GBPUSD & GBPCAD, H1

UK CPI was higher than expected at 3.2% y/y, up from 2.0% y/y in the previous month and versus consensus expectations for a 2.9% headline. This is the highest reading since March 2012. Core inflation also overshot expectations, coming in at a whopping 3.1% y/y in August, up from 1.8% in July. The RPI hit 4.8%, RPIC 4.9%. At the same time, PPI output price inflation climbed to 5.9%, as import prices rose 11.0% y/y.

The jump in headline rates may be partly due to special factors and inflation should come down again next year but coming on the back of a hotter than expected labour market report and against the background of surveys indicating that companies have already been forced to lift wage offers to fill vacancies, the numbers will add to the arguments of the hawkish camp at the BoE. At the same time, the fact that the UK government is phasing out pandemic support measures and raising taxes means the BoE is getting some support from tighter fiscal policies, which will take the pressure off monetary policy. Overall, there is a bullish view on the Pound, although other central banks are also heading to, if not already at, the tightening levers, so this isn’t a high-conviction view.

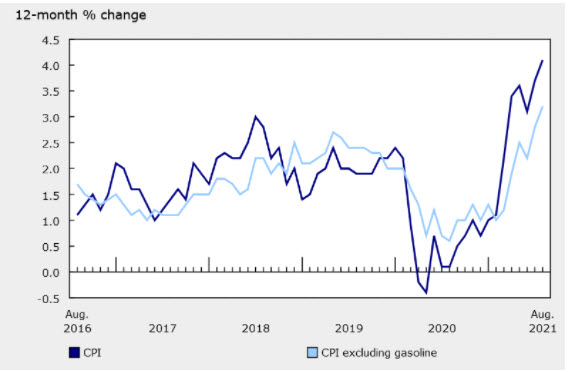

Canadian August CPI came in at +4.1% (y/y) vs +3.9% expected and 3.7% in July. CPI grew 0.2% (m/m) after the 0.6% gain in July. This is the highest reading since March 2003.The average of the BoC’s three core CPI measures was 2.6% in July. Durable goods are the main mover for the CPI figure, with passenger vehicles +7.2%, Furniture +8.7% and Household appliances +5.3%. Services inflation has also been picking up, which is what you might expect as reopening’s gain momentum. Prices for services rose for the fifth consecutive month and up to 2.7% y/y from 2.6%. Hotels (+19.3%) are a major reason why.

Today, Cable has rallied from lows in the Asian session at 1.3791, to 1.3842 before settling back to 1.3825 and the 21-EMA support zone. GBPCAD has held over the key Daily support at 1.7490 this week, today the pair has topped at 1.7557, up from lows at 1.7506 earlier and currently trades at 1.7525 following the Canadian CPI data.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.