GBPUSD, Daily

The Pound has been slipping against most of the G10+ currencies. Cable yesterday broke step with EURUSD, with the latter declining while the former ascended. Cable dropped from two-day highs to the lower 1.4100s, while EURGBP rallied to a 15-day high at 0.8672. The much stronger than anticipated read on the May German Ifo business climate indicator yesterday reinforced the picture of a rebounding Eurozone economy, as economies and borders across the EU region reopen with Brussels having finally got its vaccine program act together. The 750 bln euro pandemic fiscal support fund is also in the works. EURGBP had trended lower through most of Q1, which was a consequence of the UK’s advanced progress with Covid vaccinations. Now the gap is narrowing it is only natural for EURGBP to recoup some of the ground lost earlier in the year.

The ECB’s monetary policy meeting on June 10 is now in focus, though the governing council is likely to remain cautious and committed to stimulus. ECB member Stournaras said yesterday, for instance, that he sees no reason to change the PEPP (pandemic emergency purchase program), arguing that temporary supply-side bottlenecks have been the source of price spikes and that there is “no evidence” of a new inflationary era. The EURGBP cross still remains down by 3% on the year-to-date, and only the oil correlating Canadian Dollar and Norwegian Krone are ahead of Sterling in the outperforming lane over this time period.

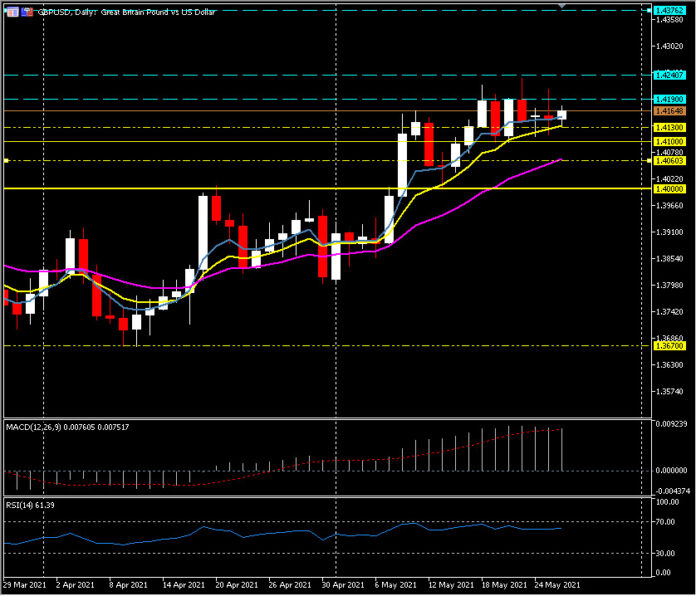

Sterling remains in demand, while the daily Cable chart remains robust as the pair trades north of 1.4100 for the eighth consecutive day, having tested 1.4212 yesterday (May 25) and 1.4233 last week, which was 7 pips shy of the 2021 high (1.4240) on February 24. Short term support is the 9-day exponential moving average (EMA) at 1.4130, the 21-day EMA at 1.4060 and then the key psychological 1.4000. First resistance is 1.4190, the end of day high for May, the 2021 high (1.4240) and then the April 2018 high at 1.4375.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.