The BoE decision is coming into view, with the UK expected to join the Fed and ECB and signal cautious patience for now.

After the inflation scare over the spring, attention has turned to growth dynamics, and particularly the downside threat from the spreading Delta Covid variant along with headwinds from various constraints including labor and materials shortages, supply chain disruptions, and rising prices. Covid cases are continuing to fall sharply in the UK, while the link between new cases and serious illness and death has clearly been broken. Even normally pessimistic experts in the UK have been admitting that the country is nearing herd immunity, even against the Delta variant. Well over 90% of the adult population in the UK have a level of immunity, whether from vaccination, natural infection or both. Those impacts were highlighted in last week’s slower than expected US and German GDP reports. And while many of those drags should be seen in upcoming data, they are expected to dissipate into the end of the year.

In the UK, the final June PMI surveys are due, although final readings are not normally of too much interest for markets. The preliminary manufacturing and services PMIs showed an unexpectedly sharp correction from the series or near-series record highs that were seen in June, though still show an overall robust level of continuing expansion. The data didn’t stop the IMF from raising its 2021 UK growth forecast this week to 7.0%, which is their joint fastest growth projection out of the major advanced economies.

The BoE’s Monetary Policy Committee meeting will gain attention after the ECB and Fed have already signaled a cautious wait and see stance over the summer and the BoE is likely to follow suit on Thursday. The Old Lady will also release its latest quarterly Monetary Policy Review, which is likely to come with upward revisions to both GDP and inflation projections. However, despite this and the fact that two MPC members (Saunders and Ramsden) have lately turned relatively hawkish, the consensus expectation is for unanimous 9-0 votes at the nine-member committee to leave both the repo rate and QE total unchanged.

The phasing out and upcoming ending of the government’s pandemic wage support scheme is a particular near-term worry for the BoE, given the risk of higher unemployment. The ongoing evolution in the pandemic is also a concern, both globally and domestically. Last week, the UK saw a pronounced decline in week-on-week levels in new Covid cases, although the prognosis remains tentative.

In the FX market ahead of the BoE, the Pound has traded modestly firmer so far today, though has remained within Monday’s ranges versus the USD, EUR and JPY, among other currencies.

The GBP, despite already being an outperformer on the year so far, may have further to rally, with the currency remaining at relatively weak historical levels by the measure of the inflation-adjusted broad trade-weighted index. This will depend on the Covid situation remaining under control and global sentiment holding up, as the UK currency has a tendency to underperform during sustained periods of risk-off positioning in global markets (being the currency of an open economy with high deficits).

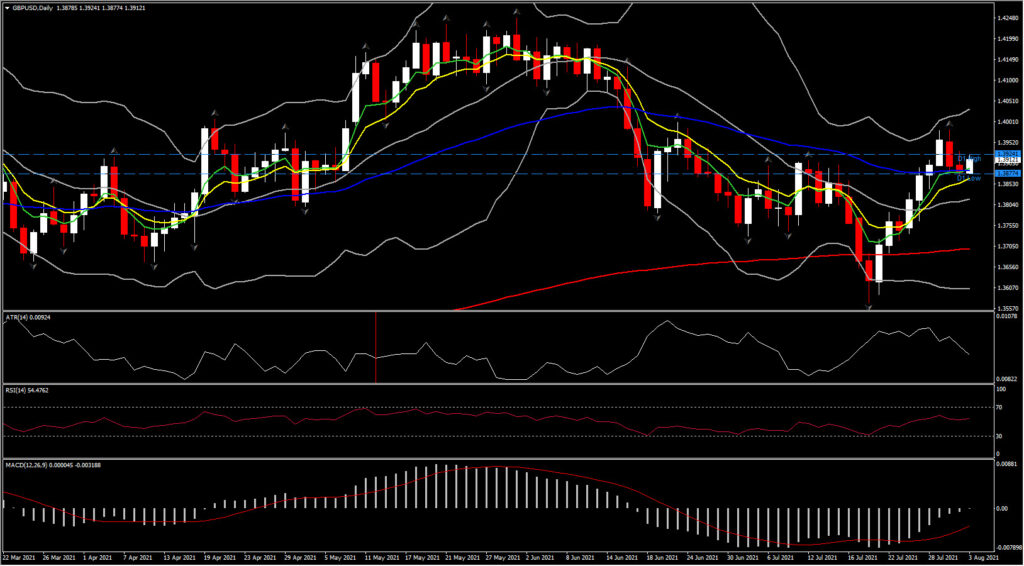

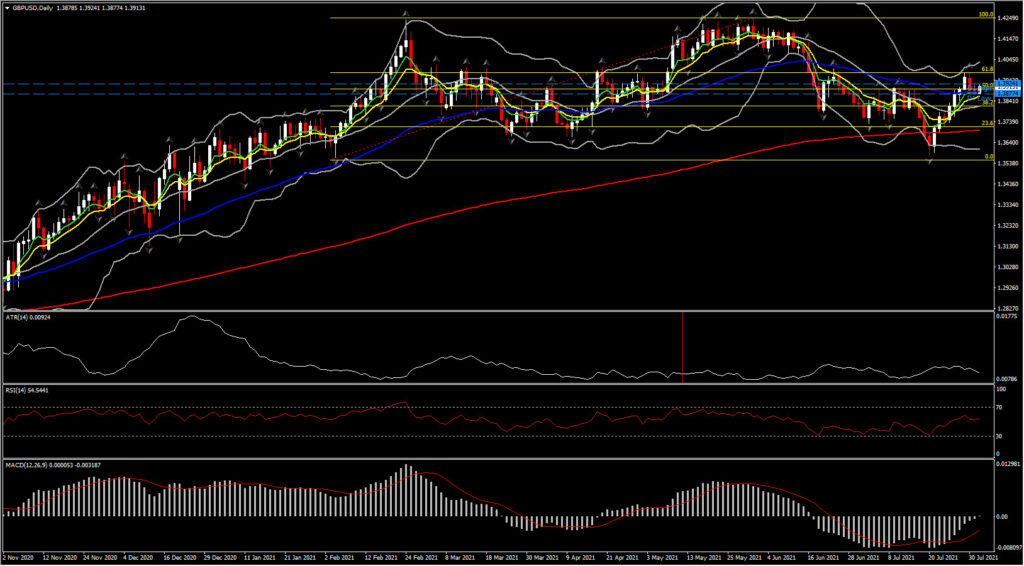

Currently the GBPUSD is resuming its northwards move after the corrective dive from 1.4000 to 1.3870. Significant is the fact that it is retesting the midpoint of 2021’s range (1.3560-1.4280) for a second week in a row. The daily RSI indicator is presenting the latest 10-day rebound but remains close to 50, suggesting lack of direction in the medium term. The MACD lines, even though they remain below 0, reflect a decisive increase in buying interest since the mid of July as they try to enter the positive territory.

The asset needs to progress into a decisive break of 1.4000 (61.8% Fib. level for 2021 and June-July resistance) in order to prompt further positive bias, with next Resistance at the year’s high, i.e. 1.4250. A break of the latter could trigger attention to the 5-year peak.

On the flipside, a drift down to 1.3815, which is the confluence of the 20-day SMA and 38.2% Fib. retracement level, could attract sellers. That said, such a downleg could bring the 23.6% Fib. level at 1.3715 and July’s floor at 1.3570 back into play.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.