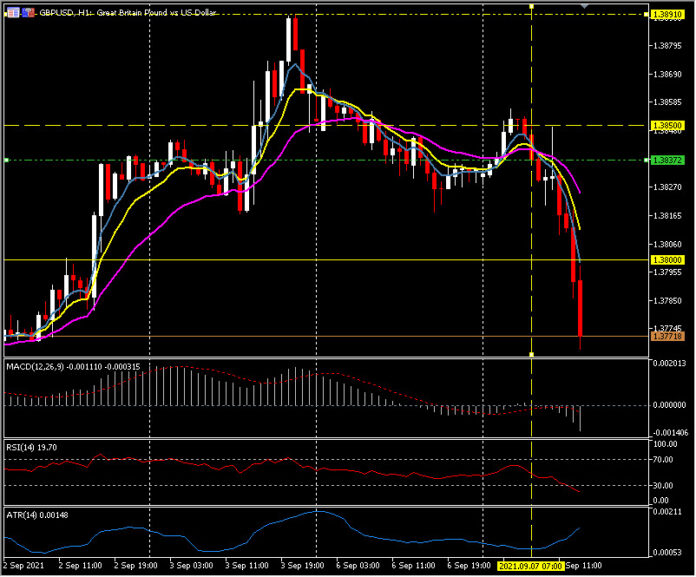

GBPUSD, H1

The Pound has posted new lows for the week against both the Euro and Dollar. EURGBP has traded over 0.8600 for a 33-day high today at 0.8610. Cable’s low is 1.3766, extending the correction from Friday’s one-month high at 1.3891, which was a product of the US jobs report miss. The pair is back to near net unchanged from week-ago levels. Sterling itself has been trading mixed in recent weeks, with dollar’s broader directional shifts having had the most causation on Cable’s shifts.

Markets are still taking stock of the US August jobs report miss on Friday, especially the offsetting factors, including the sizeable up revisions to July and June data and drop in unemployment. In sum, the report is being seen as delaying a QE taper announcement rather than taking it off the table. This conjecture is backed up by about a 3 bp widening in the US 10-year Treasury yield relative to the benchmark gilt yield since Friday.

Incoming UK data have been showing a moderation in the pace of economic growth, though the outlook remains bright, and BoE MPC member Saunders said today that “we no longer need as much stimulus as previously.” Daily new Covid cases have been ticking higher, and are above 40k per day in the latest figures, but the follow-through to serious illness and death rates remains at a fraction of previous waves in the pandemic, thanks to the high vaccination rate in the UK. The UK has been ahead of most countries, especially nations with large populations, in terms of vaccine rollout, and for this reason it has been tracked as an indicator of future trends globally. The UK government, mindful of the return of schools and many workers to offices, alongside the approach of winter, has publicly mooted this week that short “circuit breaker” lockdowns could be deployed (extending the mid-term school holiday at the end of October, is one example) if the medical system were to come under pressure again.

The UK parliament returned yesterday and today the government will set out its plans to reform the social care system in England, by increasing National Insurance by about 1.25%. The proposal has been widely criticized by many on both sides of the political divide, adding to pressure on both Sterling and the UK100 today.

Cable failed to rally in early trades today, rejecting 1.3850 and moving lower from the break of the H1 21-EMA at 1.3837, and continues to trend lower. The faster (5 & 9) EMA’s remain aligned lower and the MACD signal line and histogram are also pushing lower. RSI also continues to trend lower but has moved into the over-sold zone as it is below 30 at 23.50. The H1 ATR is now at 0.0013, up from 0.0008 earlier. Daily time frame support sits at 1.3700, 1.3750 and the 21-day EMA at 1.3785.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.