Gold has strengthened in the last 2 months where the value of gold is currently strongly associated with the hot ball topic of the year; inflation and lower government bonds. Gold is up 12% from mid-March lows $1677, with support coming from lower interest rates and lower government bond yields.

If, inflation as expressed by most Central banks is temporary, higher bond yields and an increase in vaccine launches to reduce uncertainty, then the Dollar will likely strengthen significantly and gold could retrace its true fair value, between $1600 and $1700. Conversely, if Inflation gets out of control, which cannot be ruled out, then gold will probably end the year with a new high price.

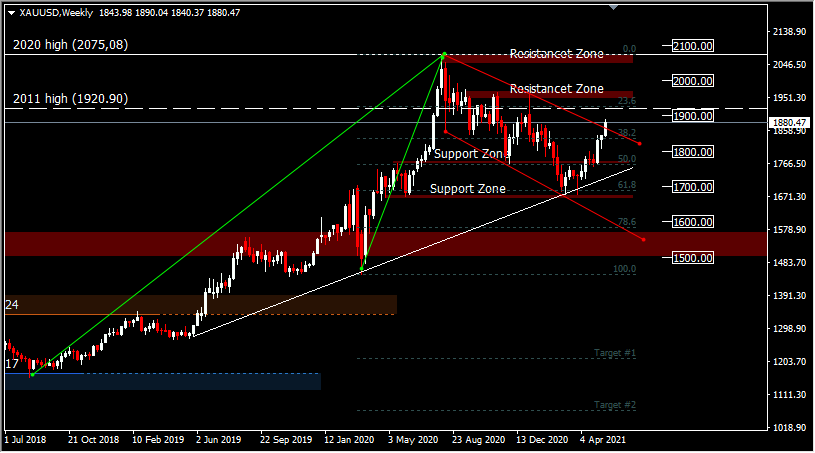

GOLD finished the trading week near the $1880 area. XAUUSD quotes continue moving upwards leaving the descending trend channel. The price move above Kumo indicates that the bullish trend is still continuing, targeting $1900 or the average high price of around $1950. The expectation of the correction in the price will test the support levels near the $1845-1850 area. Furthermore, gold price continued growth with a potential target at the $2000 level.

Click here to access our Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.