The long-term tone of optimism for global economic growth and recovery was echoed by UBS Group AG warning investors to rethink their gold bullion holdings, as the greenback will strengthen into next year.

The movement of gold prices has recorded a fourth day of gains, as the spillover from last week’s poor consumer sentiment data continued to Monday’s trading sentiment. Fed Chair Jerome Powell’s speech Tuesday and the FOMC minutes scheduled for release on Wednesday will exert some near-term price direction for the yellow metal. Because, traders will study the FOMC minutes for languages that support the initial reduction agenda. This could clearly change sentiment in assets with the greenback expected to regain some ground, if indeed the minutes reflect recent comments made by Fed policymakers.

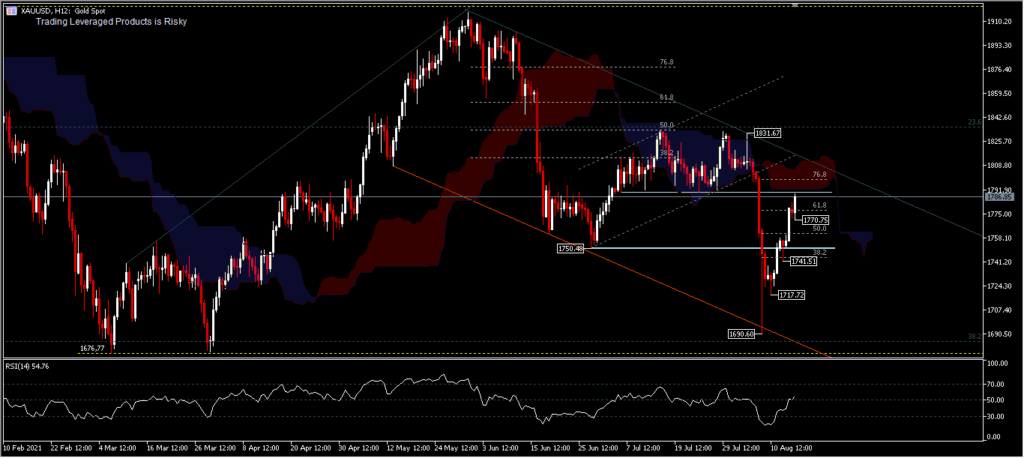

XAUUSD is gradually aiming for $1,800 again, after falling to $1,690. The combination of an exaggerated early move and a softer Dollar and lower yields gave it a new breath. Friday’s US consumer sentiment data was very good for gold as it sent US yields and the Dollar sharply lower. Worst sentiment reading in nearly a decade prompted the move, which is why gold exploded back above the $1,750 resistance zone and is now trading below the $1,790 minor resistance just a step closer to $1,800 with a strong struggle this might happen.

As long as the $1,831 resistance (61.8% of the June high and August low) remains intact, the bearish prospect will again dominate for the formation of the third descending wave given that the current position of the price is still in the descending aisle. It would be too much if the increase in 4 days did not choose a break. The $1,750 support will be taken into consideration, if the price re-enters the range bound movement.

Meanwhile, silver found support at $22.49 and struggled to bounce back from the $25.99 fall. So far it’s up 6% from a fresh low. Copper maintains its price position amid supply constraints and the development of the Delta variant. It is trading in a bound range between 4.23-4.41. Palladium is also trading range bound and likely to show weakening momentum in a descending triangle pattern between lows 2571.30 and 2737.05; while platinum is barely moving, after last week’s gains that reversed a fall at 953.60 and is currently trading at 1023.00.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.