AUDJPY, H1

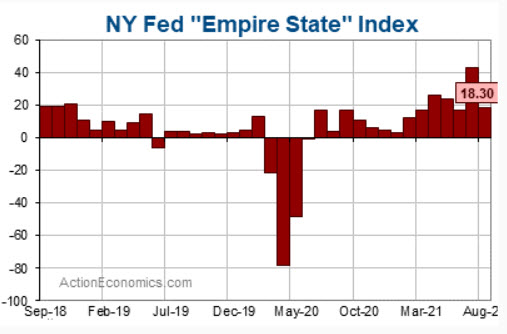

The Empire State fell by a hefty -24.7 points to a still-solid 18.3, hence almost exactly reversing the 25.6 point July surge to a 43.0 all-time high from a slightly lower 17.4 in June. We saw declines in most components, and the ISM-adjusted Empire State fell -6.6 points to 56.5, after surging 6.0 points to an all-time high of 63.1 from a slightly higher 57.1 in June, versus a 15-year high of 60.5 seen in both April and May.

Expectations are for the ISM-adjusted average of the major sentiment surveys to slip to 60 in August from 61 in July but the same 60 in June, versus a 62 all-time high in both March and May, with an intervening 61 reading in April. The record before that of 59 in two months of 2018 for a series we’ve calculated back to 2004. We expect a 60 average in Q3, after averages of 61 in Q2, 59 in Q1, 57 in Q4, and 55 in Q3. Producer sentiment remains strong despite today’s bigger than expected pullback, though we expect a gradual decline toward more historically typical levels into year-end.

The Dollar slipped slightly following the bigger Empire State index miss, taking USDJPY to 109.27 from 109.44, and EURUSD to 1.1790 from 1.1770. Equity markets opened lower, with some notable movers being, Robinhood -2.7%, Moderna -6.6%, Walmart +0.3%, and Ford -1.77%. The AUDJPY remains the largest mover of the day as sentiment continues to be pressured, the pair is down -0.92% on the day and currently trades below 80.00 to lows at 79.93.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.