The Yen and US Dollar are in the spotlight as risk appetite perked up, allowing the risk-sensitive Yen and the US Dollar to ease, while today’s backdrop has served to further diminish both currencies’ safe haven premium. There have been cautious gains in global stock markets following recent heavy losses.

News that China’s Evergrande managed to make interest payments to domestic investors allayed anxieties, fueling modest gains in Asian stock markets, followed by a rise in European markets and on Wall Street for a 2nd day in a row. Evergrande shares rallied 25% today on news that it had met a coupon payment on an onshore bond, which helped soothe nerves.

Earlier, the Chinese financial regulators are said to have issued a broad set of instructions to Evergrande, telling the company to focus on completing unfinished properties and repaying individual investors while avoiding a near-term default on Dollar bonds. As the Wall Street Journal reported: “Chinese authorities are asking local governments to prepare for the potential downfall of China Evergrande Group, signaling a reluctance to bail out the debt-saddled property developer while bracing for any economic and social fallout from the company’s travails.” There is still no news on whether or not the more than $80 mln in interest payments to Evergrande dollar bond holders, due today, will be made. The WSJ reported that Beijing appears to be reluctant to bail out Evergrande, and has asked local officials to prepare for a “possible storm”. Notably, HSBC, UBS & BlackRock are exposed to a total of $875m Evergrande bonds. As a result, the investors will keep a close eye on the company.

This has reinforced the Evergrande fear in the market, as Equity index futures indicate about a 0.5% rise for the three major indices at the Wall Street open while USD and JPY continue to be pressured so far today.

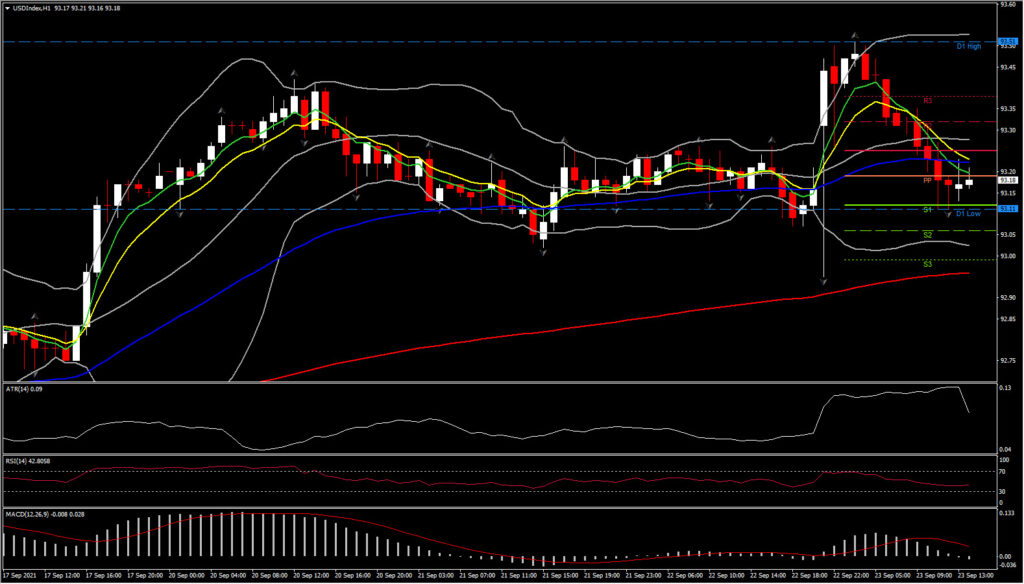

e the US Dollar reversed gains seen in the wake of the Fed’s announcement yesterday, as markets seem to slightly ignore the Fed. The Fed’s signal that tapering will commence as soon as November largely fitted the consensus view in terms of the timeline. Equity markets took the Fed’s signal in stride, but noted the modestly hawkish bent, which was perhaps a more committed level of guidance than most had anticipated though still largely fitting the consensus view in terms of the timeline of tapering. The potential that it could end by mid-year was a little unexpected as many had it as a year-long process. The increase in 2022 dots to 9 from 7 was also on the hawkish side, though balanced by the 9 who do not expect action.

