39 but higher than the $1.18 in the same quarter in the previous year, while sales forecasts for the quarter are $131.31 billion, lower than sales in the previous several quarters.

What’s interesting about Walmart’s quarterly report is the addition of Walmart+ that came out in September. Offering unlimited free delivery to customers, Walmart+ was key to maintaining a customer base during the Covid-19 outbreak, though the company did not release a Walmart+ membership number in its February report.

Last year, Walmart incurred more than $4 billion in COVID-related costs while they are planning to spend another $14 billion this year enhance the capabilities of the supply chain and automation and meet increasing demand. These expenses may result in the company’s revenues being fixed or reduced.

Since the start of the year Walmart’s share price has fallen -3.21%; last week the price closed at the 139.50 zone below the 200-DMA line in a bearish Channel. That comes in the form of a triangle indicating increased volatility before the reporting income. The first support line is at the low zone of April at 135.00, but if the earnings report comes out good the stock may rise above the 200-DMA again, with the first resistance at the original high at 142.00.

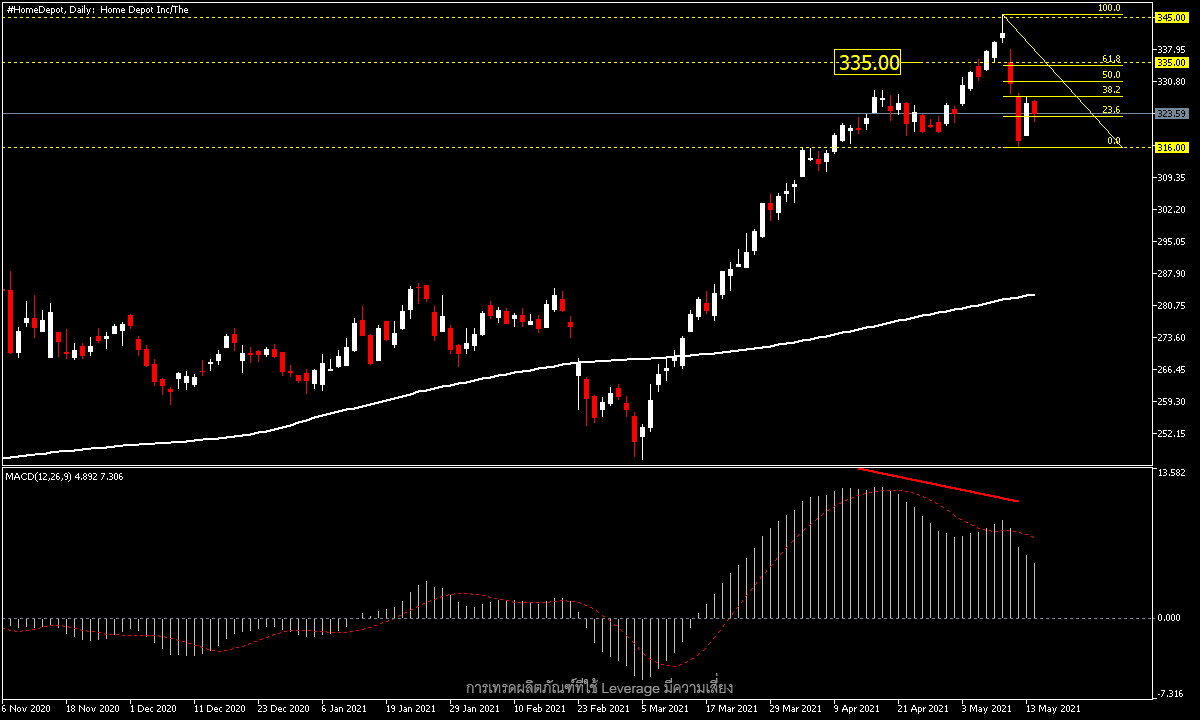

Home Depot Inc (#HomeDepot) is the world’s largest home improvement retailer and is also scheduled to report earnings on Tuesday, May 18, ahead of the open, with Zacks forecasting a return per share for the quarter of $2.98, higher than the $2.08 in the same quarter a year ago, while revenue forecasts are $34.49 billion.

The Home Depot stock price hit an all-time high last week. Since the start of the year, the stock price has risen over 21.84%, prompting investors to expect to see a new all-time high in this quarter’s earnings report. However, in the latest quarter, consumer behavior may have changed somewhat due to the progress of the vaccination program and relaxation of lockdown measures. During the last quarter 56% of the US population aged 18 and over were vaccinated, with a goal to reach 70% by June 4.

Last week the share price closed at the 323.50 zone, down from the all-time high at 345.00, where it now sees a Bearish Divergence that could lead to a sharp drop in the company’s share price if earnings do not meet expectations. The first support line is at the latest low at 316.00, and if the report turns out good the first uptrend price target will be 335.00, which is the 61.8% Fib. retracement level, and the original all-time high 345.00 will be the next target.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.