Pfizer Inc. is one of the largest pharmaceutical companies in the world, ranked 58 by Forbes. Pfizer, Inc. (#Pfizer) is expected to report its fiscal 2021 second quarter earnings on Wednesday (28/07) prior to market opening.

Pfizer’s COVID-19 vaccine success propelled Q1 2021 operating revenue to 42% growth. In its Q1 2021, earnings release, the company reported revenue of $14.6 billion, a solid but less dramatic 8% rise excluding revenue of $3.5 billion for BNT162b2, a COVID-19 vaccine produced in partnership with BioNTech SE. Q1 diluted earnings were $0.86 (reported), or $0.93 per share (adjusted), compared to Q1 2020 EPS of $0.60 (reported), or $0.63 (adjusted). Pfizer expects 2021 revenue to range from $70.5 billion to $72.5 billion and adjusted diluted EPS to range from $3.55 to $3.65.

The COVID-19 vaccine is likely to be a revenue and cash flow driver in Q2 2021. Pfizer expects $26 billion in revenue from BNT162b2 with further increased production capacity to meet demand. This is being reinforced in a cooperation agreement with the Biovac Institute to produce and distribute doses of the COVID-19 vaccine in Africa. The company is also in the final stages of vaccine approval in India, which is another big market. The US FDA has approved the emergency use of vaccines among adolescents under 18 years of age to further expand the healthy cash flow reach of the COVID-19 vaccine segment in the next few years.

Pfizer believes that excluding the impact of the COVID-19 vaccine contribution, the company can still maintain top-line growth of 6% through 2025. If this guidance is correct, the stock appears to be undervalued for now.

According to a report from Israel, the vaccine produced by Pfizer Inc. from the US and BioNTech in Germany only had an effectiveness or efficacy level of 39% when the Delta variant became the dominant strain there, lower than the efficacy rate reported a few weeks earlier, and far below 50%. Data from health institutions in Israel published last Thursday showed the vaccine was still 88% effective for hospitalized patients and 91% for severe cases.

Citing the Straits Times, Chinese authorities will reportedly soon approve the use of the Pfizer/BioNTech Covid-19 vaccine. This approval is Beijing’s first for a foreign-made vaccine with mRNA technology. Shanghai-based Fosun Pharma said the National Medical Products Administration (NMPA) recently completed an expert panel review of the Covid-19 mRNA vaccine.

Estimated earnings and share prices

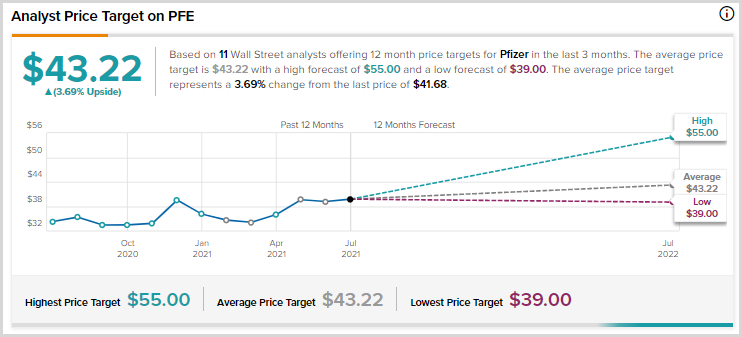

According to Zacks Investment Research, the consensus EPS forecast for the quarter was $0.96. The reported EPS for the same quarter last year was $0.78 (Hold). As for the TipRanks, analyst consensus rating, PFE (#Pfizer) shares are in the Hold category set in the last three months. For price targets, Pfizer’s average is $43.22 per share, implying a potential gain of around 3.7% from current levels.

https://www.tipranks.com/stocks/pfe/forecast

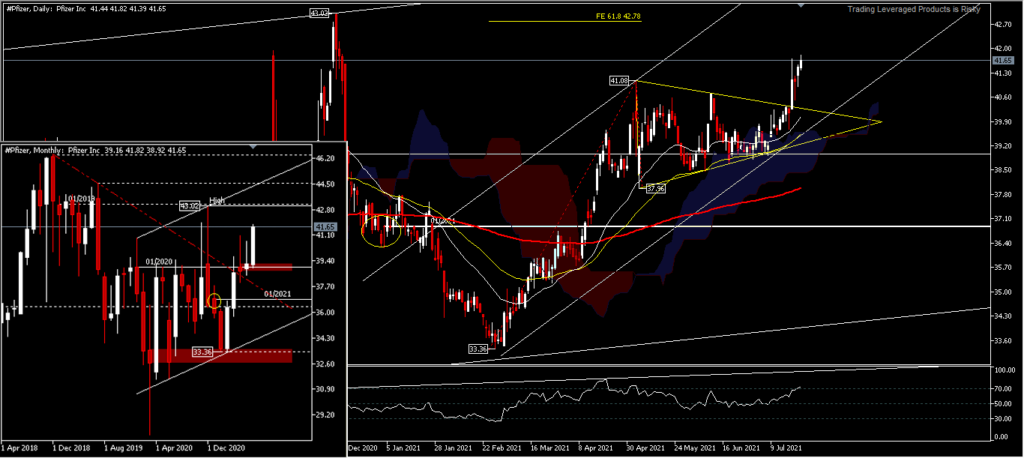

The #Pfizer share price recorded moderate growth during Q2 2021 with +8.02% growth, and total growth from early January 2021 to the closing price on Friday (23/07) last week recorded growth of 12.93%.

The movement of this asset price is still on the upward path, since rebounding 33.43 last March. The moving average is above the Kumo and the 26-day EMA (white line). From the chart we can see that the price has broken out of the symmetrical triangle and has broken through the 41.08 resistance. The next move will target the resistance level of 43.02 or the projected level of FE61.8 (42.69) above the 33.43–41.08 and 37.96 range. The RSI appears to be entering overbought levels, and although it’s not the only catalyst to limit the price rally, it still needs attention. On the downside, the movement will be limited by the supports at 39.68 and 38.92. Overall the trend still tends to be bullish.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.