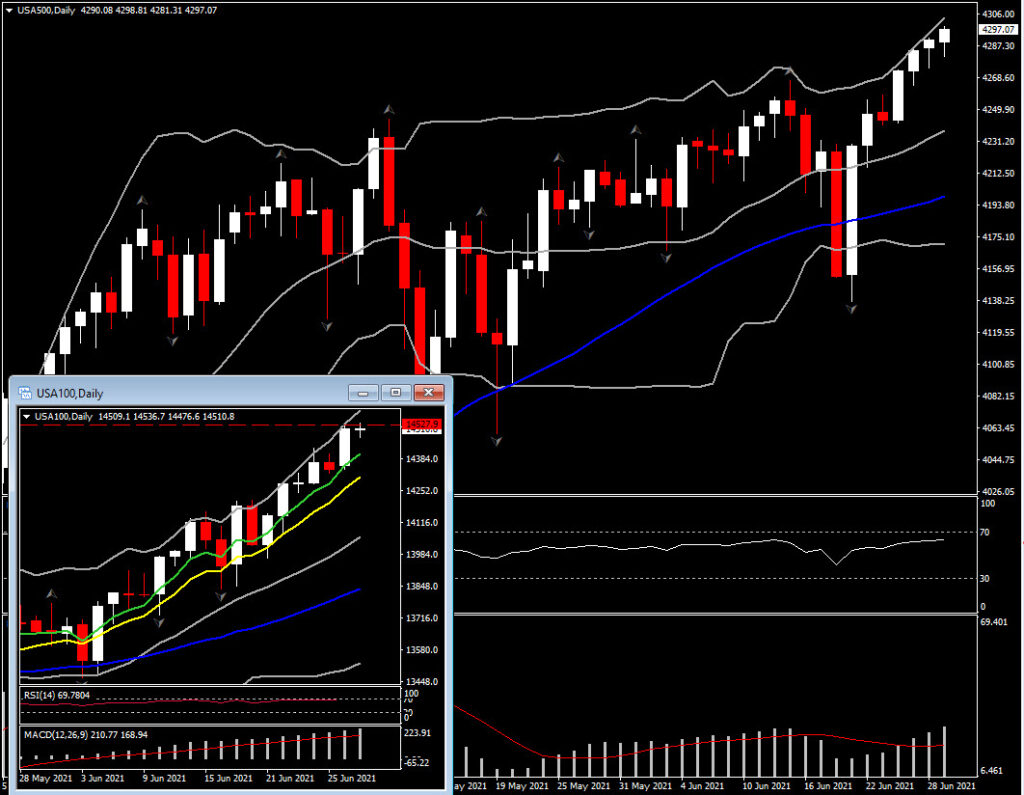

Equity futures are mixed ahead of the Wall Street open, with the USA30 adding over 80 points or about 0.25%, the USA500 flat, and the USA100 about 30 points or 0.20% underwater. The modest moves in pre-market session come following record high closes on Monday for both the USA100 and the USA500. Financial stocks are set to lead the way higher, as banks are now allowed to raise dividends and reinstate stock buyback programs following the successful stress tests run by the Fed. Morgan Stanley announced it would double its dividend, and purchase $12 bln of its own shares. JPMorgan, BofA and Goldman Sachs will all raise dividends as well. In the bigger picture, equity valuations are beginning to look stretched, so a case of two steps forward, one step back may be in place going forward.

