The commodity bull market kicked off in the second quarter of last year, as the global pandemic weighed on markets across all asset classes. Central bank liquidity, low interest rates and government stimulus stabilized the economy and led to a gradual rise in inflation over the past year.

The US Dollar is the world’s reserve currency for the global economy. As a large percentage of commodities, such as gold and oil, are priced in the reserve currency, other countries have to hold this currency to pay for these goods. The same stands for agricultural commodities such as coffee, cotton, cocoa and sugar. All of these commodities use the Dollar as a benchmark price. Sugar, which has become a staple food as the increasing world population requires more and more of it, is not only used as a sweetener for food and drinks – it has also become the main ingredient in biofuels. The opening of the economy is increasingly supporting prices, as supply chains are increasingly opening up.

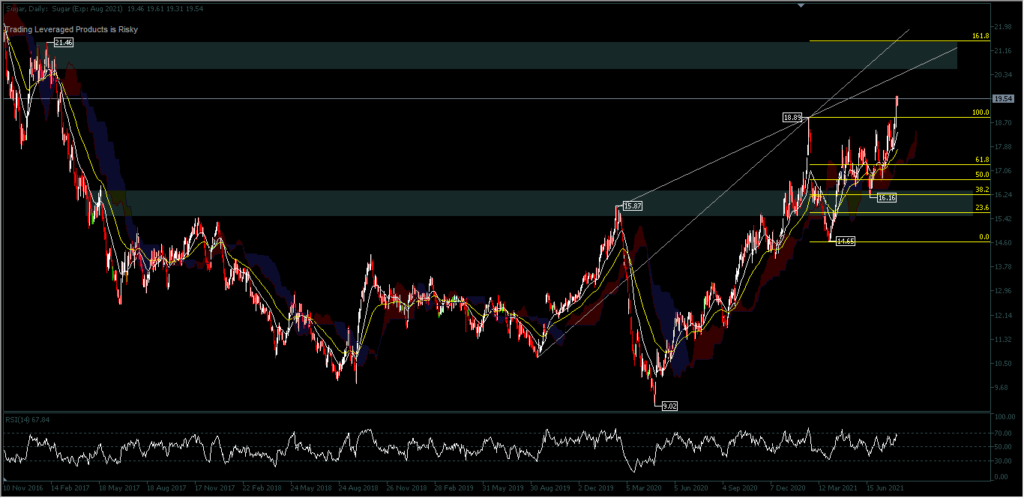

Having surpassed the February 2020 peak (15.87) there doesn’t seem to be any significant obstacle for the bulls to move the price higher. After 1 year, the asset formed a new high at 18.89 in February 2021 and since then, the price has corrected and formed a corrective wave to reach 14.65. In April 2021 the price returned to the bullish path past 14.65, reached a new 4 year high and is still heading north. A follow-up rally will target the 2017 peak at 21.46. On the downside, the resistance at 14.65 which is now the support will hold the price correction. All technical indicators are in positive rhythm and for the month of August, the asset has moved up by 9%.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.