Wall Street opened mixed, leaving the USA100 slightly higher, at record highs in early trade. The USA500 is marginally underwater, while the DJIA is underperforming, off 125 points or about 0.35%. Financials are lagging, with USA30 components JPMorgan and Goldman Sachs off more than 1%, as the Treasury curve flattens. Big tech is supporting the USA100 to a degree, with Amazon, Alphabet, Apple and Microsoft all higher.

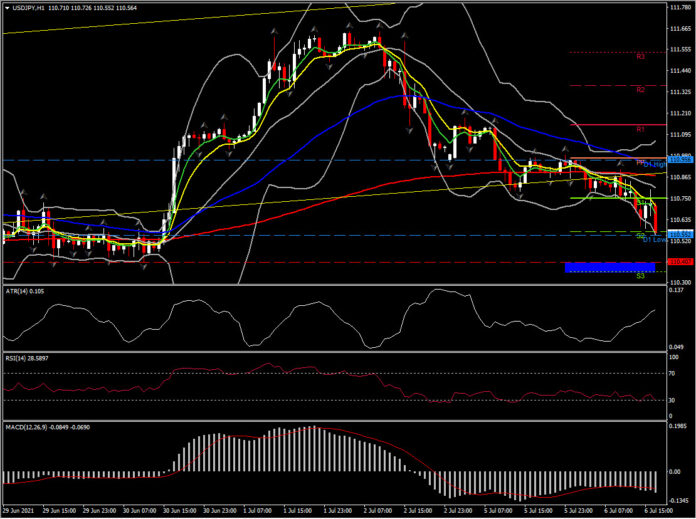

The Dollar slipped slightly after the bigger than expected pullback in the Services ISM. USDJPY dipped to intraday lows of 110.57 from near 110.75, while EURUSD headed up to 1.1840 from under 1.1835.

The US ISM Services Index fell -3.9 points to 60.1 in June, weaker than projected, after bouncing 1.3 points to a historic high of 64.0 in May. The index has been on a bumpy path amid the vagaries of the pandemic, stimulus, vaccines, reopenings, and bottlenecks. It was at 56.5 a year ago, having recovered from two months of contraction in April and May of 2020. Declines were broadbased. The employment gauge slumped further, dropping 0.6 ticks to 49.3 after falling -3.5 ticks to 55.3 in May. New orders dropped to 62.1 from 63.9. Supplier deliveries slid to 68.5 from 70.4. New export orders plunged to 50.7 from 60.0. Imports bounced to 58.2 from 50.4. And the backlog of orders component rose to 65.8 from 61.1. Prices paid dipped to 79.5 from 80.6.

Earlier we saw the US Markit Services PMI dip to 64.6 in the final June print versus the 64.8 preliminary. The index is down 5.8 points on the month, reversing the 5.7 point surge to a record 70.4 in May as activity slows a bit. It was at 47.9 a year ago. Yet this is still an 11th straight month in expansion. Prices charged also declined to 64.2 versus 66.1 in May. The employment component slid to its lowest since March. The composite index fell to 63.7 versus the 63.9 preliminary June print. It also has unwound most of the 5.2 point May jump to 68.7 which was also a fresh historic peak. It was at 47.9 a year ago and has also been over the 50 mark since July. The backlogs of work subcomponent rose to 55.0 from 54.5 previously and is a new all-time peak. Employment also dipped on the month.

Nevertheless, in Treasuries, the curve flattening trade has seen the 10-year yield slip further to test 1.40%, the lowest since early March. The curve has narrowed to 117 bps from the 120-122 bps last week and is the flattest since February. Some of the bid in longer bonds is supported by beliefs the Fed will be able to control inflation and that the current spike will indeed be transitory. The market is still correcting from overly bearish positioning into the FOMC. There is also ongoing demand from overseas investors given yield differentials. And there is some spillover from Europe where EGBs are rallying.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.