The US CPI report undershot estimates in August, with gains of 0.3% for the headline and 0.1% for the core, leaving more moderate gains over the last two months after four months of outsized gains, suggesting we may be turning the corner on supply chain disruptions. The August gains rounded from respective increases of 0.274% and 0.102%. The big updraft in vehicle prices and airfares plateaued in July and reversed course in August, after a massive three-month climb that fueled big headline gains. We’re seeing persistent gains in most of the remaining components, so there is still substantial price pressure. On a moving average basis, CPI headline gains are still trending higher. We have 6-month average price gains of 0.615% for the headline and 0.550% for the core, versus respective 12-month average gains of 0.424% and 0.326%. For the August PCE chain price indexes, we assume gains of 0.2% for the headline and 0.1% for the core. This would leave the y/y headline metric slipping to 4.1% from 4.2% in July, while the y/y PCE core metric falls to 3.4% from 3.6%.

US headline CPI underpinned the Fed’s expectation of “transient” as reopening pressures eased off.

The FOMC is expected to to remain on hold next week, maintaining its zero-rate posture while making no announcement of QE tapering. That has been our outlook and it has been reinforced by the optics of the weakness in the August jobs report and the slippage in CPI. Chair Powell recently said though the labor market has improved considerably and the outlook has brightened, but “substantial slack” remains. And the Delta variant is adding downside risk. Meanwhile, prices are easing from some of the reopening pressured, supply constrained sectors, as expected, including airline fares and used vehicle prices. But the outlook is muddled.

Uncertainties over the price path were seen in the June FOMC minutes where several participants noted downward bias in inflation was still a real possibility. The combination of these uncertainties should keep policy and guidance on hold.

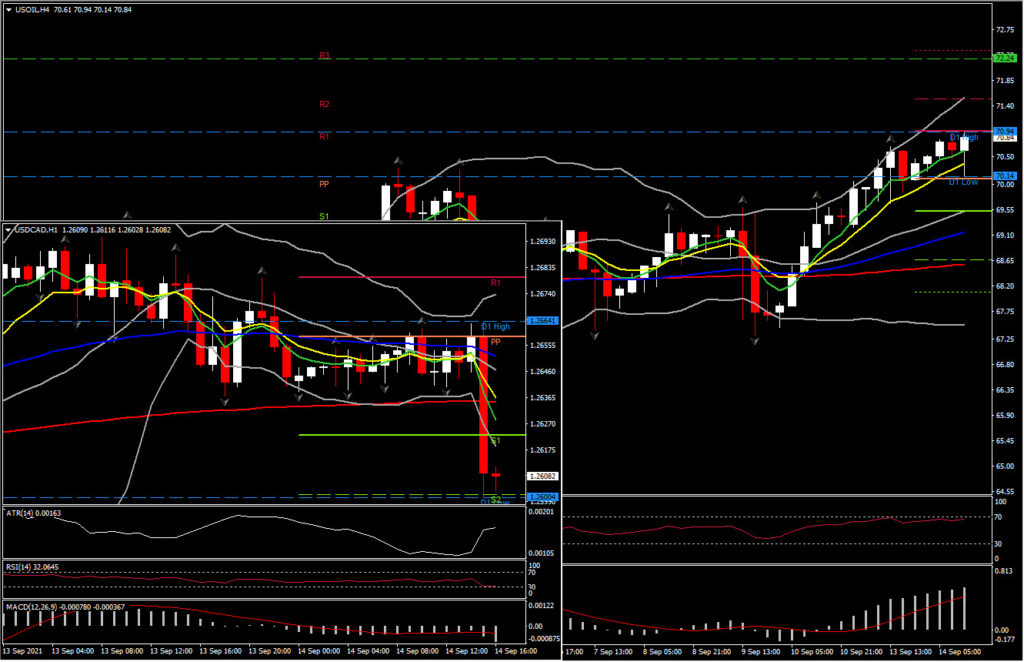

The US Dollar fell following the cooler than expected CPI outcome. USDJPY dropped from intra day highs of 110.15 to 109.87, while EURUSD rallied to 1.1846 from near 1.1805. USDCAD dropped to 1.2600 lows from 1.2655 following the mix of data, which helped to take USOIL to over 1-month highs, a CAD plus. The in-line Canada July manufacturing shipments print, which included a sharply upwardly revised June outcome, helped the loonie as well. Friday’s 1.2583 low marks the next downside Support for USDCAD, while a break below it could open the doors to 1.2500 and 1.2420 levels.

USOIL prices also remain underpinned and trading around the $71 per barrel, after another storm threatens the US energy hub in the Gulf of Mexico. ‘Nicholas’ made landfall in Texas after being upgraded to a hurricane and will add to existing problems for coastal refineries and petrochemical facilities. The IEA highlighted that global oil supplies fell by 540k barrels a day in August thanks to unexpected disruptions and thus wiped out extra supply from OPEC+. Overall outlook for the USOIL remains positive with next Resistance levels at $72.24 (upper Daily BB line), and $74.00-$74.55 (June 21st peak and 88.6% Fib. level.) Support held at 61.8% Fib level, at $70.55.

Nevertheless, equity futures headed higher after the data, with the major index contracts indicating about a 0.3% higher Wall Street open. Treasury yields are a bit lower, with the front-end and belly of the curve outperforming.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.