Market News

- Treasury yields plunged & Stock markets struggled against the background of weaker data. Buy stops were triggered on the way south for yields and added to the richening in bonds.

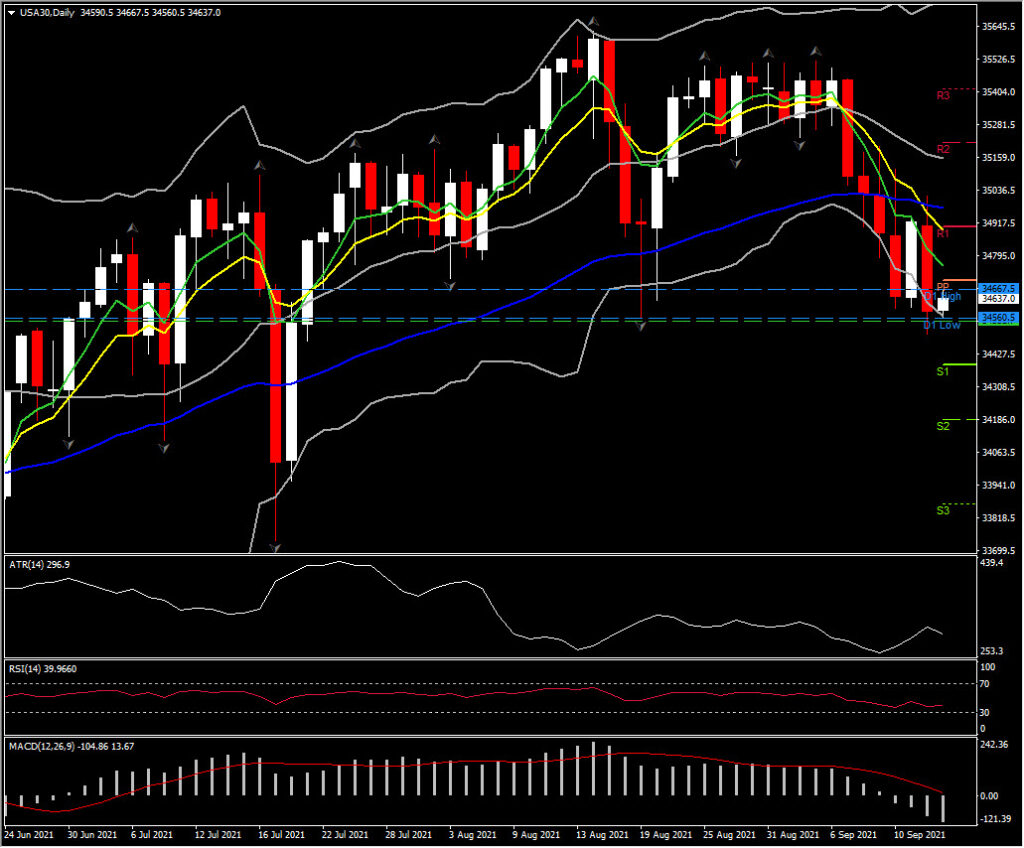

- Topix and JPN225 have lost -1.15% and -0.46% respectively. USA500 is posted a 0.6% decrease, USA100 down -0.45% while the USA30 was the weakest, slipping -0.84% as hefty declines were registered in energy, materials, industrials, and financials.

- China data round disappoints. – Retail sales down, Growth slowdown, Industrial Production weaker and investment growth also missed expectations. – The data round for China highlighted the impact of virus developments and added to the US inflation miss that left investors scaling back tapering concerns as soon as next week’s policy meeting.

- British inflation surged last month to its highest level since March 2012, i.e. 3.2% y/y.

- Fitch said that numerous sectors could be exposed to heightened credit risk if China’s No.2 property developer were to default, although the overall impact on the banking sector would be manageable. – Evergrande – fell for the 3rd consecutive day, losing as much as 5.1% to their lowest since January 2014.

- Amazon to hire 125,000 people in advance of the holiday shopping season.

- Apple unveiled an array of new hardware offerings.

- Chevron to triple its modest spending on green energy by 2028.

- The JPY strengthened as risk aversion picked up and USDJPY dropped back to 109.59.

- The EUR and GBP are little changed against the Dollar – EURUSD just over the 1.18 mark and Cable at 1.3823.

- USOil supported above $70.40, on a larger than expected drawdown in crude oil stocks in the United States.

- Gold jumped initially to 1,808 but is currently back to the 1800 floor, which it hit on prospects for lower interest rates.

Today: There is a lot on today’s calendar, including Canadian Inflation, US August Industrial Production, Import and Export prices and September Empire State index.

Biggest Mover @ (06:30 GMT) USA30 dipped to 34,501 from 35,000. Currently the asset sustains above 34560 however BB extends lower on the daily basis with RSI at 39 and slipping and MACD turning negative implying an increase of the negative bias in themedium term. Daily ATR 269.9.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.