Market News Today – USD sprang to life after strong ADP (978k vs 645k), Weekly Claims (385k vs 400k) and ISM Services PMI data (64 vs 63). USDIndex has rallied (+0.8%) to 90.57 after closing over 20-day moving average for the first time since April 7. Equity markets sank (USA100 hit hardest; -1%) (USA500 -0.4%, -15pts to 4192, as VIX rallied 1.1%). 10yr Yields have rallied to 1.632%. Asian markets also lower. All eyes on NFP at 12:30 GMT. USOil down from $69.00 to $69.70 (following a much bigger inventory drawdown of 5.1mb vs 1.2 expected ) Overnight Stronger rebound for Japanese household spending, Fedspeak remained Dovish lead by Williams “not concerned by inflation outlook”. Biden offers 15% min. rate for Corp. Tax and 28% top has post NFP press conference scheduled (14:15 GMT). EUR 1.2107, JPY 1109.25, GBP 1.4100. GOLD (& other commodities (partic. Copper) slumped on the stronger USD – touched $1855, closed at $1870 and holds there now.

European Open – The Sep 10-year Bund future is little changed, as are US futures, while in cash markets the US 10-year rate stabilised. DAX and FTSE 100 futures are fractionally lower, as are US futures. Strong data releases and tapering musings saw yields moving higher yesterday and investors will likely hold back ahead of the key US payroll numbers later today. It seems increasingly likely that central banks will start to rein in monetary support as fiscal stimulus is underway and the growth outlook improves, and expectations are that the ECB will start reining in asset purchases over the summer, in a flexible manner that allows the central bank to keep a close eye on spreads and step in if necessary.

Today – EZ and UK Construction PMIs, US and Canadian Jobs Reports, US Factory Orders, Fed’s Powell, ECB’s Lagarde, Villeroy, de Cos, PBoC’s Yi Gang, BoJ’s Kuroda, SNB’s Jordan & RBNZ’s Orr

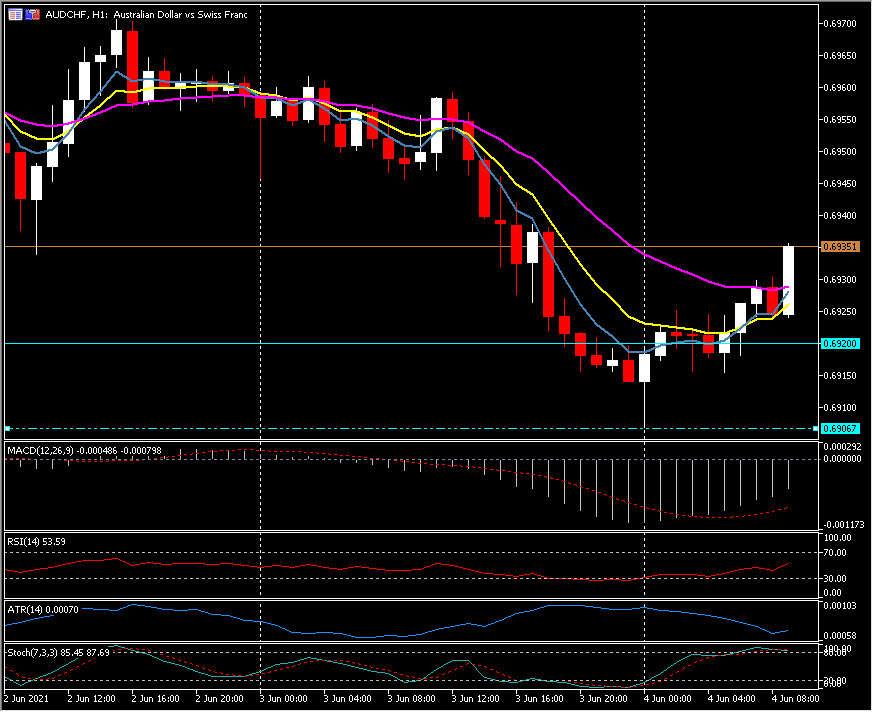

Biggest FX Mover @ (07:30 GMT) AUDCHF (+0.26%) has moved up from 15-week lows yesterday (0.6907) to rally to 0.6936. Faster MAs remain aligned higher, RSI 54 and spiking higher, MACD signal line and histogram rising but remain below 0 line from yesterday. Stochs. still moving higher and into OB zone. H1 ATR 0.0007, Daily ATR 0.0063.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.