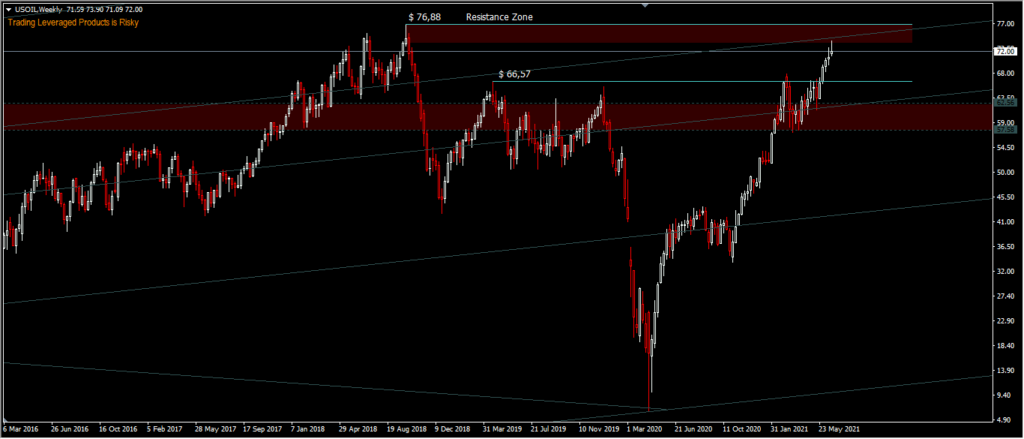

Crude oil prices found positive support and rebounded again. This rise in crude oil prices is in line with the overall high demand for the commodity which has been observed since the beginning of the summer. The pause in negotiations on the resumption of the nuclear deal with Iran, which may indicate a supply delay from OPEC, is also supporting oil prices.

USOIL tried to equalise the September 2018 peak of $76.88, but drifted by $2.98 from the $73.90 high on Monday. Meanwhile UKOIL matched its April 2019 high ($75.56) at $75.27 amid strong demand optimism to just $11.45 off the September 2018 peak ($86.72). The bullish sentiment comes as global coronavirus vaccinations continue to develop, while the summer travel season also eases demand concerns.

Technical Level

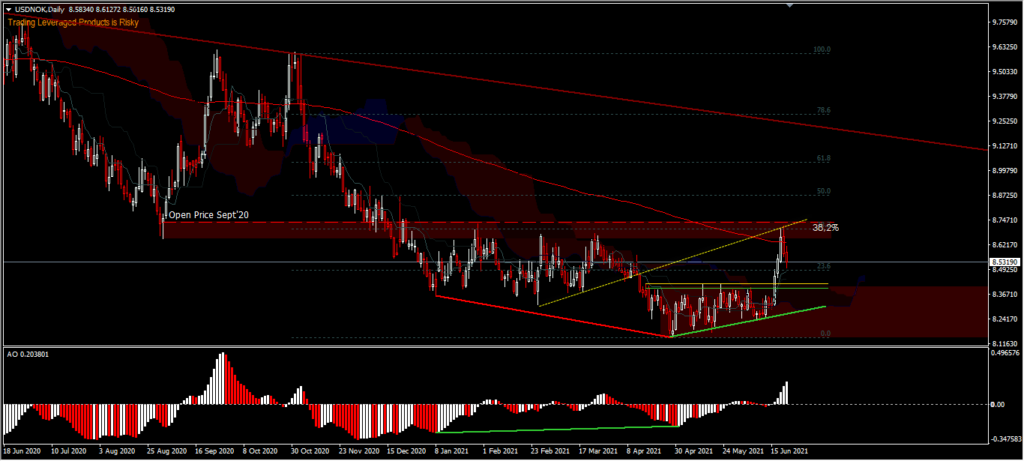

The Norwegian krone strengthened against the Euro and the US Dollar amid strengthening Oil prices. The increasingly hawkish Norges Bank said it is likely to raise interest rates in September. Last week, Governor Olsen and his colleagues on the Committee on Monetary Policy and Financial Stability voted to leave Norway’s key interest rate unchanged at 0%, but gave repeated and clear warnings that borrowing costs are likely to rise before the end of the year.

USDNOK – The bias is temporarily neutral and consolidating after last week’s gains that broke out of the ascending triangle pattern by registering a rebound up to 38.2% Fib. retracement (8.7173) and blocked by the 200-day SMA. The 38.2% Fib. retracement level is an important level, because in the past it was the average monthly high that served as resistance. Since the end of the decline before the rebound, the asset has displayed a divergence bias and consolidated in a fairly long triangle pattern about 43 days before the breakout. The technical support indicator validates the bull movement with AO on the positive side and the position of the candle above KUMO. However it looks like the asset needs further consolidation in the near term, before continuing its retracement to the upside. Immediate support is at 8.4189. As long as this level holds, the bias is likely to remain to the upside.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.