The WHO has warned that a new wave of Covid in Europe is inevitable, with cases of the Delta variant rising. The resurgence of Covid could have a devastating effect on the summer tourist season, as France for example has warned its citizens against traveling to certain European countries. Last week’s Delta-driven pullback serves as a warning that the mutating virus is not finished disrupting lives and livelihoods. The continued ebb and flow of the virus is likely to drive traders’ appetite for riskier assets through the rest of the year.

On Monday, Eurozone finance ministers will meet in Brussels to discuss the economic and financial issues affecting the area, and US Treasury Secretary Janet Yellen may also be invited.

On Tuesday, Germany releases its June CPI report, which is expected to slow to 0.4% m/m from 0.5% with the headline at 2.4% y/y. The Eurozone releases its y/y CPI reading on Friday, which could slip from 2.0% to 1.9%. The Core CPI y/y reading is expected to remain unchanged at 0.9%.

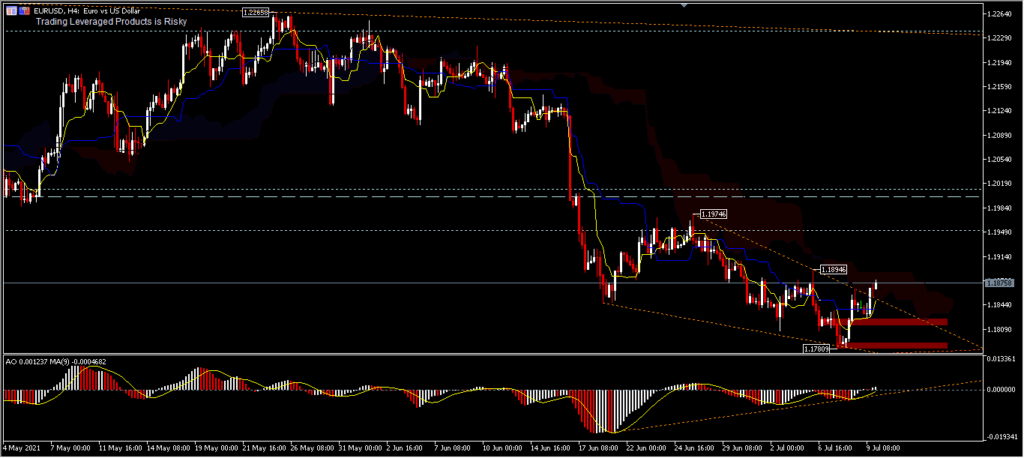

Technical Level

EURUSD closed the week with continued strength from the previous Thursday, closing at 1.1875 with a total gain of just 0.19% last week in a narrow trading range. The intraday bias has shifted slightly, although it still looks very neutral. A break of the micro trend line may have a special meaning for the small group of bears that have turned into a bull herd in the form of a divergence. The bears’ dream finally stopped for a moment after hitting the up trendline, however the bulls’ defence area was trying to hold on to the downside. The challenge ahead is the first resistance at 1.1894 price level. A break of this level would lead to the objective of the next level target at 1.1975 and that means the 1.2000 psychological level will again be in the spotlight.

On the negative side, the price movement will try to break the minor support level of 1.1824 or the third leg of 1.1780. Technical support comes from AO which is slightly firmer above the neutral zone, while the bearish Kumo has yet to be broken, although the golden cross of Tenken sen and Kinjun sen has occurred below Kumo, but is not a strong enough signal to reverse all 5 weeks of losses. The bears’ pressure is still strong, but the bulls’ efforts to build resistance are also visible.

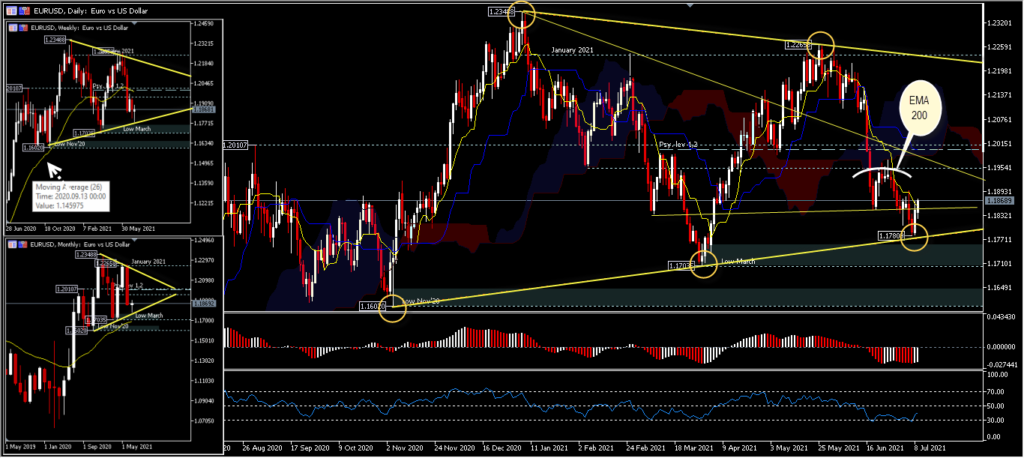

The Weekly candle presents a hammer pattern, a form of bull resistance that does not support the decline continuing in the near term, but how strong will the bulls hold the fall if market pessimism controls the action next week? No one knows for sure.

In the big period, the overall trend is still supported by the support level 1.1602. Sustained downside movement from current positions will target 1.1703 and if strong will test 1.1602. A move below 1.1601 would strengthen the retracement to 50.0% (1.1500) levels first and then 61.8% (1.1287). As long as the 1.1602 level holds, the consolidation on the upside will continue for the trading space to narrow further in a symmetrical triangle pattern, firstly for the 200 EMA dynamic resistance (38.2% FR) and if it is strong the 1.2000 psychological level (50.0% FR) will be the middle price. A move above 1.2000 will confirm that the continuation of the March 2020 rebound will still take place for the resistances at 1.2265 and 1.2348.

A Symmetrical Triangle Pattern is in the process of forming has been formed, after bouncing off the ascending trendline at the third touch 1.1780 synchronous on the RSI bounce at oversold levels, while AO has not confirmed this bounce as an attempt to rebound by only providing 2 white histogram bars in the sell area. What needs to be underlined is that the Bearish Engulfing Monthly candle pattern is still giving serious pressure and the RSI is still below the 50 level, which means that negative sentiment is still there.

Click here to access our Economic Calendar

Ady Phangestu

Analyst – HF Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.