GBPUSD, H1

The UK’s final May composite PMI was unexpectedly revised higher, to 62.9 from the preliminary estimate of 62.0. The headline is a new record high for the data series going back to January 1998. The headline improved from the April reading of 60.7. The improvement was driven by a much stronger than expected manufacturing PMI, which rose to a record (since 1992) 65.6, despite being revised lower from the preliminary figure of 66.0, after jumping from the 60.9 headline in the month prior. The services PMI was upwardly revised to 62.9 from the preliminary reading of 61.8, which marked a jump from 61.0 in the month prior. The surveys showed the quickest pace of private sector employment since June 2014. New orders rose by the most since October 2013. Cost pressures rose by the quickest rate in almost 13 years, which were passed on to customers, with prices charged rising the most in over 21 years.

The unlocking economy has released pent-up demand, and consumer confidence has improved markedly amid the evident success of the UK’s Covid vaccination program. Nearly 75% of the adult population in the UK have now received at least one dose of a vaccine and 47% both doses.

Overall, a stellar report. While the pace of improvement has slowed over the last month, the private sector of the UK economy is amid a robust recovery expansion. The prognosis for the months ahead is looking good. While there has been a creep higher in new Covid cases in the UK, which has caused the prime minister to publicly ruminate that the fourth and final phase of reopening, scheduled for June 21, might be delayed, there are good grounds to expect the prevailing lift in new Covid cases won’t develop into a full blown wave. The spread, which is being driven by the Indian variant, is mostly among younger, unvaccinated people, with the vaccinated majority proving to be resistant.

Later today the UK government is due to announce its latest updates on foreign travel for England and speculation is rife over which countries could be added to the “green” list. Spanish and Greek islands (but not their respective mainlands) plus Malta, Finland and Slovakia are among the European destinations experts believe may be given green status. However, there is also speculation that Portugal could be downgraded to “amber” following a spike in new cases there.¹

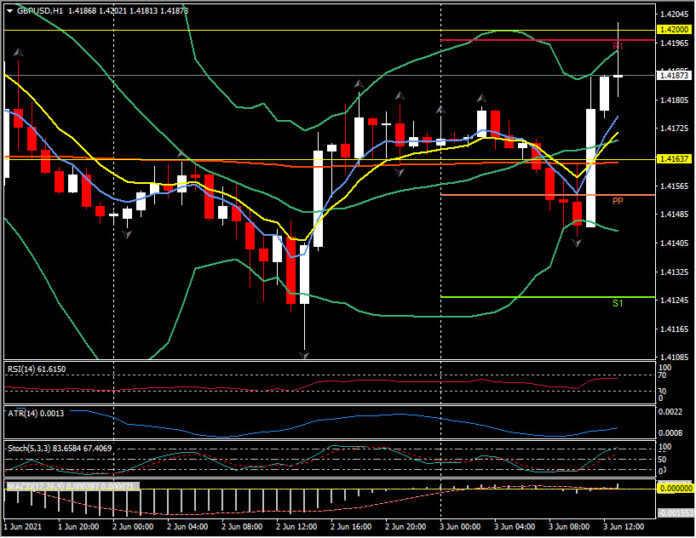

The positive swirl of the data and feel good factor from travel restrictions expectations has lifted Sterling today. Cable currently trades at 1.4180, up from 1.4142 lows earlier, and R1 today sits at 1.4200, a key psychological and technical resistance level, with today’s pivot point at 1.4154. EURGBP dipped under 0.8600 earlier and has pushed down to S1 at 0.8591, S2 sits at 0.8576 and today’s pivot point and 200-hour moving average coalesce at 0.8615. GBPJPY continues to accrue, as it enters its 27th day above the 20-day moving average. Currently trading at 155.70, the recent high from May 27, it briefly breached 156.00 at 156.06 which represented a 39-month high.

¹https://www.bbc.com/news/live/uk-57340860

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.