Netflix (#Netflix) and Philip Morris (#PhilipMorris) are expected to release their earnings reports on 20th July, with the former being released after market close and the latter being released prior to market open.

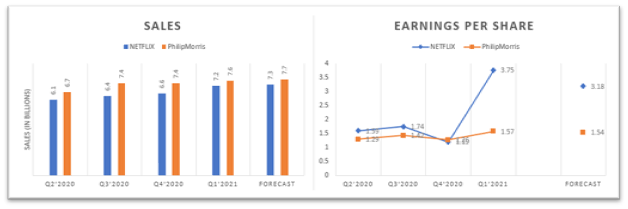

Figure 1: Reported Sales and EPS versus Analyst Forecast for Netflix and Phillip Morris.

Netflix

Sales of the streaming behemoth Netflix are on par with consensus estimates for the past few quarters. In Q1 this year, reported sales of the company amounted to 7.2B, up 9.09% q/q from the previous quarter. On the other hand, following consecutive losses in the past few quarters, the company’s earnings per share (EPS) have turned positive and exceeded analysts’ estimates in its latest announcement, at $3.75. For the upcoming earnings announcement, market sentiment remains positive, whereby sales are expected to hit 7.3B, up 19.67% (y/y), while EPS are expected to double from the same quarter last year (but slightly below the previous quarter), at $3.18.

Nevertheless, global streaming paid memberships remain a hidden concern. In the previous quarter, this key item was short of about 2 million subscribers from its previous guidance, which eventually led to a fall in the company’s share price by 11% in after-market trading. According to the management, the recent miss of subscribers is related to factors such as increased competition (Apple TV+, Amazon Prime Video, Disney Plus, HBO Max, NBCUniversal’s Peacock etc) and pandemic-induced production delays that caused a lower slate of content on the platform.

Despite the recent challenges, the management’s outlook on Netflix remains positive and they reiterated that the company “is on track to be break-even for full year 2021, even with the increase in content spending”. Also, a deal made with Sony Pictures recently and a plan to venture into video games may allow Netflix to further expand its business opportunities.

Netflix

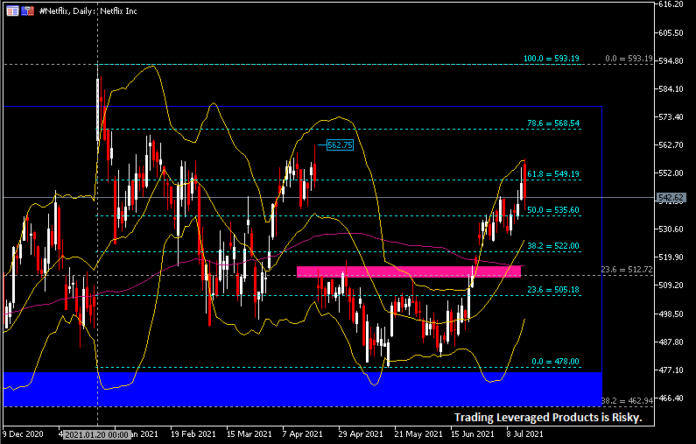

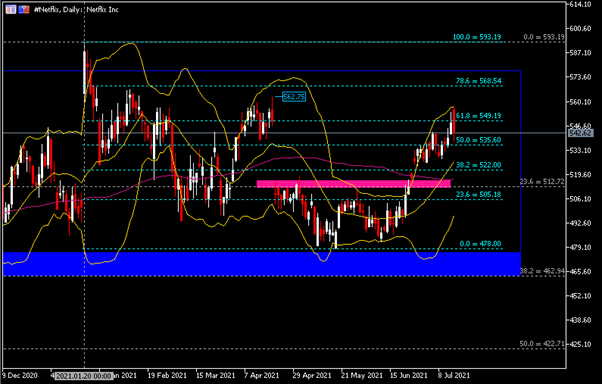

In the bigger picture, #Netflix remains consolidated in a rectangular zone since its retracement from the first high at $575.15 a year prior. The level was again tested on 20th January, forming an ATH at $593.19, yet retraced lower soon after. The overall retracement met its lowest end at $478.00, on 19th May this year, before it rebounded higher and broke above 100-SMA near $520.00. It currently remains pressured below the FR 61.8% ($549.20) resistance that extends from the ATH to the lowest end of the retracement.

