Market News

- European bond markets already underperformed yesterday, after a jump in UK inflation and as markets continue to evaluate last week’s ECB move. The US Treasury rate is down, but yields in Australia and New Zealand jumped.

- Solid data on industrial production and a big bounce in the Empire State manufacturing index, along with weaker than expected trade prices, contributed to the improved outlook. The USA500 bounced 0.85%, with the USA100 0.82% firmer, while the USA30 was up 0.68%. The JPN225 lost -0.75%, while GER30 and UK100 futures are up 0.08% and down -0.02% respectively, which suggests a cautious start to the session.

- Data: New Zealand Q2 GDP data much stronger than expected, Australia’s employment report highlights lockdown impact & Japan’s trade data, which showed a huge deficit, as export growth slowed, also added to the negative risk backdrop. Canada’s CPI rose to a 4.1% pace in August from the 3.7% growth rate (y/y, nsa) in July.

- Tech shares got a solid push from Microsoft which announced a boost to quarterly dividends and an increase in share buybacks.

- The JPY strengthened and USDJPY declined to 109.20.

- The EUR and GBP declined against a largely stronger USD, which was only beaten by the JPY.

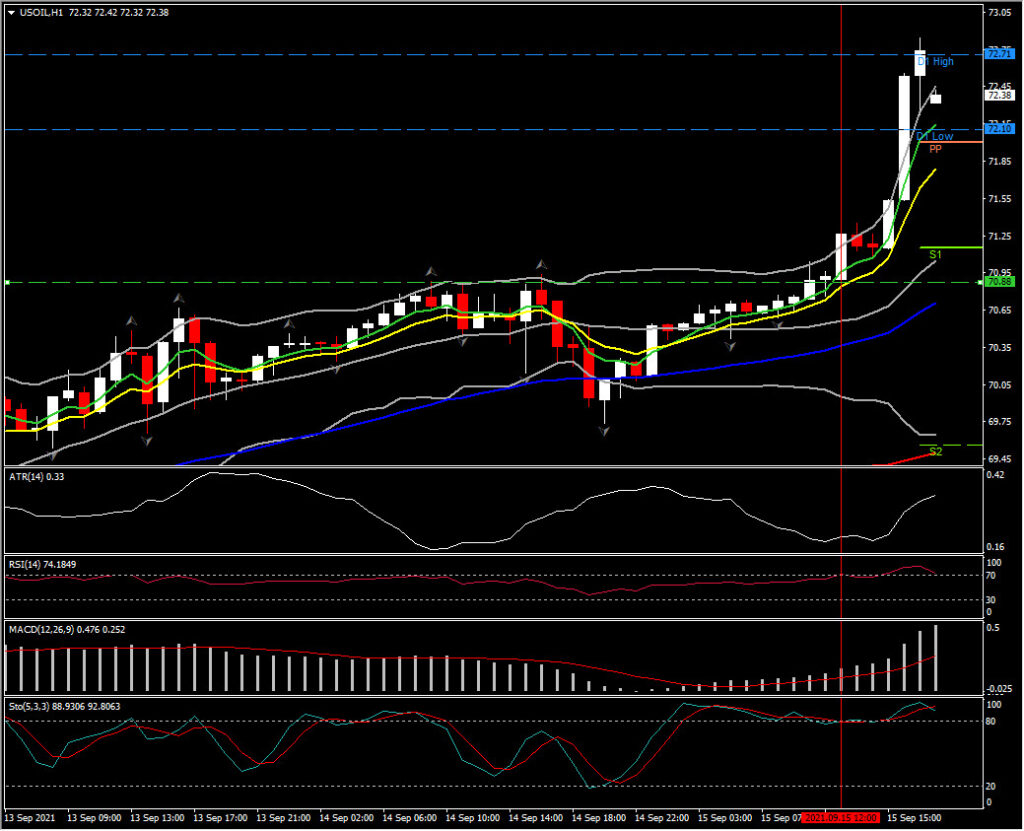

- USOil spiked to $72.84, albeit from a further reduction in stockpiles, which helped lift the indexes. In the European open it gapped down slightly at $72.38.

- Gold down for a 2nd consecutive day. Currently at $1,784.

Today: Today’s data calendar will be closely tracked, with weekly jobless claims and the Philly index on tap, though none of the reports should impact the outlook on near term Fed policy. The August retail sales report is the highlight.

Biggest Mover @ (06:30 GMT) USOIL rallied to $72.84. Fast MAs flattened implying to short term correction, howveer the outlook holds positive as RSI is at 71 and MACD lines way above neutral zone and extending hgher. ATR (Daily) at 1.69 and ATR (H1) at 0.34

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.