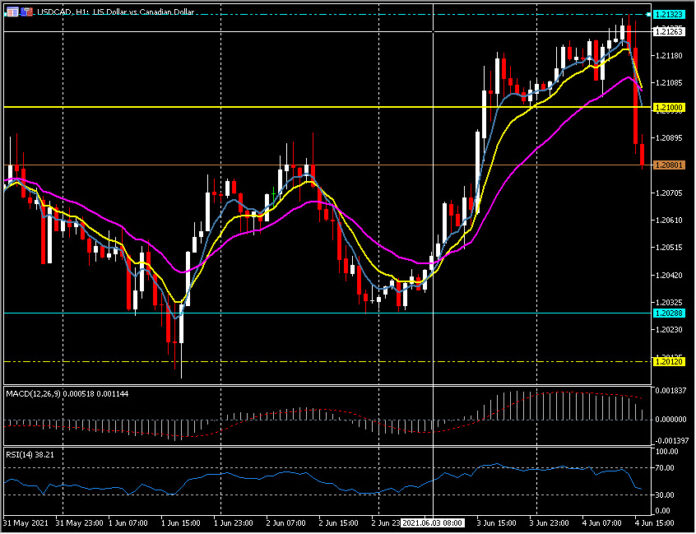

USDCAD, H1

US nonfarm payrolls climbed 559,000 in May, falling a bit short of estimates, following increases of 278,000 (was 266,000) in April and 785,000 (was 770,000) in March for a net 27,000 upward revision.

The unemployment rate dropped to 5.8%, as forecast, after edging up to 6.1% in April, and compares to 13.3% a year ago.

Average hourly earnings climbed another 0.5% following the 0.7% in April from -0.1% in March. On a 12-month basis, earnings surged to a 2.0% y/y pace from 0.4% y/y (was 0.3% y/y), though largely on base effects.

The workweek was steady at 34.9 hours (April revised from 35.0). The labour force declined -55,000 after rising 430,000 previously, with household employment increasing 444,000 after the prior 328,000 rise. Labour force participation dipped to 61.6% from 61.7%.

Private payrolls were up 492,000 (about half of the ADP’s 978,000 surge) from 219,000 (was 218,000). The goods sector added 3,000 jobs versus -36,000 (was -16,000) in April. Manufacturing jobs rebounded 23,000 from -32,000 (was -18,000). Construction jobs declined -20,000 from -5,000 (was unchanged) Employment in the service sector surged 489,000 versus the 255,000 (was 234,000) gain in April, with strength in leisure/hospitality, up 292,000, and education/health up 87,000. Government jobs fell -11,000 versus the prior 10,000 (was 48,000) gain.

Canada’s employment fell -68,000 in May following the -207,100 tumble in April, as the third wave of restrictions continued to weigh on the labour market. The drop was a bit larger than expected (-40,000) but well within the wide forecast range for this release.

The jobless rate ticked higher to 8.2% from 8.1%. Full time employment slipped -13,800 after a -129,400 plunge. Part time positions saw a -54,200 drop following the -77,800 contraction in April.

The average hourly wage rate of permanent employees, a BoC favourite, fell -1.4% y/y after the -1.6% y/y rate of decline in April. This measure turned negative in April amid the shift to difficult annual comparison. Meanwhile, long term unemployment held nearly steady at a near record high 478,000 in May, which is sure to be noted by the BoC. While increasing vaccination rates and the gradual unwind of restrictions should allow the labour market to resume improvement this year, the April and May reports are consistent with no more surprises from the BoC next week — steady policy and no additional cuts to the QE programme.

The USD weakened following the NFP data; overall USDCAD pushed under 1.2100 from Friday highs at 1.2132 to test down to 1.2085, but well above the low on Tuesday at 1.2006. The 20-day moving average sits at 1.2120. EURUSD up to 1.2170, USDJPY down to 109.60 and Cable rallied to 1.4198. Equity futures are firmer as USA500 moves to highs of the day at 4208.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.