The US500 (S&P500) and US100 (NASDAQ) futures indexes traded at historical highs on Monday following positive market sentiment. Facebook shares joining the $1 trillion club gave support to the US100 index following a district court decision dismissing the FTC’s antitrust case against Facebook (up 4.18%). Other technology stocks such as Intel (up 2.81%), Microsoft (up 1.4%) and Apple (up 1.26%) also supported the rise of the US100 index.

The US500 index reached a high of 4281.44 points in late trading before declining slightly to 4277 before closing at new all-time highs at 4290.62 it closed with strong bullish momentum and remains above the MA-50 H1 level. It has remained traded in the ascending channel since June 21. The nearest support is at 4264 points.

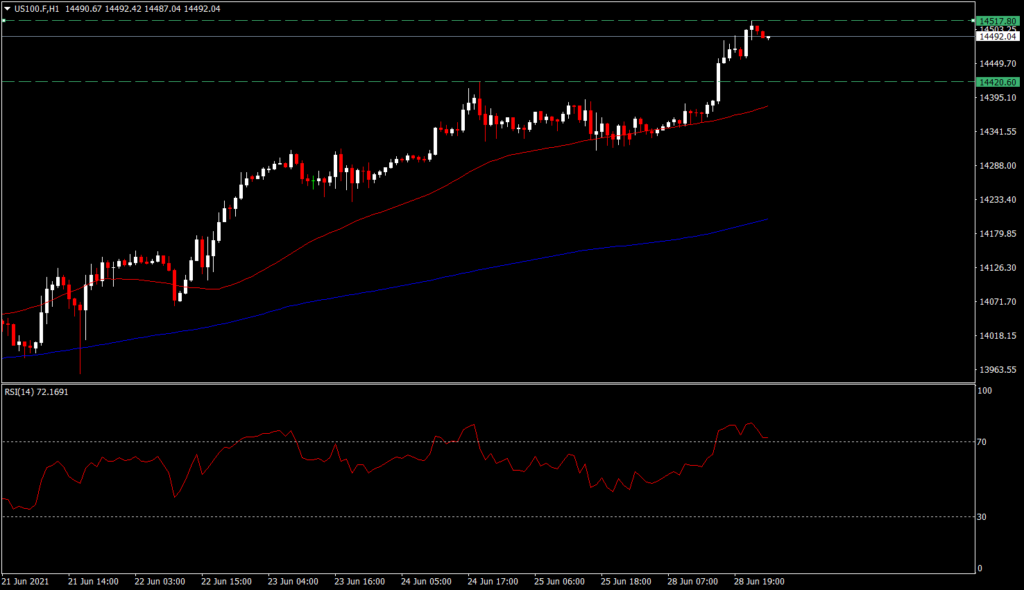

Meanwhile, the US100 also set a record intra-day high when it reached 14,517.80 points before declining back to 14,492 and closing at the key psychological 14,500. The nearest support is well below at 14,420 points.

The strengthening of the US100 was supported by a surge in technology shares where Facebook managed to get a court order to set aside 2 complaints filed by prosecutors with respect to antitrust policies. The surge in Facebook shares pushed the company to be worth more than $1 trillion in market capitalization and join other big tech companies in the trillion+ company club. Facebook shares closed at historical highs at $355.37, an increase of more than 30% in 2021. 49 of the 58 analysts tracked by Bloomberg now place Facebook shares in the Buy category, 6 in the holdings category and only 3 place FB shares in the sell category.

Positive sentiment from the US close cooled in the Asian session, where Covid infections and continued lockdowns weighed on markets. The Nikkei JPY225 moved down to 28,689 to a 5-day low before recovering in late trading to close at 28,812 (-0.81%).

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst

HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.