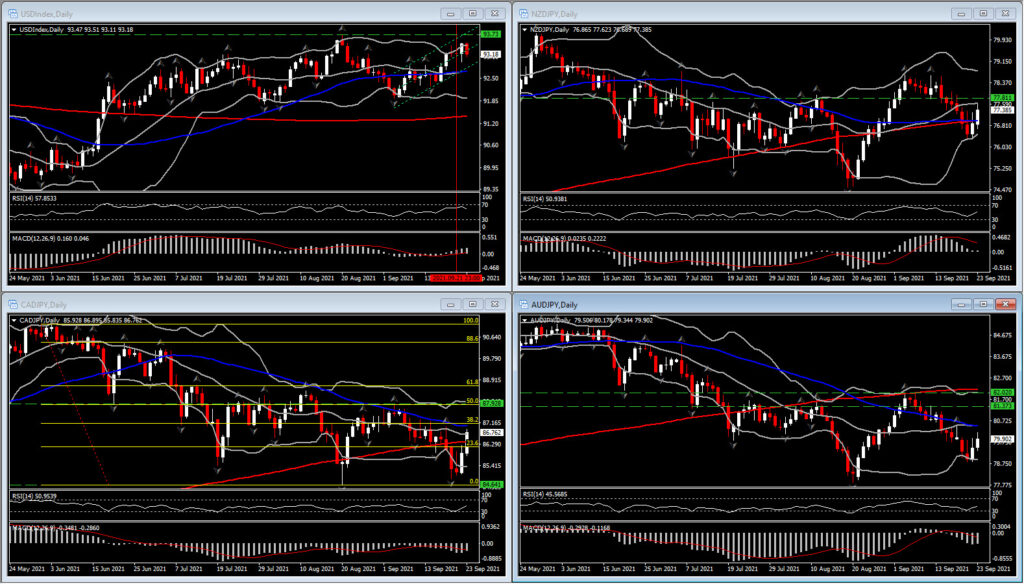

e the US Dollar reversed gains seen in the wake of the Fed’s announcement yesterday, as markets seem to slightly ignore the Fed. The Fed’s signal that tapering will commence as soon as November largely fitted the consensus view in terms of the timeline. Equity markets took the Fed’s signal in stride, but noted the modestly hawkish bent, which was perhaps a more committed level of guidance than most had anticipated though still largely fitting the consensus view in terms of the timeline of tapering. The potential that it could end by mid-year was a little unexpected as many had it as a year-long process. The increase in 2022 dots to 9 from 7 was also on the hawkish side, though balanced by the 9 who do not expect action.Following FOMC, BoJ and SNB (all mostly uneventful), but mainly due to the Evergrande headlines, USDJPY posted a 3-day high at 110.00. Remember that the Yen is a low yielding currency of a surplus economy, and tends to weaken during risk-on phases in global markets, and strengthen during times of pronounced and sustained risk aversion. Therefore greater rallies than USDJPY have been seen with commodity related currencies, such as AUDJPY, CADJPY and NZDJPY.

Other than AUDJPY, in the other two crosses we can identify an early outlook shift, as both retest significant resistance levels. CADJPY was successful in piercing the 20- and 200-day SMA, while currently managing to be resilient enough to hold above the 86.50. The 85.00 area remains however a key medium term support level for the asset as the bulls have found significant footing since June.

The RSI flirts with the 50 zone pointing higher but both RSI and the MACD have to show convincing improvement in order to prove that the nearly 5-month downtrend pattern has run out of steam. Key is the convergence noticed between the price action and the higher lows in both RSI and MACD lines since July, indicating that the asset might reverse in the next few weeks or months. Nevertheless, if the price manages to break the 87.00 level, which has played a resistance role with the help of the 50-day SMA and 38.2% Fib. retracement levels since May, which are hovering around the same location, this could gear up to August’s and July’s ceilings of 88 and 88.70, respectively.

NZDJPY meanwhile, other than the retest of 20-day SMA at 77.65, and returning more than 50% of the downleg from 78.63 to 76.26, is also extending northwards of 50- and 200-day SMA. So is this a continuation of August’s rally?

For now, momentum indicators present a slight decrease of bearish bias, with RSI at 52 and MACD holding negative even though it’s getting closer to the 0 zone. Key resistance remain the 20-day SMA and August peak, at 77.65 and 77.90 respectively.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.