Moderna, Inc. ( #Moderna ), one of the first companies to produce the mRNA vaccine approved for emergency use, was one of the first companies to produce a Covid-19 vaccine. The company’s vaccine has already been administered to millions, and. it has contracts to supply hundreds of millions more doses to countries around the world. The company is expected to report its quarterly results ending June 2021 on August 5, before the market opens.

The Zacks forecast expects Moderna’s sales in the latest quarter at $4.29 billion, higher than the same quarter a year ago, with sales of just $66.35 million, representing a jump of more than 6368.43%. The quarter’s return on equity is expected to be $6.01, 2,038.71% higher than the prior-year quarter ($-0.31 per share).

Vaccinations had begun to slow down in major economies, but as a result of the return of the outbreak of the Delta variant, demand for effective boosters continues. According to the Financial Times, both Moderna and Pfizer have agreed to deliver 2.1 billion doses of the vaccine through 2023 to the EU. After the three phase trials, Moderna and Pfizer were found to be more efficient, and so although Oxford/AstraZeneca and Johnson & Johnson are cheaper, Moderna’s higher demand meant they was able to raise the EU dosing price from $22.60 to $25.50, but below the $28.50 previously. Moderna is estimated to have made $30 billion in vaccine sales.

Meanwhile, the EU aims to vaccinate at least 70% of the adult population by the end of September. Israel will begin offering a third shot to those over the age of 60 who are already vaccinated against COVID-19 on Sunday, while UK will start next month.

Since the beginning of the year, Moderna’s share price has risen 231.78% with a new all-time high yesterday above 365.00, before dropping to close at 346.94. Meanwhile the Day time frame sees RSI in the overbought zone and moving down. While smaller timeframes like H1 and H4 show a bearish divergence, that means prices may have been shortened prior to the earnings report date. If the report is not good, there may be a continued decline, with an important support line at the 300.00 psychological zone.

Siemens AG ( #Siemens ) is a German industrial giant – one of the largest in Europe – and is another company scheduled to report second-quarter earnings on Thursday before the market opens. The Zacks sales forecast for the quarter is $17.98 billion higher than the $14.85 billion in the same quarter of the previous year. It represents a growth rate of 33.87%, while the return per share is expected to be $0.83, above the $0.62 the prior year quarter.

Bloomberg reported in June that Siemens had announced a 3 billion euro ($3.6 billion) share buyback plan running from next year to 2026. The company also said it was targeting an acquisition to enter a new market, having agreed to pay $700 million to acquire American company SupplyFrame Inc., a digital platform company specializing in connecting companies throughout the electronic supply chain. This will help customers reduce costs, increase mobility and make wise decisions. An agreement is expected to be reached later this year.

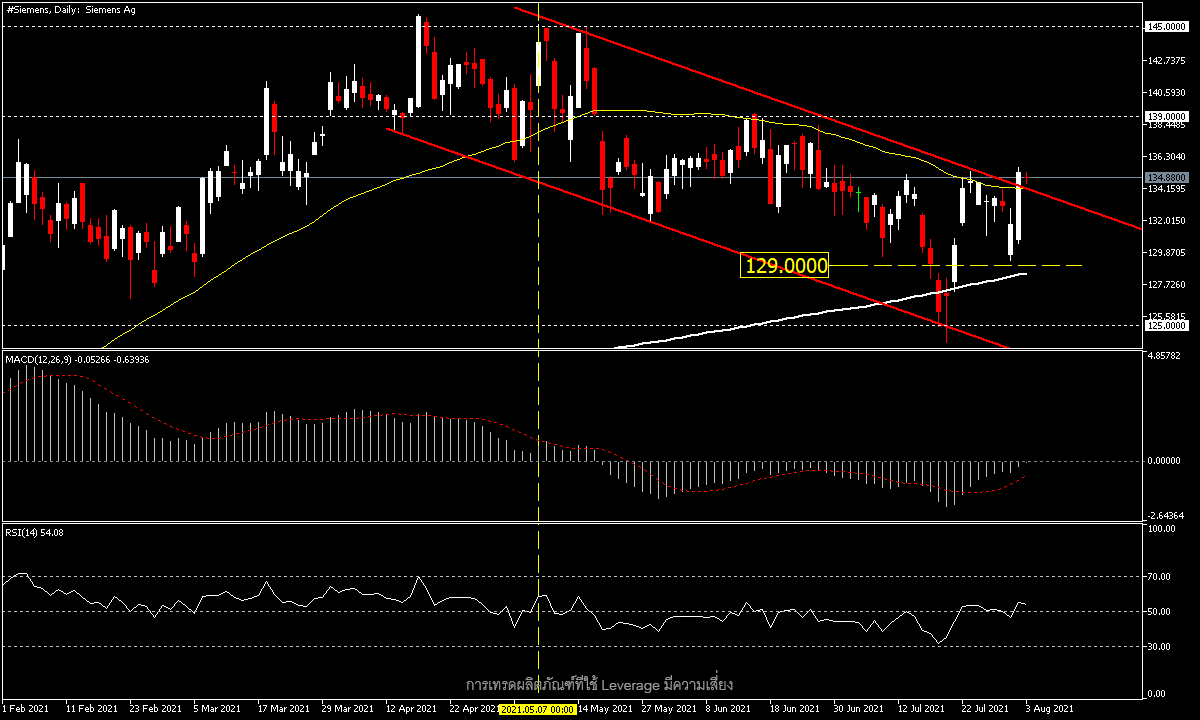

Siemens‘ share price has fallen from the year’s highs following May’s second-quarter earnings report and bounced at the 200-day SMA line at the end of July. This week the price could rise above the bearish channel and the 50-day SMA line again if the price is able to support above the 50-day SMA and the earnings are good. There will be the first target at 139.00 and the next one in the year’s high at 145.00, while if earnings are bad there will be key support at the 200-day SMA at 129.00 and the next one at the latest low at 125.00.

Click here to access our Economic Calendar

Chayut Vachirathanakit

Market Analyst – HF Educational Office – Thailand

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.