Risk off trades continued to dominate the Asian part of the session, but there are signs of stabilisation.

Stocks declined as fears that the rapid spread of the Delta variant will delay re-openings and force extended lockdowns in countries with lower vaccination rates continue to fuel risk aversion. Investors will be keeping a very close eye on virus developments, but speculation that market developments will delay central bank tapering plans should put a floor under markets that have corrected from very high levels.

Today, in the Asia session and on European open:

- Bond markets continued to play catch up with the sharp rally in Treasuries yesterday. Australia’s 10-year rate is down -6.2 bp , New Zealand’s has corrected -7.8 bp and China’s 10-year bond is -1.5 bp richer.

- Japan’s CPI rate nudged higher in June, with core lifting to 0.2%. Data are not expected to change the course of the BoJ.

- Developer Evergrande slumped after local authorities halted some of its sales.

- US futures are down and in cash markets the 10-year Treasury rate has lifted 1.1 bp to 1.200%. – Currently the USA100 has rebounded with 0.4% gains.

- September 10-year Bund future is little changed. – GER30 and UK100 futures are up 0.3% and 0.2% respectively.

- German PPI inflation lifted to 8.5% y/y in June – remains mainly driven by developments in commodity prices.

- RBA minutes: Strengthen rather than taper QE as stock markets continue to sell off.

- In Australia, nearly half the country’s 25 million people are living under lockdowns to quell an outbreak of the Delta variant.

- US yield curve continues to steepen. JPMorgan’s HuiP: “reflects reduced inflation expectations if reopening is delayed and potential downside risk to the economy, but that value and cyclical sectors should continue to outperform over the next 6-12 months given the ongoing recovery globally.”

Today’s data calendar in Europe and the US remains pretty quiet, with US housing starts, while neither German PPI nor Eurozone current account numbers are likely to change the outlook much.

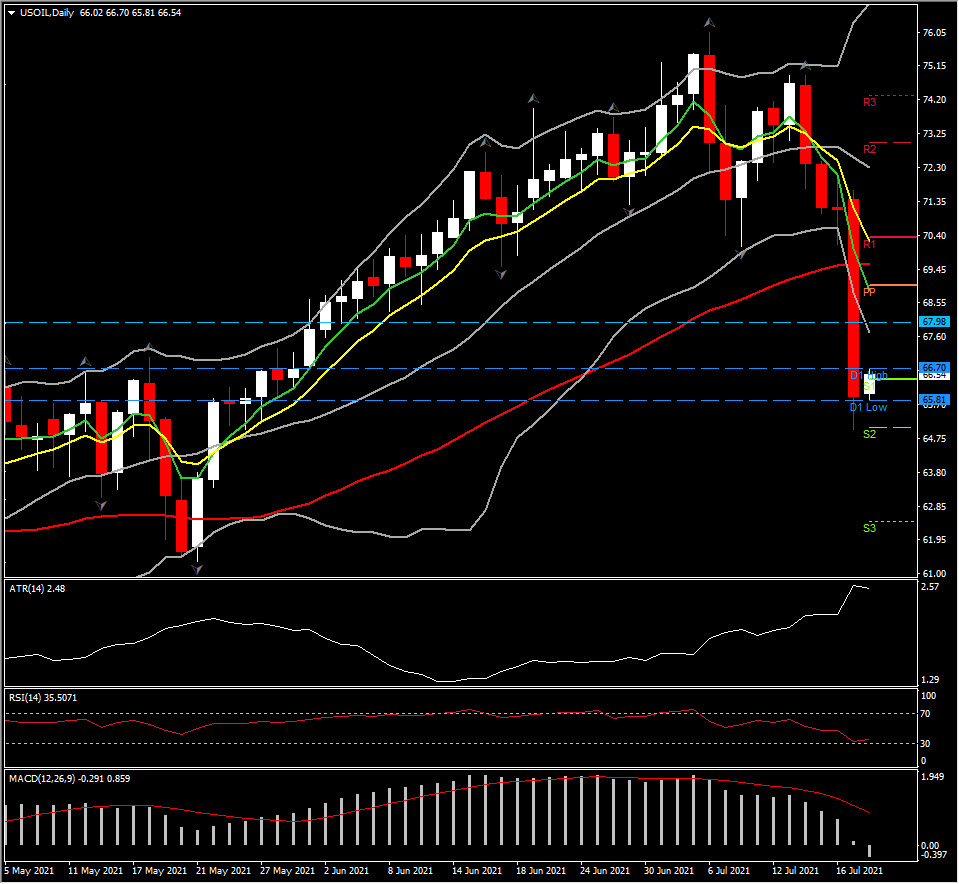

FX markets: In FX markets the USD remained supported by safe haven bids and EURUSD dipped to 1.1773, while GBPUSD is at 1.3647 crossing the 200-day SMA. Safe-harbour currencies like the JPY and USD traded near multi-month highs against the riskier AUD, NZD and GBP. USDJPY is little changed at 109.35-109.60. USOIL prices stabilised at 66.50.

Key mover: USOIL – Oil prices stabilised on Tuesday after slumping around 7%. The aggressive selloff of USOIL was fueled by worries about future demand and after an OPEC+ agreement to increase supply. The contract for August, which expires later on today, was up 15% at $66.57 a barrel.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.