It is the Fed and BoJ’s turn this week to reassure markets that officials still view the surge in inflation as transitory, and hence not a threat to the low for long policy stance, and that QE will be trimmed later rather than sooner. A busy data slate is also of interest stateside, but the FOMC takes center stage. The BoJ is on tap, where markets will be on the alert for an expansion of the Covid aid program.

The FOMC headlines in the US this week with the meeting on June 15-16. No changes are expected to the 0%-0.25% rate band or the $120 bln in monthly QE purchases. But markets forecast that the Chair Powell will acknowledge that taper talks have begun, though action is still a ways off since the recovery in the labor market is still far from complete. Along with the FOMC, there is also a plethora of key data including retail sales, production, manufacturing PMIs, and housing starts. These are likely to reflect the diverging impacts of the unwinding of pop from stimulus payments, constrained inventories and supply chain disruptions, along with rising commodity/input price pressures. The data look to remain very noisy, and the results are likely to be too mixed to provide clear direction on the economy.

Also, the plunge in Treasury yields last week to levels not seen since late February/early March clearly indicated that there is no fear of the Fed, and that investors have bought into the “transitory” view of inflation. And while markets believe the robust recovery, the improvement in the labor market, and the acceleration in inflation will get officials to start talking about tapering, we expect Chair Powell will downplay it, suggesting action is not imminent as the “substantial further progress” criteria has yet to be met.

Of interest, this meeting will include the new quarterly forecasts (SEP) where it is expected to see modest revisions in growth, inflation, and unemployment to reflect the strength in the recovery thanks to the massive monetary and fiscal stimulus, along with the increased vaccinations and reopenings in the economy. The new forecasts will likely show a narrowing in the official GDP forecasts around the path estimated in March after the passage of the last stimulus package, alongside boosts in the low-end jobless rate estimates to account for a diminished downtrend, and massive boosts in the PCE chain price estimates. For GDP, we assume the Fed’s central tendency will remain at 5.8%-6.6%, versus our own 6.3% estimate, though the full range should be narrowed. We expect an increase in the 2021 jobless rate central tendency to 4.5%-4.8% from 4.2%-4.7%, versus our own 4.6% estimate. Upward revisions are also expected in the PCE chain price central tendencies to 3.0%-3.2% from 2.2%-2.4% for the headline and to 2.6%-2.9% from 2.0%-2.3% for the core, versus our own respective estimates of 3.4% and 3.1%. And importantly, we expect the Fed to mostly repeat their funds rate estimates from March, though with boosts to high-end estimates, and a hike in the 2023 median to 0.4% from 0.1%.

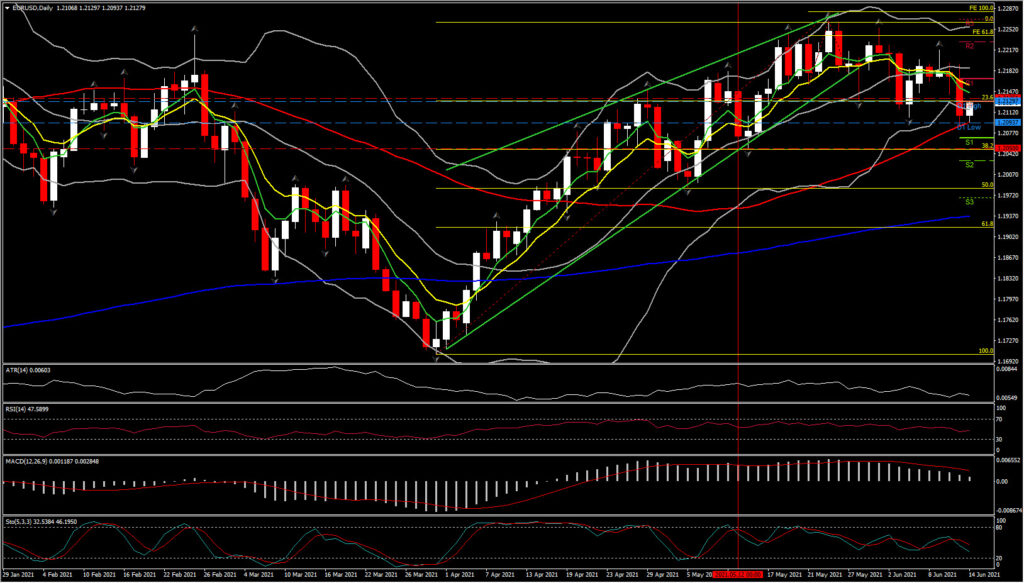

Meanwhile, EURUSD has remained heavy and again breached Friday’s 1-month low en route to printing a new 1-month low at 1.2094. The pair has subsequently lifted back to 1.2100 so far, with the market lacking commitment to follow through. As well as Fed anticipation the ECB at its policy review last week stuck to its commitment of significantly higher PEPP purchases, which disappointed some, including ourselves, who had been anticipating the removal of the word “significantly” from the bank’s statement. This has curtailed EURUSD’s upside potential, while the forex market also appears reluctant to commit to selling US Dollars despite the sharp drop in longer-dated Treasury yields last week. It seems unlikely that the FOMC will impact prevailing policy expectations, with the Fed now widely expected to remain on an inflation-accepting stance on the view that price pressures will abate a y/y base effects and reopening supply bottlenecks shake out, although the central bank will be upwardly revising quarterly economic forecasts.

