PayPal Holdings, Inc. is a digital payment platform provider company that was founded in 1998 and is headquartered in San Jose California. PayPal is a major leader in digital finance where it provides a platform to buyers and sellers in facilitating payment transactions. Among PayPal Holdings’ product portfolio are PayPal, Venmo, Xoom and One Touch. PayPal will announce its 2nd quarter 2021 financial report on July 28, 2021 after the market closes.

In October 2020, PayPal surprised the market by announcing the launch of its latest service that allows the use of buying, selling and holding cryptocurrencies. It is now one of the largest sources of revenue for PayPal. Recently, PayPal announced that it had raised the cryptocurrency transaction limit from $20,000 to $100,000 and revoked the annual limit. A PayPal spokesperson was quoted as saying the decision was made in line with the needs and wants of their customers.

The Covid-19 pandemic is clearly having a positive impact on online technology-related companies as online spending (e-commerce) soared following the movement control order and hence the payment transactions and payment volume increased in the 2nd quarter of 2021. Zacks.com market analysts project a 16.8% (y/y) increase in user accounts on 404 million active user accounts. Payment transactions using PayPal products were estimated at 43.2 million transactions compared to the same quarter last year with the total payment volume at $296.01 billion (an increase of 33.5%).

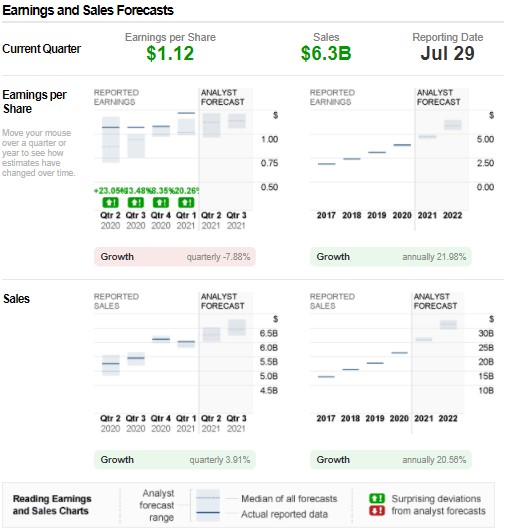

(Source: Money CNN)

PayPal has consistently managed to report financials that have surpassed market consensus over the past 4 quarters. In the first quarter of 2021, PayPal reported revenue of $60.3 billion and earnings per share (EPS) of $1.22 compared to a projection of $1.11 supported by increased payment transactions using PayPal products. PayPal Chief Executive Officer (CEO) Dan Schulman said that cryptocurrency will be key to PayPal’s growth and that a new “digital wallet” product will be introduced in the 3rd quarter of 2021.

PayPal’s business tactical efforts in cryptocurrencies are expected to be the impetus for financial reporting for the 2nd quarter. Market analysts project EPS earnings of $1.12 representing a +5.6% y/y increase. Revenue is expected at $6.3 billion, a growth of 20.1% over the last year.

PayPal’s share price (MT5: #PayPal) was a bit of a roller coaster in 2021, hitting a high of $309.05 before recording a big drop to $223 in mid-February. But it bounced back consistently after that and PayPal shares hit an all -time high last Friday at $309.47 after the announcement of the cryptocurrency’s maximum transaction limit change. The trend is still in a strong Bull rally state and the Bears need an incredible effort to regain control of PayPal shares. Analysts expect the 12-month Forward median price at $327.50 and all analysts put a BUY consensus on PayPal shares.

Click here to access our Economic Calendar

Tunku Ishak Al-Irsyad

Market Analyst – HF Educational Office – Malaysia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.