During otherwise quiet trading among the main fiat currencies, Euro lifted against most currencies, providing a modicum of directional action. EURUSD recouped about three quarters of the decline the pair saw on Friday, printing an intraday high at 1.2220, which was concurrent with the 10-year Treasury yield dipping below recent two-week lows near 1.610%.

EURGBP registered the biggest percentage movement, rising over 0.5% in posting a 2-week high at 0.8650. EURJPY posted a high at 133.03 after rising by just over 50 pips from its low. The cross remained shy of the high seen on Friday at 133.23. There didn’t appear to be a catalyst. The European calendar was near empty, and there are public holidays across Europe today.

There are of course running Euro positives, not least the solid May PMI readings out of Europe on Friday, alongside the re-opening of economies and borders across the EU region, with Brussels having finally got its act together on its Covid vaccine program. Hence the common currency has also been benefiting from the improving outlook in the Eurozone economy, with the recent wave of Covid infections having been quelled. The 750 bln Euro pandemic fiscal support fund is also in the works.

On top of all that, the buying into the Fed’s inflation-will-be-temporary argument is keeping the Greenback on a softening tack. The prevailing dominant view on US inflation risk is that price pressures could abate in Q3, as year-on-year base effects narrow and supply bottlenecks are ironed out, which — for now at least — is keeping shorter-dated Treasury yields anchored at low levels, with the Fed expected to hold out on ZIRP.

The CME’s Fedwatch Tool shows that market positioning is implying a probability for a 25 bp Fed hike by year-end of just 11%, which is only marginally up on the 9% probability being implied ahead of the release of the FOMC minutes, and the 7% probability that was being discounted ahead of the release of hotter than expected April CPI.

That said, EURUSD futures are implying a first 25 bp hike in 2023, a year ahead of what the Fed has been signaling. The EURUSD’s prevailing upside bias could sustain for now as overall momentum is positively configured, though see downside risk should Fed tapering start to look more inevitable. This would be when the US versus Eurozone growth differential is matched by a Fed versus ECB tightening expectations differential, which would be the circumstance for the directional bias of EURUSD to shift to the downside.

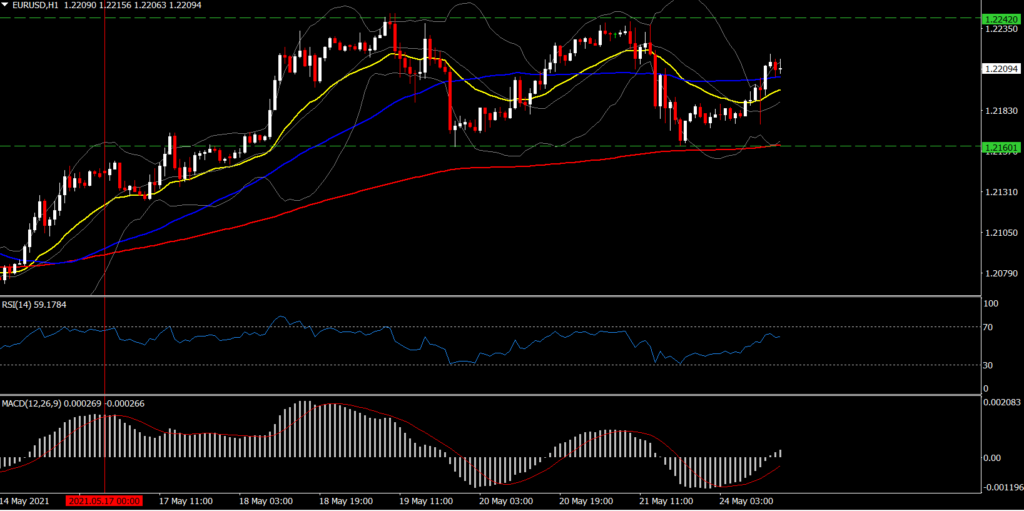

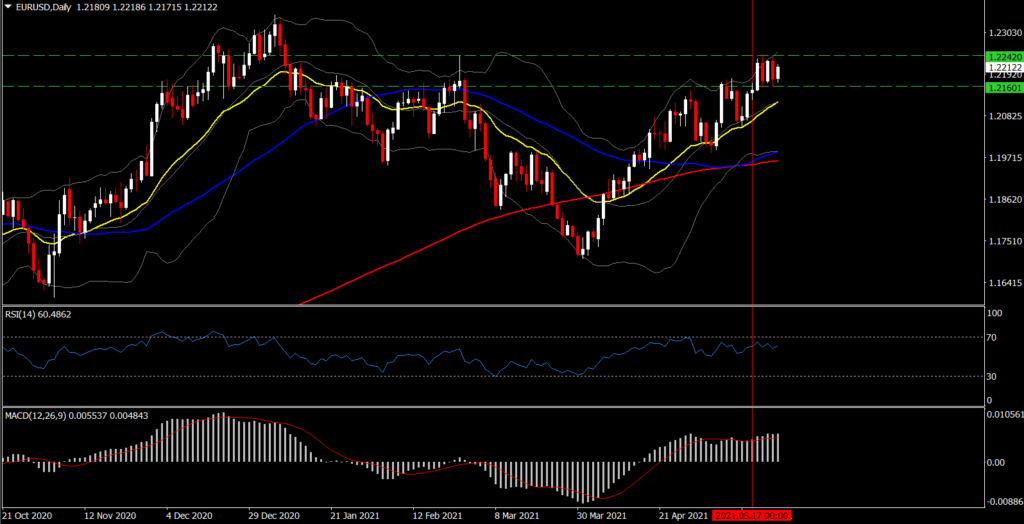

From the technical perspective, even though EURUSD sustains its 5 day range presenting a sideways movement, the overall outlook remains positive as the asset remains in an upwards channel since March, above all its daily Moving averages, with Bollinger bands extending northwards. Also key is the bullish cross between 50- and 200-DMA seen last week, boosting the odds of further appreciation for the asset. The MACD lines have extended higher however, and RSI presents a pullback posting lower highs as it struggles to break the 70 barrier, increasing the odds for a downside correction in the near term.

That said, the 20-DMA at 1.2120 provides a solid immediate Support level for the asset, as it remains untouched since April. A break however below the latter could attract bears back into play, with a potential swing down to the 1.2000-1.2050 area. On the flip side however an exit above the current range could alert the continuation of the 2 month rally, and could retest December’s highs at 1.2300 -1.2340.

Nonetheless, the inflation debate will remain front and centre, with the price indicators in the consumer sentiment measures and personal consumption releases sure to draw attention, and the data slate will not add anything new to the recovery/reflation story. Hence we could see the same market behavior for the rest of the week.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.