Market News

- USD (USDIndex 93.52) rallies following FOMC – Taper possible from November, first rate rises now brought forward into 2022, Evergrande due to pay local bondholders today, shares rise in HK.

- Yields flattened as 5yr up 30 yr down – (10yr closed higher at 1.336%) trade at 1.329% now.

- Equities rallied over 1%, sentiment rises but Evergrande worries persist (HSBC, UBS & Blackrock – exposed to a total of $875m). USA500 +41 (+0.95%) at 4395. USA500.F flat at 4396. Dow +1.00%, Nasdaq +1.02%. Nikkei (closed) & China higher. VIX tumbles to 21.62.

- USOil continues to recover broke $72.00 – inventories in line (-3.5m barrels). GS talk of $85+ if there is a cold winter

- Gold dropped to $1760 but has recovered to $1764.

Overnight – FED Highlights – We now have 9 forecasts of a 2022 rate hike instead of 7, with 9 instead of 11 now expecting no change. From the dots, it’s clear that the large majority of policymakers want to start raising rates in late-2022 & get back to near-normal by 2024. GDP, saw trimmings for the Fed’s 2021 central tendency to 5.8%-6.0% from 6.8%-7.3%, 2021 headline and core PCE chain price central tendency boosts to 4.0%-4.3% and 3.6%-3.8% respectively. 2021 jobless rate central tendency boosts to 4.6%-4.8%. POWELL – “substantial further progress” has been met for inflation, but there is more uncertainty surrounding the maximum employment goal. Powell noted a split among the FOMC whether employment has improved satisfactorily. He thinks it has “all but been met”. Tapering “could end around the middle of next year.”

AUD PMI’s stronger than expected but remain very weak (Services only 44.9).

European Open – The December 10-year Bund future is down 21 ticks, the 30-year future meanwhile has moved higher with Treasury futures. DAX & FTSE 100 futures are up 0.5% with risk appetite strengthen post-Fed and amid easing concern on Evergrande, at least for now. In FX markets both EUR and pound strengthened against a steady to lower dollar. Investors are likely to remain cautious ahead of the local central bank announcements from BoE, SNB and Norges Bank today. EURUSD at 1.1715 & Cable at 1.3653. USDJPY recovered to 109.86.

BoE Preview: Expected to keep policy settings on hold, but minutes will be watched carefully especially with 2 new MPC members – Catherine Mann (Centrist) & Huw Pill (Hawkish). The central bank already signaled a more hawkish outlook on rates at the previous meeting, which to a certain extent pre-empted the jump in inflation and tightness in labour markets that were the key message of last week’s economic reports. However, retail sales numbers were pretty dismal & consumers are facing higher taxes as well as a phased out wage support, with the phasing out of the furlough scheme a key factor for the BoE’s policy decision going forward. On top of this the country is facing an energy crisis that is having unexpected knock on effects also for the food sector. The central scenario at the moment is for the labour market to remain tight & wage growth strong, as companies are increasingly forced to up wage offers to attract staff. Against that background, the first rate hike could come in H1 2022, depending on virus developments & how the energy market gets through the winter.

Today – SNB, Norges Bank (rate hike likley), BoE, CBRT & SARB rate decisions, Eurozone, UK & US flash PMIs, US Weekly Claims, Canadian Retail Sales, ECB’s Elderson.

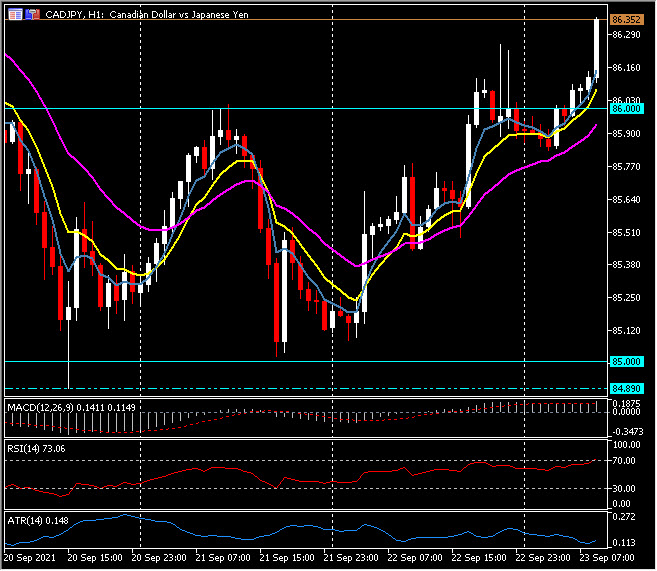

Biggest Mover @ (06:30 GMT) CADJPY (+0.38%) 3 days in row! Breaks two day high t 86.00 and rallied to 86.32 now. Faster MA’s aligned higher, MACD signal line and histogram broke 0 line yesterday, RSI 72.96 OB but still rising. H1 ATR 0.150, Daily ATR 0.695.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.