European stock markets are broadly higher as sentiment stabilises. Indices bounced back following yesterday’s sell off, and while markets are off earlier highs GER30 and UK100 remain up 0.3% and 0.5% respectively. US futures are also posting broad gains, with a 0.5% gain in the USA30 leading the way.

Markets have started to scale back tapering expectations and there were some suggestions that the RBA may actually add to QE rather than scale it back. Warnings from BoE’s Haskell against the risk of pre-mature tightening moves and expectations that the ECB will strengthen the dovish message in the forward guidance at Thursday’s meeting may have also helped. Virus developments remain in focus, but have to be put into context. Incidence rates are rising thanks to the more infectious Delta variant, but remain relatively low in Germany and France, and at the same time, vaccination programs are also advancing. Although the UK raised the alarm on the Beta variant in France, studies have shown that this is a mild variant that is mainly found on a French island in the Indian Ocean, and it is already known that vaccines may not be able to prevent all infections. The UK’s 7-day incidence rate of 473 meanwhile is only topped by holiday hotspot Cyprus and compares to rates of just under 90 for France and around 11 in Germany.

As virus developments highlight that the pandemic is not over, the ECB is in focus for the rest of the week. Against that background it seems President Lagarde is set to strengthen the dovish tone of the forward guidance at the upcoming July 22 council meeting. That doesn’t mean that the central bank isn’t slowly preparing for tapering measures, but even if there are no setbacks and the ECB really does start to scale back monthly asset purchase targets and phases out PEPP as planned, monetary policy will remain extremely accommodative and rate hikes won’t be on the agenda for a long time.

A strengthened forward guidance then would set the stage for a scaling back of purchase levels, which is still to come at the September meeting, with the next set of forecasts. The decision on PEPP meanwhile may not be taken until December and will likely come with a strengthening of other asset purchase programs, which may not offer the same flexibility on the distribution of purchases, but still leaves the central bank with room to step up support again if necessary.

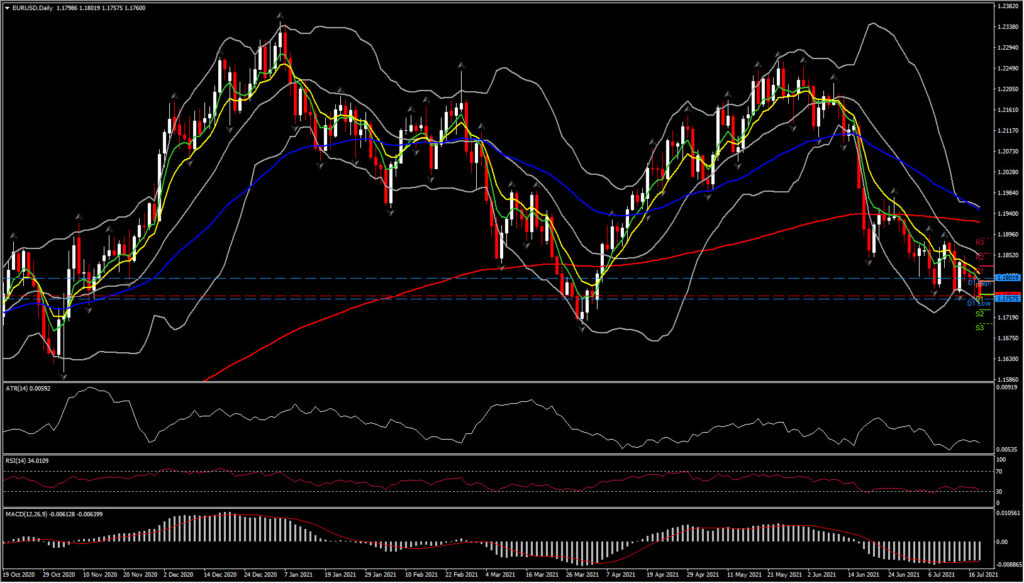

EURUSD has found a toehold after tumbling to a three-and-a-half month low at 1.1764 yesterday and so far today as well. Safe haven demand for USD weighed on the pair, though the dust has settled today and European stocks and US equity futures have managed a rebound, unable to take the pressure off EURUSD.

As for the Euro, June inflation data out of the Eurozone showed there have been markedly more benign price pressures in Europe versus the US and UK, and ECB policy members have for the most part continued to sing from the dovish hymn sheet. Both the Fed and ECB holding onto a dovish stance, with both pursuing ongoing near zero rate interest rate policies (EURUSD neutral). US inflation is higher than Eurozone inflation (EURUSD bullish), but US economic growth is outpacing that of the Eurozone (EURUSD bearish). At the same time, the U.S. is running a current account deficit and the Eurozone a current account surplus (EURUSD bullish), although the currency impact of this may be mitigated, and even more than offset, by capital inflows to the US should the marked growth differential between the US and Eurozone sustain (potentially EURUSD bearish). A periodic safe haven influence is also in the mix, with the dollar apt to outperform during periods of heightened risk aversion in global markets.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.