USOil, H4

The drop in US crude oil prices made a new low of the week. Despite the EIA report, oil inventories continued to drop for the eighth week at -7.9 million barrels, as a result of the United Arab Emirates (UAE) and Saudi Arabia successfully compromising on production quotas, with the UAE agreeing to reduce its original demand from 3.8 million barrels per day (currently 3.168 million barrels) to 3.65 million barrels. This means that UAE production is on the verge of increasing and OPEC+ may have to maintain the group’s production cut deal until the end of 2022. The group has not yet set a date for the next meeting.

Concerns about the outbreak of the Delta virus are still a backdrop for market concerns that may cause economic recovery to halt and lower oil demand. Most recently, Indonesia reported 54,000 daily infections, which is higher than India. Meanwhile, on Wednesday Australia announced an extension of Sydney’s lockdown for at least 14 days in addition to the original three weeks.

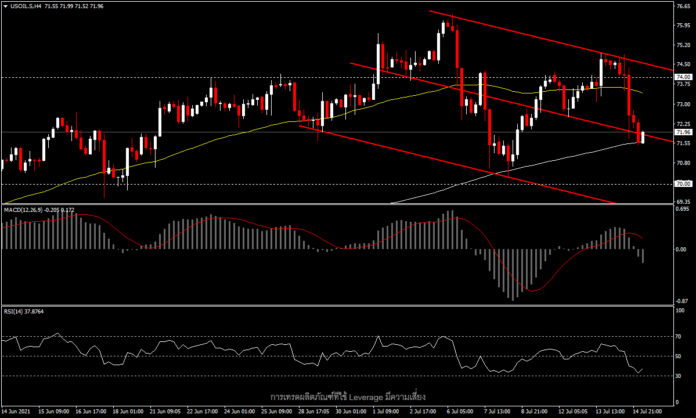

In terms of the technical point of view there are reasons to support the decline in crude oil prices as well. Signs of a bearish divergence were seen in both the Day and Week timeframes, before testing a near three-year high (September 2018) and then collapsing.

For today’s USOil H4 trend, price is stuck at a key support and the MA200; if it breaks down, the next support is at 70.00. Key resistance remains at 74.00, slightly above the MA50, but what is noteworthy is that volatility increased in July. The Daily ATR now stands at 2.13 which means the price swing after this may be wider.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.