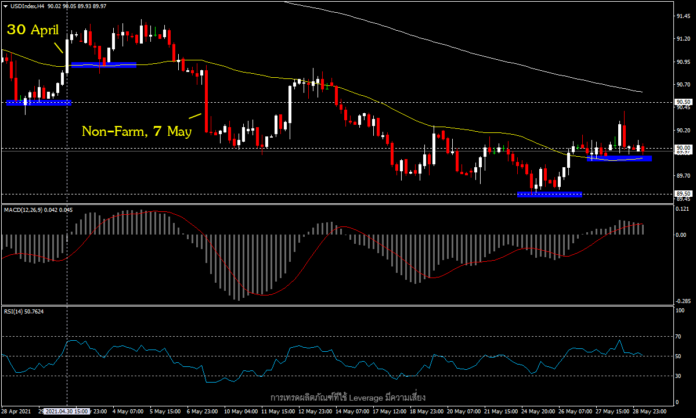

USDIndex, H4

The Dollar Index’s move to close the week cooled from 90.41 to 90.00 ahead of the long weekend. This raises the question of whether this is a normal end-of-the month correction, or is the break set to continue down? The key data this week to begin the new month is the US Non-Farm Employment Change on Friday June 4.

Last week the H4 timeframe saw the price break above the MA50 and make a two-week high at 90.41, and saw a trend reversal with a new higher low in line with the MACD that broke above the 0 line and RSI stand above the 50 level. It is similar to the end of April when the price broke above the MA50 and rested there before breaking back and falling heavily on the lower-than-expected non-farm payrolls report at 266k from the 978k forecast. This Friday’s forecast is between 621k and 700k.

As Fed Vice Chairs Randal Quarles and Richard Clarida announced, the heating up of US inflation should prompt policymakers to start talking about inflation at the upcoming meeting. This is consistent with comments in the minutes of the previous April meeting.

US inflation for April jumped to 4.2%, the highest figure in 13 years since September 2008, from 2.6% in March, 1.7% in February and 1.4% in January.

As for the technical trend this week, H4 has a chance of price circling within the MA50 and MA200 frames in anticipation of the hiring figures this Friday. But given the trend that the MACD is cutting the signal line down and the RSI is falling at the 51 level, if the price breaks below the MA50 the first support is at the latest low at 89.50.

Click here to view the economic calendar or the free webinar.

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.