In the bigger picture, #Netflix remains consolidated in a rectangular zone since its retracement from the first high at $575.15 a year prior. The level was again tested on 20th January, forming an ATH at $593.19, yet retraced lower soon after. The overall retracement met its lowest end at $478.00, on 19th May this year, before it rebounded higher and broke above 100-SMA near $520.00. It currently remains pressured below the FR 61.8% ($549.20) resistance that extends from the ATH to the lowest end of the retracement.

If breakout at the said resistance is successful, the next level to watch will be the high point seen on 20th April at $562.75, the zone between FR 78.6% ($568.50) and the first high ($575.14) from a year ago, and ATH at $593.19.

On the contrary, failure to break above the said resistance may indicate price reversal to retest support at $535.60 (FR 50.0%), confluence zone between 20-SMA/Bollinger middle band and $522.00 (FR 38.2%), and $512.70 (FR 23.6% that extends from the lows seen in September 2019 to the ATH; also the neckline of double bottom pattern).

Philip Morris

Philip Morris is an American-Swiss multinational company, specialized in the manufacturing and selling of cigarettes and tobacco in over 180 countries. Since 2019, through sophisticated heating systems and technologies, the company has successfully developed various e-cigarettes as potentially less harmful alternatives to cigarettes, thus benefiting not only the consumers, but the environment and society as well.

In the previous quarter, reported sales of Philip Morris remained almost in line with the past two quarters, last stood at 7.6B. Earnings per share (EPS) were outstanding, at $1.57, exceeding consensus estimates by 12.14%. Market participants continue to expect the company to record 7.7B in sales and $1.54/share for the coming earnings announcement.

In the near term, Philip Morris is set to complete acquisition on Fertin Pharma by Q4 2021, hoping to leverage the latter’s scientific insights and technologies (Nicotine Replacement Therapy solutions) to help broaden access to smoke-free alternatives (such as nicotine pouches and lozenges) globally.

In addition, following the company’s partnership with another tobacco behemoth KT&G in January 2020, it is set to achieve its goal to ship 90-100 billion heated tobacco units worldwide this year, while aiming to generate more than 50% of net revenues from smoke-free products by 2025.

Taking into consideration the mentioned optimistic outlook of the company and its ability to deliver positive surprises nearly 70% of the time, regular dividend payment without failure, plus its soon-to-be new three-year share repurchase program, the potential for growth exists.

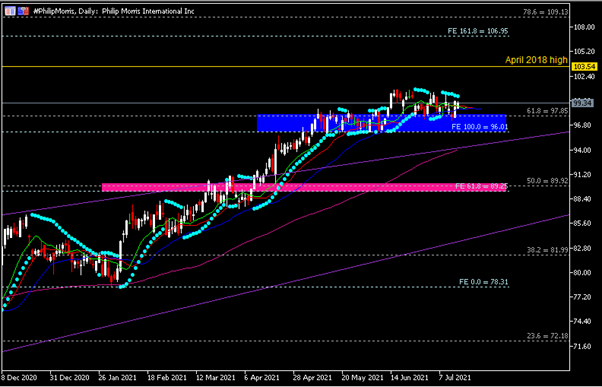

The #PhilipMorris share price has traded in a strong uptrend since regaining its support from the lows seen in late March 2020, at $56.00. It then recorded cumulative gains of 77.4% to last close at $99.34.

The #PhilipMorris share price has traded in a strong uptrend since regaining its support from the lows seen in late March 2020, at $56.00. It then recorded cumulative gains of 77.4% to last close at $99.34.

Recently, the company’s share price remained consolidating at a high level (in line with the Alligator indicator), above the immediate support zone $96.00-$97.85. Coupled with the parabolic SAR that are positioned above the share price, the bulls may not be activated at this moment.

An additional catalyst may be required for a clear breakthrough. A surge in bullish momentum may drive the share price higher towards the high seen in April 2018, at $103.54. The second and third resistance are $106.95 (FE 161.8%) and $109.15 (FR 78.6%).

If price breaks below the said support, the bears may drive the price lower to test the confluence zone between the upper line of ascending wedge and 100-SMA. Moving further, a break below the support zone $89.25-$89.95 may indicate a change in the current trend structure.

Click here to access our Economic Calendar

Larince Zhang

Regional Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.