Exxon Mobil Corporation (#ExxonMobil) and Chevron Corporation (#Chevron), two of the world’s energy giants, are due to report Earnings on Friday, July 30, ahead of the market open. Zacks forecasts revenue for both companies to increase significantly compared to the previous several quarters, with revenue of $63.73 billion and a return on share of $1.02 on Exxon Mobil, the highest forecast since the quarter ended March 2020.

For Chevron’s earnings report, revenue is expected to be $35.63 billion and return per share $1.5, the highest number since the quarter ended March 2020 in terms of both earnings and return per share. However, its ten-quarter earnings forecast showed that Zacks surpassed the reported 7-to-3 ratio for both Exxon Mobil and Chevron.

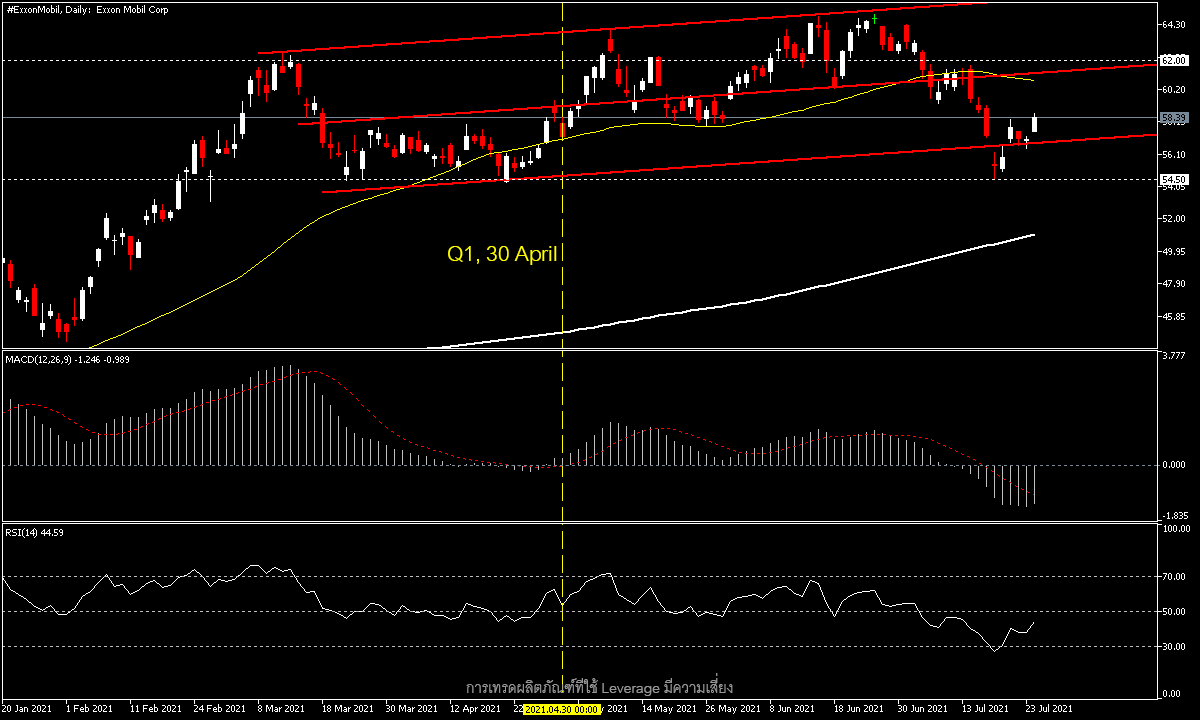

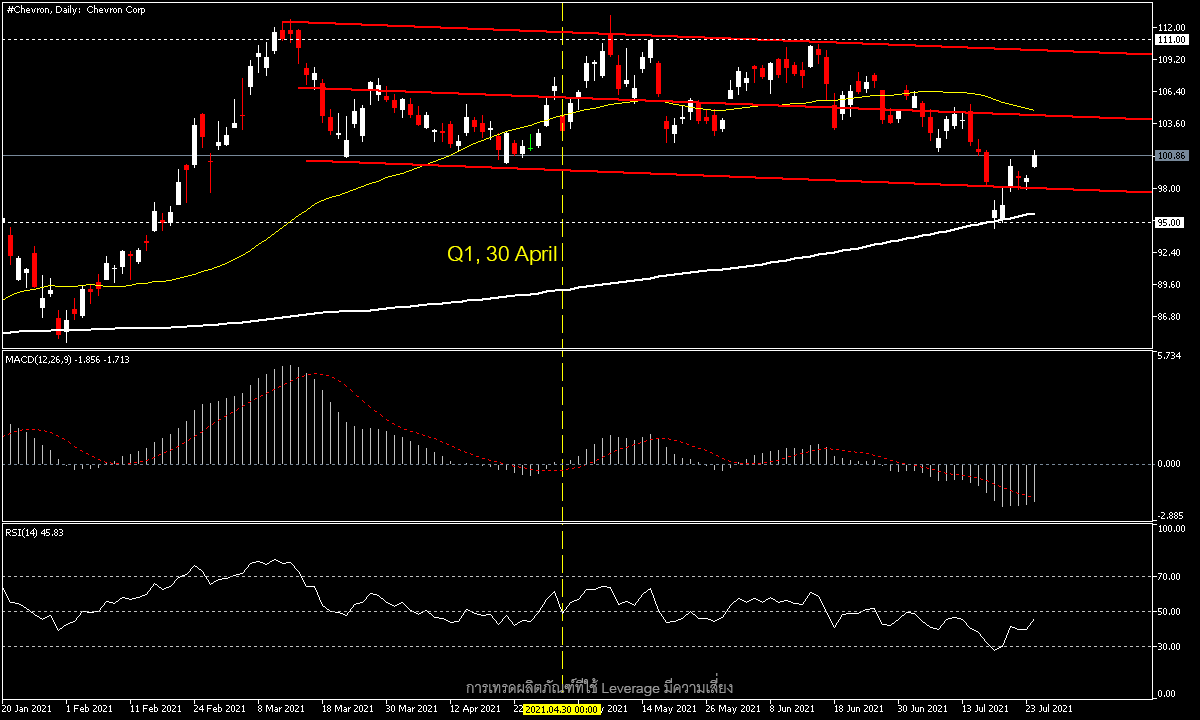

What’s interesting for energy stocks in Q2 is that neither Exxon Mobil nor Chevron’s share prices have recovered again to the pre-Covid-19 levels that occurred earlier this year. Meanwhile, oil prices could rise above pre-pandemic levels at $65.00 a barrel. After the previous quarter’s earnings report (30 April) and with an expense restructuring plan in light of the impact of last year’s outbreak, Exxon Mobil has cut its investments for 2021 by 30% and its operating expenses by 15%, all of which, when combined with continued oil prices up from the previous quarter to the highest level in years, is expected to continue to reflect positive results for the upcoming earnings report.

However, as the largest commodity-related venture, Oil continues to face uncertainty from the Covid-19 outbreak and OPEC’s efforts to increase production in the second half. That means the risks of Exxon Mobil and Chevron are not going anywhere.

On the trend, Exxon Mobil shares fell from a high in the $65.00 zone, testing a three-month low of 54.50 before moving up within the Channel range again. This price level is similar to the previous quarter’s earnings report (April 30), and if the results of this round turn out to be good the price may rise again. The first target is at 52.00, slightly above the 50-day SMA, while the next target is at the original high of 65.00. There will be the first support at 54.50 and the next support at the 200-day SMA at the 51.00 zone, which is still supported by bearish divergence on both the Day and Week timeframes.

While Exxon Mobil is in the bullish channel frame, Chevron is in the opposite channel frame. As a result, prices fell harder than during July, when oil prices fell. It hit a five-month low at the 20-day SMA at the 95.00 zone, causing the price to bounce back to the psychological resistance of 100.00, the lows of April and March before the earnings report on Friday. If earnings are good, the first target will be at the 20-day SMA at the 105.00 zone and the next target at 111.00 or the peak seen in mid-June, while if the earnings are not so good there will be a key support at the latest low at 95.00.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.