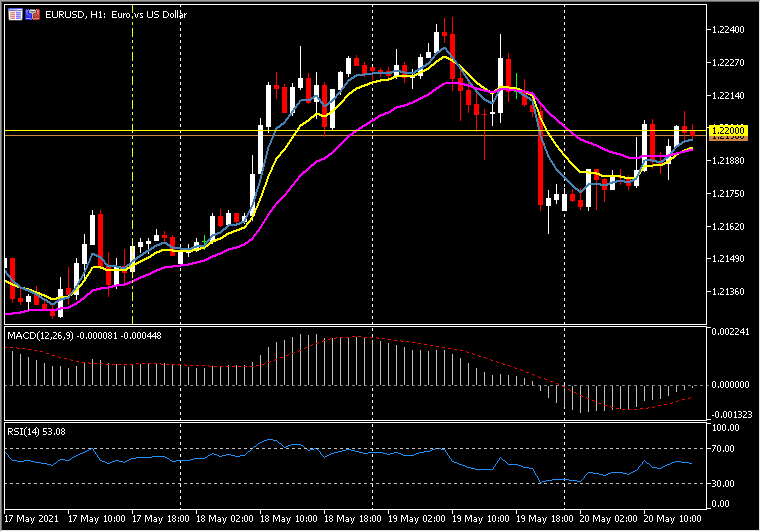

EURUSD, H1

The Dollar was little changed following the key US data today, which saw initial claims fall more than expected, 444,000 versus expectations of 453,000, for another pandemic era low. However, continuing claims unexpectedly rose to 3.751 million versus 3.630 million and the four-week moving average of continuing claims also rose to 3.681 million versus 3.656 million. Additionally, the Philly Fed Index fell much more than forecast, coming in at 31.5 versus expectations of 40.8 and 50.2 last time. USDJPY remains above 108.90, while EURUSD is static just over 1.2200. Equity futures remain narrowly mixed, while yields remain slightly lower.

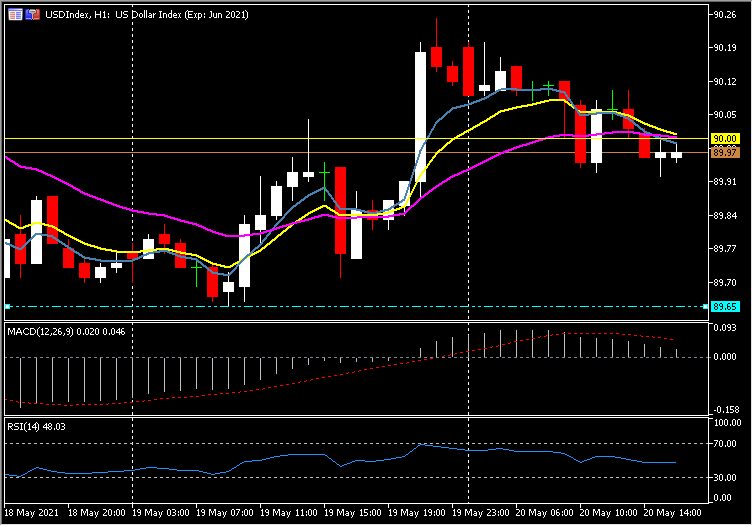

On a wider note the Greenback has corrected some of the gains seen following the release of the FOMC minutes from the late April meeting, which showed that “a number” Fed members were thinking about when to taper. This pushed longer-dated Treasury yields and the Dollar higher, the latter of which printed a three-day high at 90.29 by the measure of the narrow trade-weighted USDIndex. The Dollar has since ebbed back to levels around 90.00, but remained comfortably above the three-month low that was seen on Tuesday at 89.65. Market commentaries are reminding what happened after the FOMC, including the disappointing April jobs report and run of Fed speak that has consistently downplayed inflation risks.

Global stock markets have been trading mixed, with gains in Europe contrasting to the moderate losses that U.S. index futures have been enduring following a mix session in Asia.

Base metal prices came back under pressure, and oil prices dropped by over 1% in reaching three-week lows. Oil prices were showing a loss of over 8% at the lows versus the high seen on Tuesday.

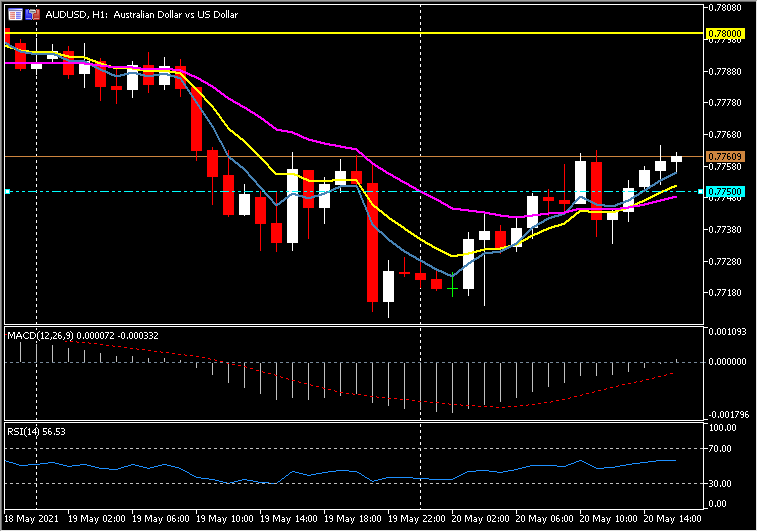

The Australian dollar rose versus the greenback, Yen and other currencies, aided along by an overall encouraging jobs report out of Australia, with headline weakness offset by a rise in full time employment and a drop in the jobless rate.

Bitcoin and the other leading cryptocurrencies steadied after yesterday’s meltdown. The bitcoin community (who are essentially permanently bullish) blamed the plunge on the liquidation of “over leveraged” positions. The fact is that the outsized volatility can only be a deterrent for many institutional investors and corporate treasurers, and bitcoin remains a mighty long way from being a fiat-currency challenging means of exchange and unit of account.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.