Chinese ADRs seen worst since 2018 – Hang Seng tech extends losses. The Chinese education sector knocked the CSI off -3.2%. Overnight, Stocks traded mixed, with China bourses still pressured by fears of China’s regulatory clampdown. Chinese shares fell sharply to their lowest levels this year on Monday as investor worries over the impact of government regulations kneecapped the education and property sectors, after Beijing barred for-profit tutoring in core school subjects.

Data releases included Japan services PPI, which came in a tad higher than anticipated at 1.4% y/y, which was still down from 1.5% y/y in the previous month. China industrial profit growth slowed to 20.0% y/y from 36.4% y/y.

European open: Treasury futures are fractionally lower, although in cash markets the US 10-year has remained supported, leaving the rate down -1.2 bp at 1.378%. Eurozone bonds underperformed versus Gilts yesterday as peripheral stock markets caught a bid, but GER30 and UK100 futures are down -0.2% and -0.1% respectively at the moment, after a mixed session across Asia overnight.

In FX markets: EURUSD down at 1.1788, while Cable is trading at 1.3809. USDJPY is at 110.12, with the Yen broadly higher. USOIL meanwhile is at USD 71.76 per barrel. The Aussie and Kiwi traded cautiously, at 0.7362 and 0.6977. While the antipodean NZD is backed by a strong economy and a hawkish central bank, recent strength in the US Dollar and concerns about rising global COVID-19 infections have kept the Kiwi range-bound over the last month. Markets are likely to remain cautious going into tomorrow’s FOMC announcement. Tesla’s profits soared to record 1.1 billion, LVMH Q2 sales soared beating forecasts.

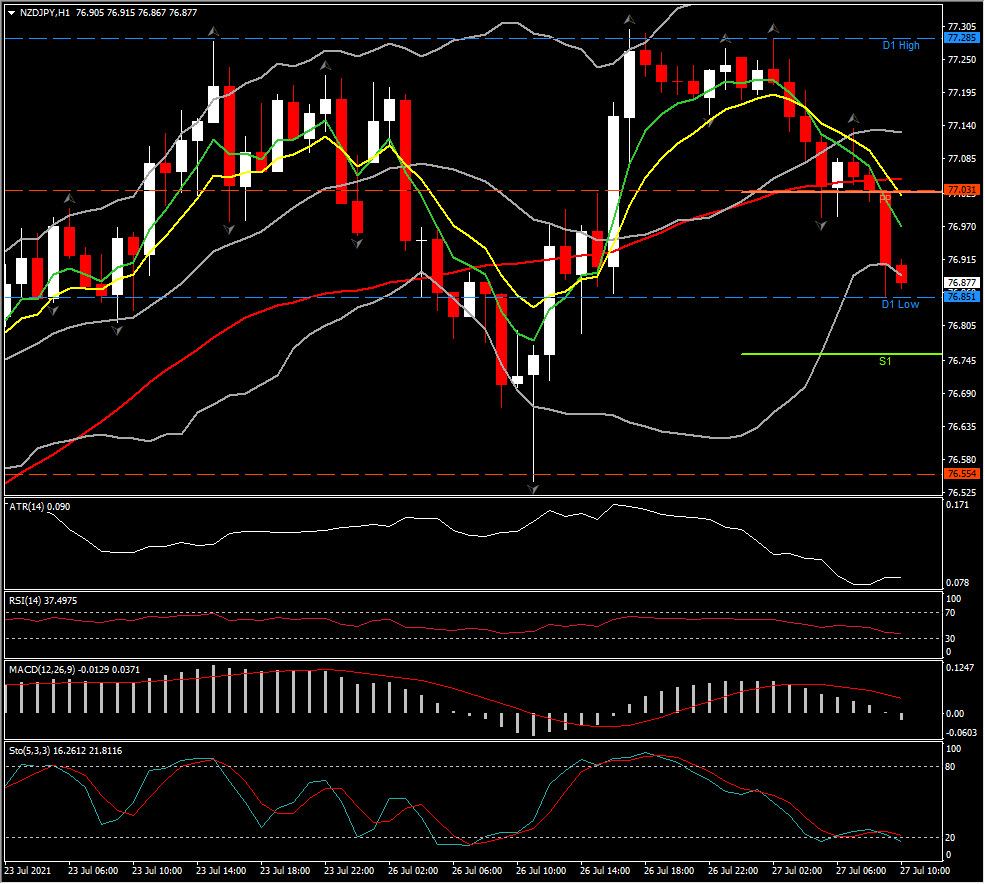

Biggest FX Mover @ (06:30 GMT) NZDJPY (-0.57%) – Dived from 77.30 to 76.53, breaking S1. The fast MAs aligned lower, MACD signal line & histogram under 0 line and moving lower, RS 26 and moving lower testing OS zone.

Today: Wider markets are watching virus developments while waiting for US tech earnings and the FOMC announcement tomorrow. Earnings reports provide a distraction and investors will also keep an eye on virus developments. Local data releases meanwhile are unlikely to change the picture much, with US Durables, consumer confidence and Home prices later on.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.