All eyes are on virtual Jackson Hole Symposium which takes place from Thursday to Saturday this week and traders are questioning whether a repeat of last year’s stock sell-off followed by a post-Jackson Hole rally will happen again. The big risk-off moves in the market last week, especially with the Russell lagging, provided flash indications and warnings for stocks in the near term. Risk-off opportunities still have a chance for this week, but traders look likely to be cautious.

Morgan Stanley reviewed the Australian and New Zealand Dollars and stated that they expect the AUDNZD to return to the 1.0800 area as markets underestimate the pace of Australia’s economic recovery after COVID-19 vaccinations were rolled out more broadly in recent months. Additionally, global growth expectations are likely to be reassessed too low over time, increasing the likelihood of an upside surprise and supporting the cycle-sensitive AUD.

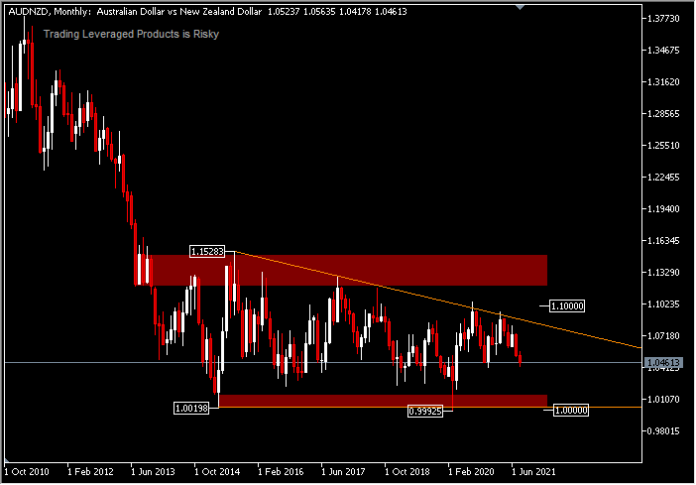

AUDNZD – The pair is still under strong bear pressure, however the 1.0416 support limitates further losses. In the A, B, C pattern is seen trying to rebound from the 1.0417 low price point by breaking the H4 descending wave structure. The pair has been consolidating for 8 years with only over 1000 pips traded and is getting more and more tapered by the day in a descending triangle pattern. Further moves should go beyond the recent minor resistance at 1.0539. A move above this level could retest 1.0615 at the 50.0% Fib. retracement level. On the downside, a move below the 1.0416 support would imply a continuation of the 1.0944 decline towards lower prices.

Elsewhere, the New Zealand Dollar lagged behind other commodity currencies on Monday, but edged higher against the US Dollar, Euro, Swiss Franc and Sterling. It seems that Wellington’s third lockdown extension is being ignored. The latest coronavirus outbreak in New Zealand has grown from just a single infection last Tuesday to more than 107 on Monday, although the NZDUSD has continued to stabilize while GBPNZD stalled its short-term rally.

The GBPNZD beat further declined from 1-year highs earlier this week and is seeking to surpass the 2.0000 level. The RBNZ already deflected a rate hike earlier last week, but indicated the decision was simply being delayed. Market attention has shifted to bank meetings in October and November where it is expected to announce a total interest rate hike of 0.50% in a 0.25% increase, marking the start of the process to continue to withdraw the monetary support provided to the economy during the crisis in an effort to ensure that rising inflation rates remain consistent with the target range of 1% to 3% over the coming years.

GBPNZD – The pair is still moving in an ascending channel, above the median line. Currently trading back below 2.0000 after trying to level the resistance at 2.0071 with 2.0092 last week. Divergences are increasingly visible, after forming the double top, with RSI at 57.15 and AO thinning to the middle. A downside move would target the support at 1.9647 or the median line, while a move above 2.0092 would target 2.0269.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – Educatinal Center – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.