Market News

- USD (USDIndex 93.25) holds gains, Evergrande will pay some local debt on Thursday, but major doubts remain. Strong Housing data helped USD. AUD recovers lifting NZD, JPY slips post BOJ. CAD holds gains. $3.5bln infra. bill goes to Senate, Biden doubles climate crisis investment.

- Yields moved two ticks higher (10yr closed at 1.32%) trade at 1.33% now.

- Equities remain weak, Evergrande worries persist. (USA500 -3 (-0.08%) at 4354. USA500.F flat at 4358. No Tuesday turnaround. ; Dow -0.15%, Nasdaq +0.22%. Nikkei & China down VIX cools to 23.42.

- USOil continues to recover broke $71.00 earlier – inventories to come later today.

- Gold also recovers to $1780 but remains shy of key resistance at $1788.

Overnight – BOJ – no change – if anything a more Dovish outlook ” economy picking up as a trend, although it remained in a severe state due to the impact of the pandemic.” No sign of tapering any time soon. AUD back to 0.7250, AUDJPY up to 79.50. Evergrande will only pay local bond holders tomorrow but that was enough to ease concerns, at least for now. PBOC injected more funds into the local credit market. FT report there are enough empty apartments (new & unsold) in China to house 90 million people (30 million Chinese families) …-FT

European Open – December 10-yr Bund future down -22 ticks, underperforming versus Treasury futures. In FX markets both EUR & GBP corrected against USD, leaving EURUSD at 1.1718 & Cable at 1.3647. USDJPY recovered to 109.56 from 109.10 pre-BOJ. Risks from China & realization global supply chains will take longer to recover from Covid disruptions (BBG report chip shortage getting worse, lead time now 21 weeks, Honda in Japan working at 40% of capacity for 2 mths) have seen investors scaling back tapering concerns & we expect Fed to stick with a cautious wait and see stance for now, which should help keep stock markets underpinned.

Today – US Existing Home Sales, FOMC rate decision & Chair Powell press conference, more new supply from UK & Germany.

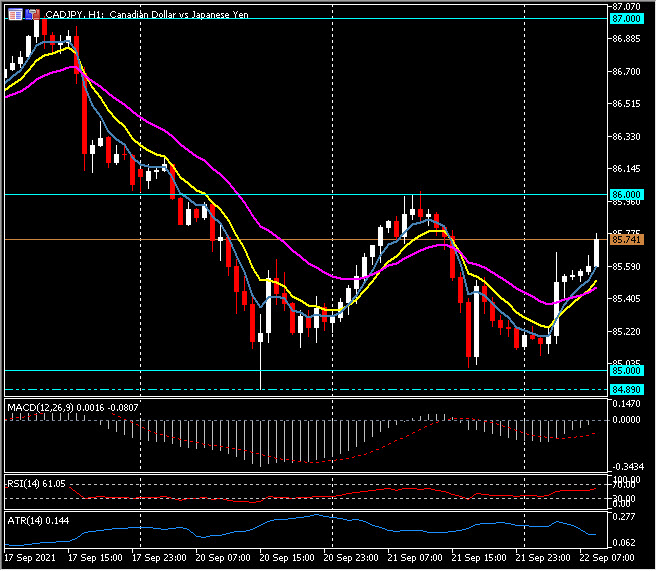

Biggest Mover @ (06:30 GMT) CADJPY (+0.65%) The oscillations continue capped at 86.00 and back to 85.00 yesterday trades at 85.75 now. Faster MA’s aligned higher, MACD signal line and histogram below 0 line but rallying. RSI 61 and rising. H1 ATR 0.150, Daily ATR 0.695.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.