The coronavirus continues to invade many Asian countries. Among them, Taiwan, which had a record of zero confirmed cases from April to December last year, could not escape the fate of an outbreak. From cluster infections in the Novotel Hotel among pilots to clusters in tea rooms and infections in multiple places, as of June 7, the total number of confirmed cases of virus infection in Taiwan has exceeded 10,000, reaching 11,491. According to local media reports, the cause of such a rapid rise in infections is nothing more than the slackness of the authorities in the long-term prevention and control measures (from the original 14-day quarantine to the 3+11 quarantine model that is 3 days for home quarantine and 11 days for independent health management). Following the infection incident, the local government was unable to obtain enough vaccine supply for the first time because the speed of purchasing vaccines was slower than that of other countries. In any case, with Japan’s generous donation of vaccines to Taiwan, and the United States also saying that it will distribute vaccines to many countries around the world (including Taiwan) by the end of June, Taiwan’s “vaccine shortage” has been alleviated. Statistics show that only 2.94% of Taiwanese people have received at least one dose of the vaccine. At present, the Taiwan government has once again announced the extension of the “third level alert” until June 28.

Previously, local semiconductor packaging and testing giant King Yuan Electronics was forced to shut down due to the outbreak of the infection and pressure from employee groups. As the world’s largest professional testing plant (including wafer probe testing, IC product testing, burn-in testing and packaging), the shutdown of KYEC greatly affected production capacity and triggered a new round of “chip shortages” worldwide. In Taiwan, its semiconductor industry chain is at the forefront of the world. Statistics show that the proportion of Taiwanese semiconductor contract manufacturers by market share reached 63% last year. It is worth noting that not only did other semiconductor manufacturers also have a series of infections, the local area faced drought and power outages, and the “semiconductor industry chain disconnection” situation was severe.

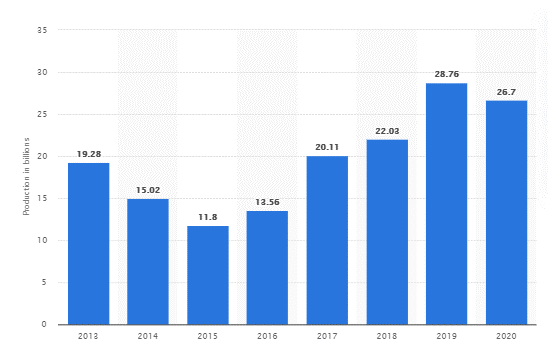

图1:2013至2020年马来西亚半导体产量。来源:https://www.statista.com/statistics/719265/semiconductor-production-malaysia/。

In addition, another country that is currently suffering a new wave and has re-implemented a “total lockdown” similar to that of the first outbreak (the lockdown started on June 1, with a two-week first phase and 4-week second phase) is Malaysia, which will also affect global semiconductor packaging and testing and production capacity. Data show that in 2019, the country’s semiconductor production capacity reached 28.76 billion, an increase of nearly 145% from the low level in 2015 (11.80 billion). Although the government implemented a control order last year, the degree was relatively relaxed, so the impact on the industry was limited, only a decline of about 7% compared with 2019, to 26.70 billion. At present, the government has announced that it will limit the manpower capacity to 60%. At the same time, coupled with its earlier reduction of the inflow of foreign labor, the problem of labor shortage will eventually affect production. The problem of chip shortage will also drive a chain reaction and spread to many industries such as automobiles, steel products, air-conditioning manufacturing, concrete and soap production, and beer brewing.

Taiwan and Malaysia’s “restriction orders” are expected to affect many companies around the world, including Nvidia (#NVIDIA) and Texas Instruments (#TexasInstrumen); the daily chart shows that the stock prices of both are still above the 100-day simple moving average. Intel (#Intel), STMicroelectronics (#STMicroelectro), Advanced Microelectronics (#AMD) and Infineon (#Infineon) are trading below the 100-day simple moving average], and many other related companies are also affected.

Click here to access our Economic Calendar

Larince Zhang

Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.