Market News Today – Dollar a tad weaker, but holds onto gains, USDIndex 91.80, USA100 & 500 at ATHs. Agreed $1.2 tn Infrastructure plan lifts sentiment. However, mixed US data yesterday, Claims missed, GDP confirmed at 6.4% & Durable Goods missed. All US Banks passed stress tests late in the day. BoE – no change & no hawkish surprises but looks like tapering measures will start after the summer. GBP hit. Overnight Asian markets also bid, NZD bounces and JPY weakest. US 10yr yields 1.49%. EUR holds at 1.1950, JPY under 111.00 to 110.75 & Cable tests under 1.3900 now back to 1.3925. Gold still rotates at $1780/75, USOil Holds over $72.50 now.

European Open – German GfK consumer confidence much better than expected at -0.3 vs -6.9 in the previous month. The September 10-year Bund future is slightly lower, as are US futures. Gilts led a rally in EGBs yesterday after the BoE affirmed its accommodative policy stance, but there could be a slight pullback as markets continue to digest the statement. DAX and FTSE 100 futures meanwhile are up 0.3% and 0.1% respectively, alongside broad gains in US futures.

Today – US PCE Price Index, Personal Income and Consumption, Fed’s Williams, Rosengren, Mester, Kashkari; ECB’s de Cos.

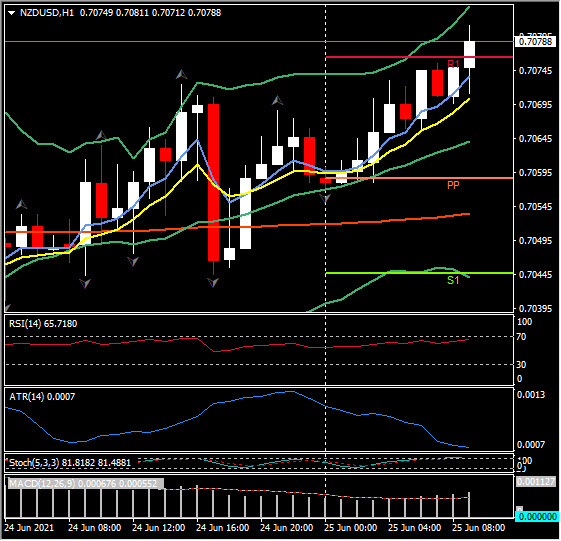

Biggest FX Mover @ (06:30 GMT) NZDUSD (+0.25%) Rallied from test of 200HR MA yesterday at 0.7745. Faster MAs aligned higher, RSI 65.7 and rising, MACD signal line and histogram rising remain significantly above 0 line. Stochs rising and testing OB zone again. H1 ATR 0.0007 Daily ATR 0.0045.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.