RBA left policy rates unchanged and maintained plans to taper QE. The bank acknowledged the impact of the rapidly spreading Delta variant but Governor Lowe still confirmed that the bank will purchase government bonds at a pace of AUD 4 bln a week, down from AUD 5 bln – but with purchases extended until at least mid-February. The previous schedule had included a review in mid November. Lowe said in a statement that the decision to extend purchases “reflects the delay in the economic recovery and the increased uncertainty associated with the delta outbreak”. He added that “the board will continue to review the bond purchase program in light of economic conditions and the health situation”.

At the same time, Australia is still grappling with the Covid outbreak which has left most of its population placed under some restrictions. The arrival of the delta variant and subsequent lockdowns have been leaving their mark, while the monthly inflation number from the Melbourne institute showed prices unchanged over the month, bringing the annual rate down to 2.5%. The Australian Dollar, however, continues to recover from August lows despite the restrictions. AUDUSD has risen from the August 20 low of 0.7105 back to 0.7477 and is currently having a pullback down, sustaining a floor at 0.7400.

The Australian Dollar benefited from the prospect of a slowdown in the US economy which suffered a setback amid rising cases of the Delta variant, hitting consumer and business confidence and triggering a slowdown in economic output and hiring; this was confirmed in the disappointing August jobs report. Despite the strengthening of the Australian Dollar, downside risks remain, including China’s slowing growth rate in recent months which could lead to reduced demand for Australian commodity exports.

As seen last week, the Australian Q2 GDP growth came in at 0.7% q/q, and the Q1 growth was revised higher to 1.9% q/q. So activity levels were higher than previously thought when the latest wave of virus restrictions hit. Private consumption boosted the recovery in Q2, but will be hit most by the current level of restrictions, which are likely to lead to a subdued Q3 number, especially as fiscal support is being scaled back. Still, with economies starting to adjust to living with the virus and vaccination levels rising, the impact should not be as hard as during the last wave. The experience to date has been that once restrictions are lifted again, the economy will bounce back quickly.

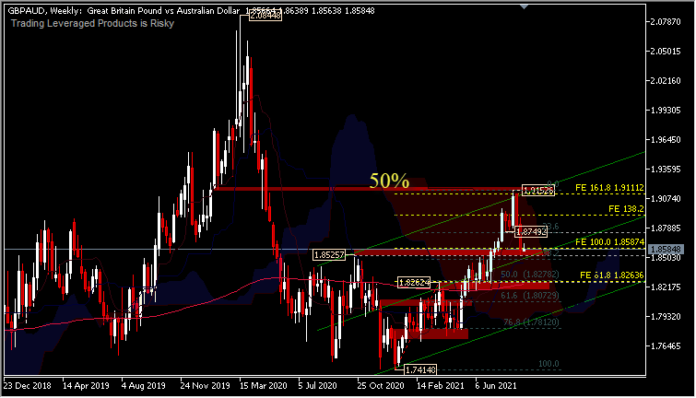

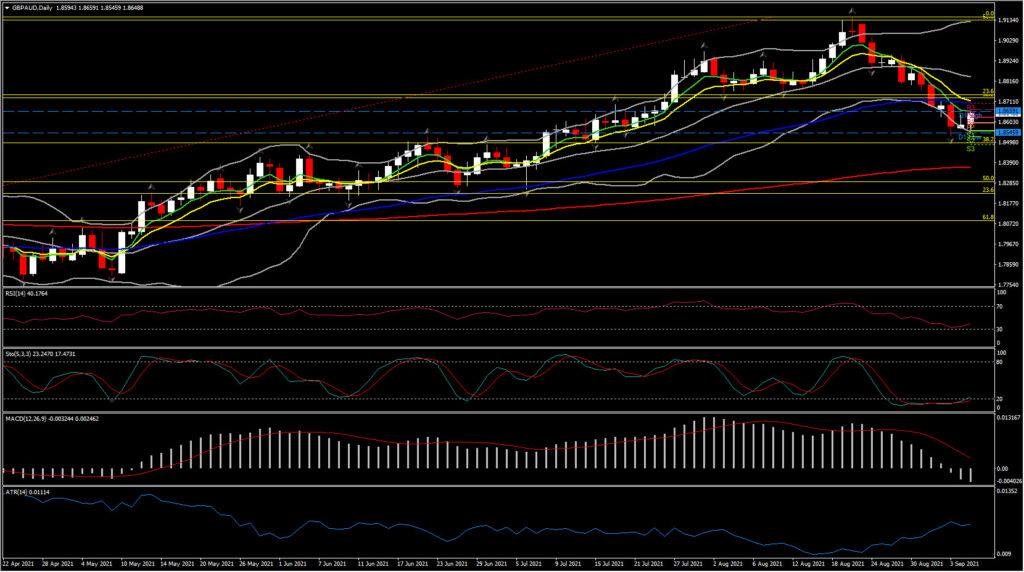

Meanwhile GBPAUD has fallen from a high of 1.9152 on August 20 to 1.8530, turning below the 38.2% Fib level seen on 2020’s downleg. Further decline could retest 1.8262 (50.0% Fib. level of 8-month rally) with immediate support at 1.8500 and 1.8370 (200-day EMA). The momentum indicators comply with the decline suggesting a shift to a negative outlook for the asset. The RSI is at 40, still sustaining a move above an oversold condition, while MACD lines turned negative, with signal line above 0. These imply a possible consolidation in the near term, while if the asset finds a footing at 1.8500, a correction could retest 1.8755 and 1.8900.

Click here to access our Economic Calendar

Andria Pichidi

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.