Technically, EURUSD has lost upside momentum after rallying from late March through to the 5-month high that was clocked in late May at 1.2267. The 1.2250-1.2270 area can be considered a strong resistance zone. A choppy, broadly sideways phase looks likely for the pair over the coming weeks, considering the flattening of weekly RSI at 55 and weekly Bollinger Bands. In the near-term meanwhile, the outlook remains neutral but with increasing negative bias as daily RSI is at 46 (below 50), BB are extending northwards and MACD has zeroed.

On the other side of the Atlantic, Japan’s calendar is loaded with a BoJ meeting and a heavy slate of key economic reports. The BoJ ends its two-day meeting on Friday, and while the policy measures currently in effect will remain, including the -0.10% rate and yield curve management, there is risk the Bank could extend its Covid aid program, which is currently set to expire in September, either at this meeting or in July. Rising Covid cases have hit consumption in Japan, negatively impacting growth so far this year, with another recession looming as the rise in infections over the spring and the renewed emergency measures have weighed on the economy, while also leading consumer prices to remain in deflation since the fall of 2020.

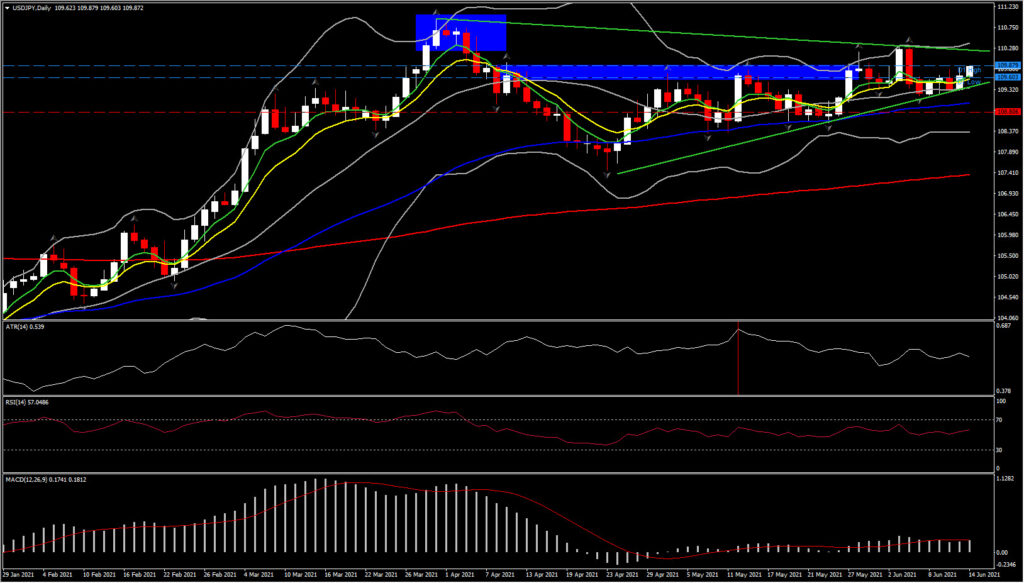

USDJPY has continued to oscillate between the 109.50-109.90 area. The sharp drop in US Treasury yields last week, which saw the 10-year US versus JGB yield differential narrow by well over 10 bp (with the JGB 10-year yield remaining stable under the BoJ’s yield curve control policy), had little sustained downside impact on USDJPY. The pronounced US versus Japan inflation differential also stands out as a negative dynamic for the nominal level of USDJPY. But the bears aren’t biting. There are offsetting forces at play, not least of which being the Yen’s long standing proclivity to inversely correlate with global market stock market direction, which in the latest phase, with the MSCI all-country stock index having hit record highs (on Friday), has been a negative for the Japanese currency. The Yen is a low yielding currency of a surplus economy, and tends to weaken during risk-on phases in global markets, and strengthen during times of pronounced and sustained risk aversion.

It should be of no surprise that the Yen has been the weakest performing of the G10+ currencies during the reflation trade. The Japanese currency, for instance, is registering a loss of over 40% against the Australian Dollar from levels seen at the height of pandemic panic in global markets, in March 2020.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.