Yields remain richer but are off their overnight lows as some of the buying eases. A slightly better than expected jobless claims report has had little impact. Equities are still near their cheapest overnight levels though. The 10-year rate is 3 bps richer at 1.286% versus 1.2479% earlier. The 30-year is down 4 bps at 1.898% versus 1.855%. Those are the lowest yields since early/mid February. And the 2-year is fractionally lower at 0.206%. The 2s-10s spread has narrowed to 104 bps earlier, versus 120 bps at the start of the month. Reduced worries over inflation and removal of accommodation by the FOMC and ECB, along with fresh signs that the PBoC may ease again have wrong-footed bonds with a resulting short covering scramble.

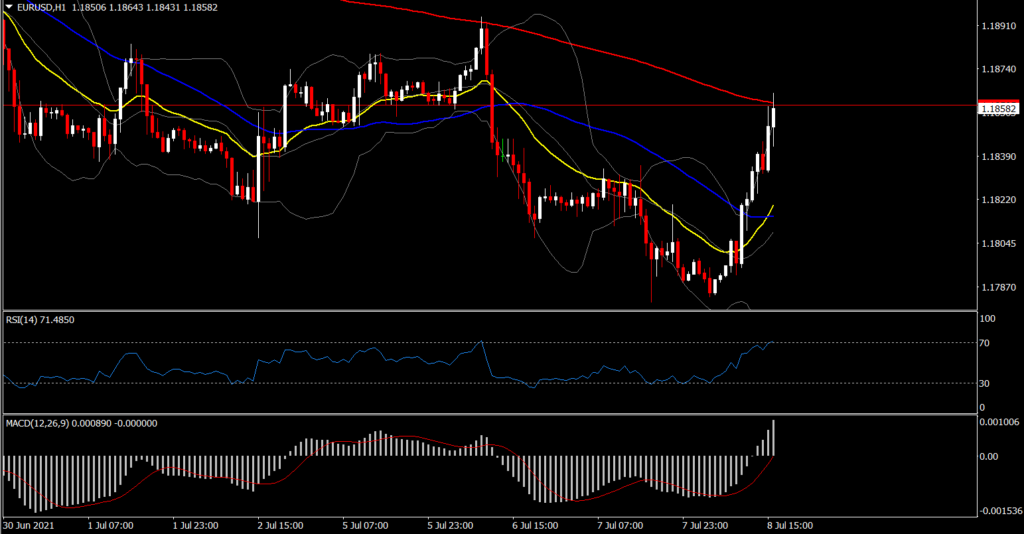

The US Dollar was steady following the jobless claims, which saw initial claims a bit higher than consensus, and continuing claims down quite sharply. EURUSD headed from 1.1840 to over 1.1850, while USDJPY touched near one-month lows of 109.60, down slightly from 109.70.

According to ECB Lagarde today, ECB fixed inflation goal at 2.0% as part of the strategic policy review. The move was widely expected and changes the definition of price stability as “below but close to 2% over the medium term in favour of a symmetric 2% target that could “imply a transitory period in which inflation is moderately above target”. In reality, the central bank’s medium term focus has always ignored temporary inflation overshoots, but at the moment the move will be taken as a signal that above target inflation won’t prompt quick tapering moves. The ECB also said that it will now take into account climate consideration in its monetary policy operations. Furthermore, owner-occupied housing costs will be included in the supplementary measures of inflation. No real surprises on the whole.

EURUSD has lifted out of lows and reversed most of the losses seen yesterday in returning to levels around 1.1800., aided by a degree of Euro outperformance. The pair seems to have belatedly found some support from the precipitous narrowing in U.S. over Bund yield differentials at longer-dated maturities. The 10-year US Treasury yield fell to near 1.26%, levels last seen in February and extending the decline from recent highs above 1.70%. The 2-year US T-note yield is moderately down from recent highs but overall relatively steady amid the curve flattening play, which is reflecting of a significant unwinding in the reflation trade. Yesterday’s release of the FOMC minutes didn’t challenge the “on hold for the foreseeable” view of the Fed’s policy stance. While this helped Wall Street to new record highs, global sentiment is becoming palpably more leery. Investors face lofty valuations, surging Covid cases in many regions where there has been only limited vaccinations, and a plateauing in the economic recovery expansions in major economies. This had engendered a degree of safe haven demand for the dollar, though this seems to have abated for now. EURUSD’s former consolidation support in the 1.1910-15 now marks a resistance risk zone, as a break back above would negate the significance of last week’s decline. As for euro fundamentals, economic recovery has been ongoing robustly, with the final release of June PMI out of the eurozone confirming this, though preliminary June eurozone inflation data has showed an abatement in price pressures, which will strengthen the hand of the doves at the ECB governing council.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.