Q2 earnings got off to a lackluster start Tuesday. Hefty earnings beats from JPM & Goldman Sachs were overshadowed by concerns over revenues& as a lot of the strength was on easy comps.

US: A much hotter than expected CPI print & very poorly bid 30-yr bond auction were a potent combination for a Treasuries selloff. The combo also left Wall Street heavy. June CPI surged 0.9% on both headline & core, more than double the estimate for the overall index & 3x the forecast for the ex-food & energy component. For the former it was the biggest jump since June 2008, while for the latter it tied for the largest since late 1981.

Asia: Bonds across the Asia-Pacific region were under pressure though & New Zealand’s 10-yr rate spiked 7.3 bp to 1.73% after the RBNZ unexpectedly decided to end large scale asset purchases by July 23. Stock markets mostly struggled, though the ASX managed to lift 0.4%, despite extended virus restrictions in some parts. JPN225 is -0.3%. The NZX 50 is down -0.5%. UK CPI inflation unexpectedly jumped to 2.5% y/y from 2.1% y/y in the previous month. A strong round of numbers, even if PPI readings show a slight deceleration in price pressures. The official BoE line has been that inflation overshoots will be transitory, but after today’s round of higher than expected numbers, labour market data later in the week will be watched very carefully.

Fed Chair Powell testimony preview: Chair Powell goes to Capitol Hill for his semi-annual Monetary Policy Report (aka Humphrey Hawkins) & his comments will be especially scrutinized after another hefty CPI jump. However, while he will likely indicate that price pressures have been above Fed expectations, we expect him to reiterate the price pressures should be “transitory” & largely a function of base effects & the supply/demand impacts from reopenings & supply chain constraints. He will also repeat that the FOMC is not yet ready to begin withdrawing accommodation as the labor market has yet to fully recover. And he won’t give a timeline on QE unwinding.

FX markets: GER30 & UK100 are down -0.1% & -0.007% respectively, while US futures are still narrowly mixed, with the USA100 future outperforming. NZD rallied in the wake of the hawkish turn at the RBNZ. USD is steady to weaker, with USDJPY at 110.53. EUR & GBP lifted against a largely weaker USD, although EURUSD remains below 1.18 & Cable below 1.39. USOIL meanwhile is at $75.06 per barrel.

Today – Data releases today focus on US June PPI, BoC Monetary Policy & Press Conference & the first day Testimony from Fed Chair Powell. The earnings calendar includes BOA, Wells Fargo, Citigroup and Blackrock.

Central banks are likely to gradually reduce the extraordinary degree of stimulus later in the year, but monetary policy will remain accommodative for a long time to come which should see economies through virus setbacks.

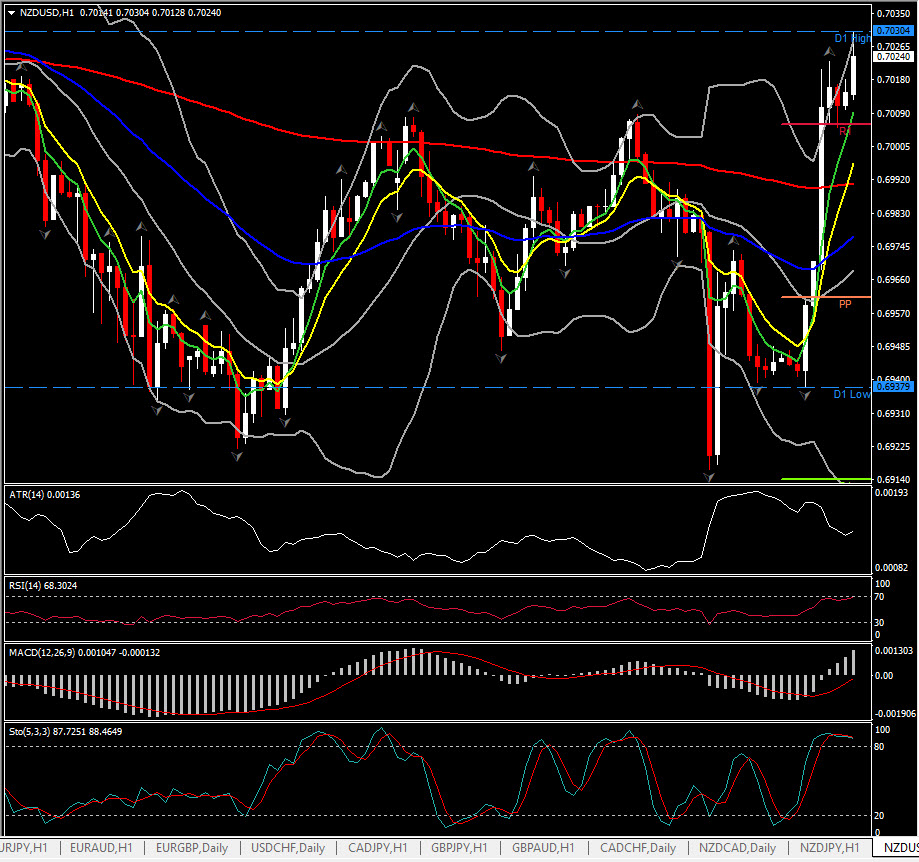

Biggest FX Mover @ (07:00 GMT) NZDUSD (+1.20%). Kiwi spiked to 0.7030 following the RBNZ’s unexpected move. Momentum indicators are still positively configured with exception of Stochastics which flattened into the OB area implying a potential sideways move. Fast MAs aligned higher

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.