USOIL has bounced nearly 2% from Thursday’s close, peaking at $63.19. Prices had fallen the past 3 days with the asset being down just fractionally this week and bottoming at $61.50. Prices fell sharply on Wednesday on reports that US sanctions on Iran may be lifted as part of a nuclear deal. This would allow the country to further ramp up production and exports and it could bring as much as 2.0 mln bpd of crude back into the market. The prospect of a deal remains uncertain however as next week we will ended the 5th and maybe the last round of Vienna talks between allies.

Reports yesterday from Reuters stated that US has agreed to lift all major economic sanctions on Iran, including those on the banking and oil sectors. However, reports don’t look to comply with other officials as European diplomats and a senior Iranian official contradicted the president, both suggesting that success of the talks is not guaranteed and very difficult issues remain.

Iran’s president said on Thursday that the United States was ready to lift sanctions on his country’s oil, banking and shipping sectors that were reimposed after former US President Donald Trump exited a 2015 nuclear deal three years ago. Iran and world powers have been in talks since April on reviving the deal and the EU official leading the discussions said on Wednesday he was confident a deal would be reached. But European diplomats said success was not guaranteed and very difficult issues remained, while a senior Iranian official contradicted the president.

“The talks in Vienna are about minor issues. They have accepted to lift sanctions on Iran’s oil and shipping sectors as well as sanctions on the Central Bank and others,” President Hassan Rouhani said during a televised cabinet meeting.

Elsewhere, Indian refineries have reportedly cut refinery runs as a result of a 20% slide in gasoline demand over the past month. India is the world’s third largest importer of crude, and a continuation of the Covid-19 crisis there could materially impact oil prices in the coming weeks. Unless it becomes clear Iran sanctions will continue, oil looks to remain in sell-the-rally mode for now.

Increased anxiousness over the restoration of the Joint Comprehensive Plan of Action with Iran will remain in place next week. That said, rising Covid-19 cases in many parts of Asia have weighed as well, crimping fuel demand. On the positive side, ramped up vaccination programs in the US and Europe could result in more travel this summer, good for demand. Today’s bounce comes into the weekend where short covering has been noted.

Technical Analysis

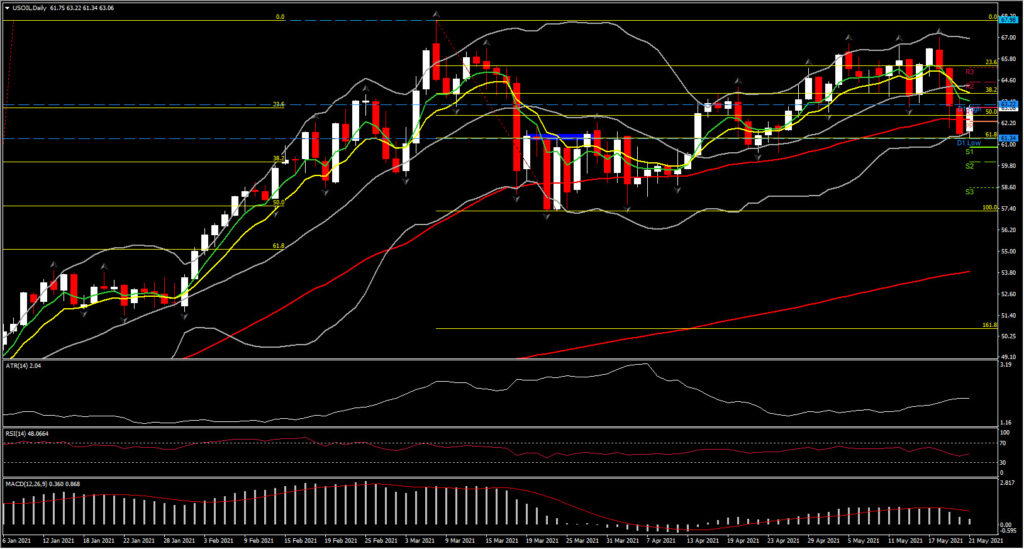

USOIL futures, despite recent decline, stabilised today above its 50-day EMA and within BB area. The decline, however, was not enough to break the 61.8% Fibonacci level since March dip, suggesting that this remains a strong Support level.

As regards the price momentum, the momentum indicators in the medium term are neutrally configured with the RSI and the MACD close to neutral zone implying a neutral-to-bearish bias for short-term. Overall outlook remains positive as the asset sustains a rally since March 2020 drama.

Nevertheless, the 61.8% Fib. level at 61.35 but more precisely the round 61 level remain key barrier for the asset. A break however of the latter could trigger more bears into the market and could lead to a retest of 3-month low. If that is the case, the downleg could last until 57.25 where any drift lower would questioned the 7-month uptrend.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.