Market News Today – USD (USDIndex 93.00) ticks lower but holds at 93.00, Yields (10yr 1.255%) lower too as Asian stock markets follow US markets higher. (USA500 closed +0.85% @ 4479 & FUTS trade at 4485 now). Nasdaq biggest mover +1.55% on formal approval by the US of Pfizer (+2.5%)/BioNtech (+9.5%) vaccine. PMI data very mixed yesterday. Overnight – VP Harris (in Singapore) calls China actions in S. China Sea “intimidation” and “coercive”. USOil rallied over 5% and trades at $65.50, Gold moved on USD weakness and holds over $1800 at $1802 up from Friday’s close at $1778.

European Open – Bonds remained under pressure overnight, as stock market sentiment continued to improve. The September 10-year Bund future is down 9 ticks, U.S. futures are also in negative territory too. DAX and FTSE 100 futures meanwhile are posting gains of 0.16% and 0.21% respectively, pointing to another move higher in indexes today as investors price out an imminent tapering announcement from the Fed. In FX markets haven flows are also reversing, leaving EURUSD little changed at 1.1743 and the Pound underpinned with cable lifting to 1.3743, from a Friday close down at 1.3610. USDJPY gave up 110.00 yesterday and sits at 109.80. AUD & NZD are the best performing of the majors following strong retail sales in NZ. German Q2 GDP a tick higher than expected at 1.6%.

Today – US New Home Sales, ECB’s Schnabel, BOE’s Tenreyro and supply from Germany and the US. G7 to meet regarding Afghanistan.

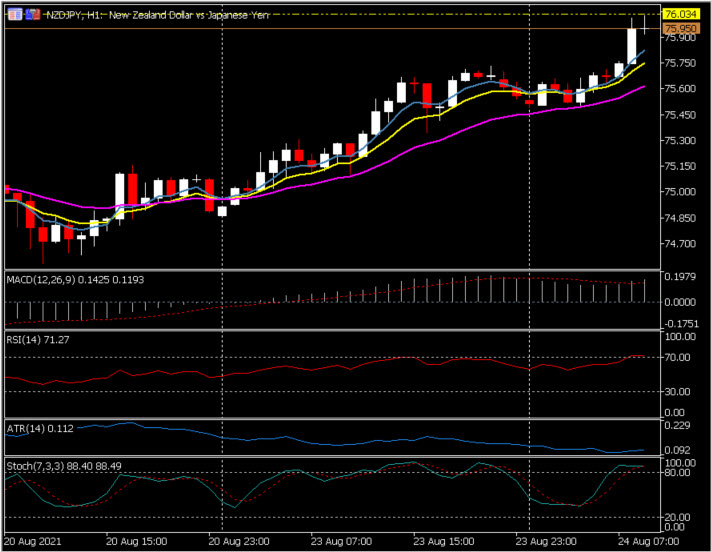

Biggest FX Mover @ (06:30 GMT) NZDJPY (+0.55%) Breaks 7-day losing streak, currently up from 74.56 low on Friday to test 76.03 today. Currently back to 75.97. Faster MA’s aligned higher, MACD signal line & histogram above 0 significantly and consolidating. RSI 70.82, rising and testing OB zone. Stochs in OB zone. H1 ATR 0.112, Daily ATR 0.69.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.