Market News Today

Today’s employment report is eagerly awaited for directional purposes. The markets traded very quietly Thursday, though with a bullish bias. Treasury yields finished marginally lower with the 10-year just under 1.30%. The mix of data had little impact, though the improvement in claims did underpin an upbeat outlook into the jobs numbers, even as the factory and trade data, along with the already seen weakness in vehicle sales, weighed heavily on Q3 GDP projections.

- Action on Wall Street was equally light and range-bound, though, the USA500 and the USA100 made still more new highs.

- Data releases in Asia highlighted the impact of virus developments on the services sector in particular – Asian stock markets have moved higher and stocks across China, Japan and Australia are poised for a weekly rise, despite gloomy data.

- The fact that the JPN225 still rallied nearly 2% and the ASX is up 0.5% shows how reliant markets are on central bank support.

- GER30 and UK100 futures are up 0.076% and 0.014% respectively.

- USD (USDIndex 92.16) extending 22-day support.

- USOil extended to $69.78.

- Gold steadied to 1,803-1,817.

Today – The calendar includes the final PMI readings for the Eurozone and the UK, which are likely to confirm that high vaccination rates limit the impact of the rapidly spreading delta variant. Eurozone retail sales and ISM Services PMI are also due. The highlight of the day is the NFP number.

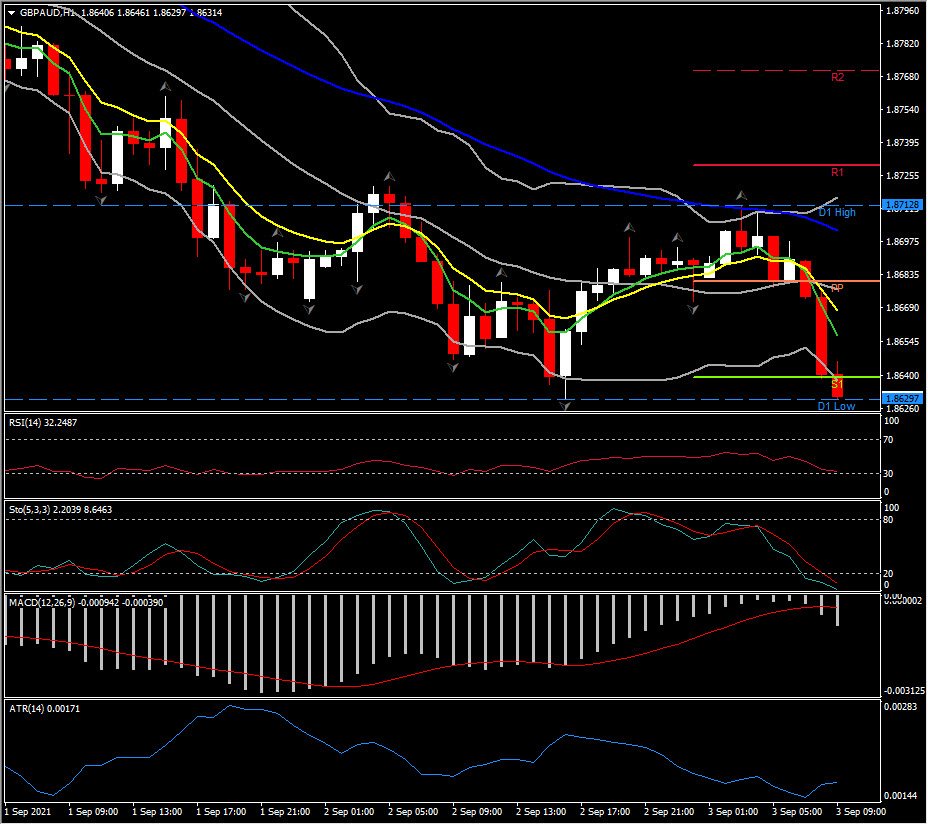

Biggest Mover @ (06:30 GMT) GBPAUD (+0.26%) Broke 28-day Support. Faster MAs aligned lower with MACD resuming its decline, Stochastic below 20 and RSI at 31.80, all suggesting a decline in the short term. H1 ATR 0.00173, Daily ATR 0.01062.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.