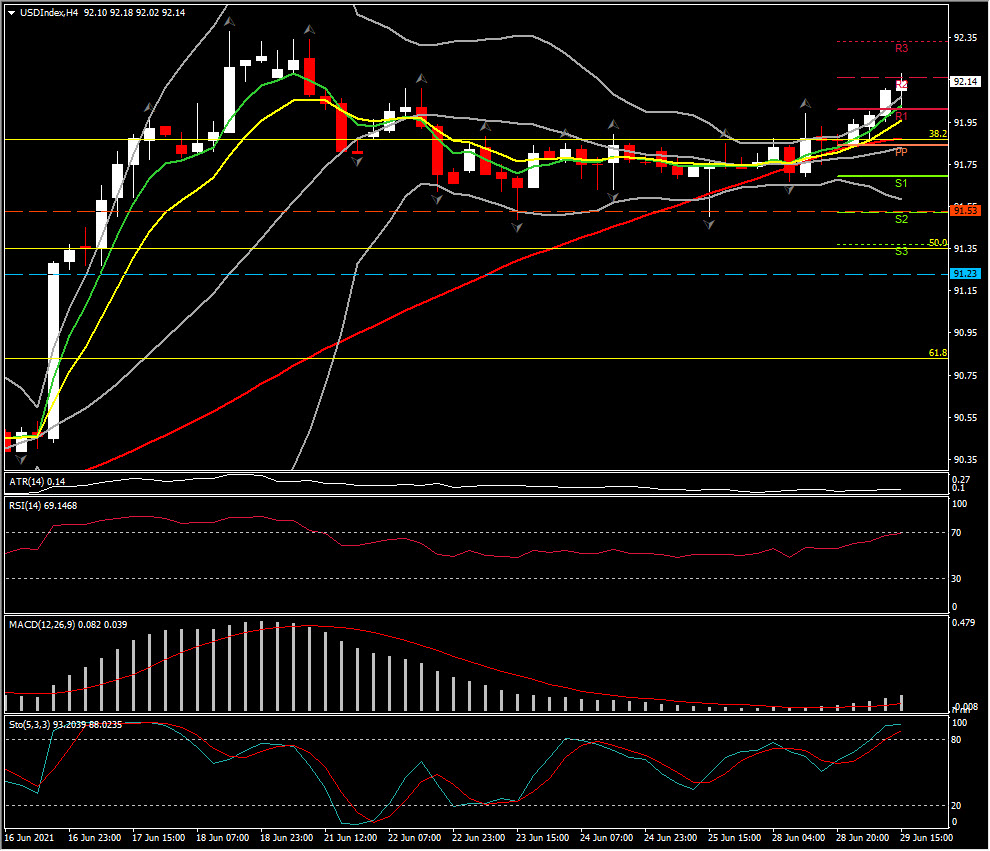

The USD Dollar has been trading with a firming bias, overall, posting fresh highs versus many currencies. The spate of cautious trading in world stock markets, due to concerns about the highly transmissible Delta variant’s spread in Asia and elsewhere, has revived some safe haven demand for the US currency. Data out of Asia have been adding to the wary sentiment. Data out of Japan today showed that while retail sales rose, the jobless rate hit a five-month high as a consequence of virus restrictions. This followed weekend data showing profits at Chinese industrial companies falling in May. Data from Europe were better, including a new series record reading for the Eurozone ESI economic confidence index. The USDIndex printed a 1-week high at 92.18, and EURUSD pegged a 1-week low just under 1.1900.

Incoming data will continue to be scrutinized, culminating this week with the June US payrolls showstopper. All eyes are on the June nonfarm payroll estimate, which sits at 550k, close to May’s 559k rise. The gain is consistent with a solid 7.8% Q2 GDP growth estimate, assuming a June workweek of 34.9 that leaves a solid 0.4% June rise for hours-worked, alongside a 0.2% hourly earnings gain that extends the 0.5% May rise, and a jobless rate drop to 5.6% from 5.8%. Claims data continue to tighten and producer sentiment remains robust, though most consumer confidence measures have plateaued.

Hourly Earnings

Hourly Earnings are expected at a 0.2% June average hourly earnings figure, after hefty gains of 0.5% in May and 0.7% in April. Swings are likely still being impacted by the percentage of lower paid workers in the jobs pool, as seen with the 4.7% surge in April of 2020 and the 1.0% pop in December. A 3.5% y/y increase in June is anticipated, which partly reflects an easy comparison from a 0.4% y/y rise in April. Growth in hourly earnings was gradually climbing from the 2% trough area between 2010 and 2014 to the 3%+ area up to the start of the pandemic. The y/y wage gains are being distorted in 2021 by the base effect from last year’s wage spike and ensuing unwind.

Hence, the June payroll forecast is for a 550k increase that reflects the rebound in the economy through Q2 due to vaccine distributions, stimulus, and business reopenings. Market forecasts are mostly stronger than our own, but payroll gains in the 550k area are consistent with the 7.8% Q2 GDP estimate. The jobless rate should fall to 5.6% from 5.8% in May.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.