USDCAD, H4

Amid the ongoing pandemic, the Canadian provincial government has relaxed restrictions in several regions across the country, directly affecting the retail sector. Given the growing restrictions, retailers and consumers have adapted to changing business conditions.

Canadian retail sales reportedly fell -0.6% to CAD 55.8 billion in July, better than expectations for a -1.2% monthly decline. This was the third decline in four months, driven by lower sales at food and beverage stores (-3.4%) and building materials and garden equipment and supplies dealers (-7.3%). Sales decreased in 5 of the 11 subsectors. Based on previous estimates, sales rose 2.1% m/m in August. Sales decreased in 5 of the 11 sub-sectors, representing 38.7% of retail trade. Core retail sales excluding gas stations and dealerships of motor vehicles and parts fell 1.3%. In terms of volume, retail sales fell 1.1% in July.

Given the rapidly evolving economic situation, StatCan provided a preliminary estimate of retail sales, which shows that sales increased 2.1% in August. Due to its preliminary nature, this figure will be revised. This unofficial estimate is calculated based on the responses received from 50.4% of the companies surveyed. The average final response rate for the survey over the previous 12 months was 90.6%.

Meanwhile, US Initial Jobless Claims rose 16,000 to 351,000 in the week ended September 18, above expectations of 317,000. The four-week moving average of initial claims fell -750 to 335.75k. Continuing claims rose 131,000 to 2.845million. The four-week moving average of continuing claims fell -16k to 2.804million, the lowest since March 21, 2020.

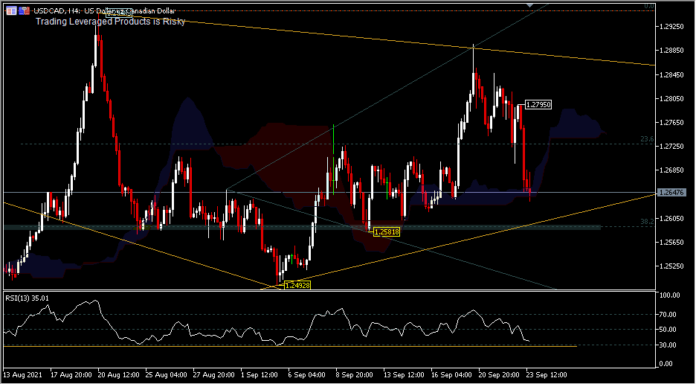

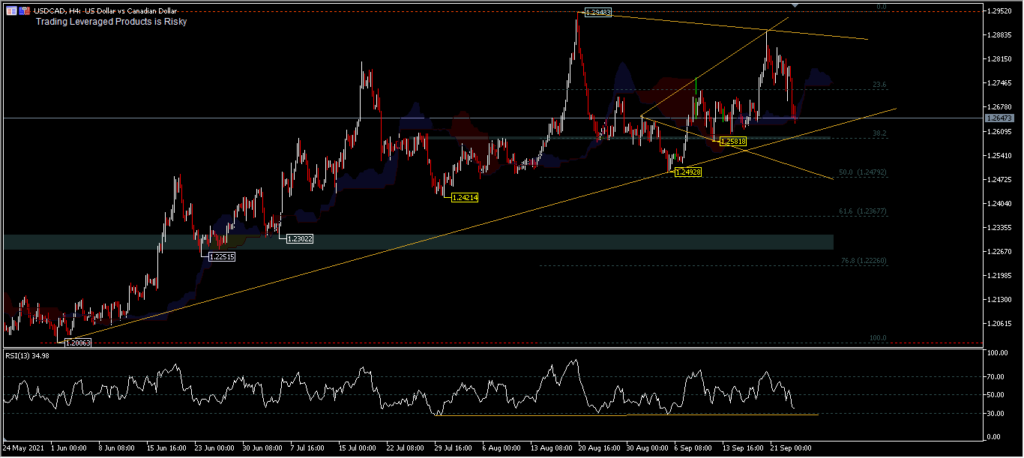

The US Dollar currency pair against the Canadian Dollar continues to move as part of the correction from the 1.2006 rebound. At the time of writing the estimated exchange rate of the US Dollar against the Canadian Dollar is 1.2647. Kumo is still showing a near-term bullish trend for the pair. Prices retested last Friday’s lows, indicating pressure from sellers. The downside will test the support level near the 1.2581 area (38.2% FR) near the trendline. A rebound is possible in this area, with indications given by the RSI approaching oversold levels, to continue the advance with a potential target around the 1.3000 level. However, a break of the trendline will lead to a deeper correction to the level of 50.0% FR at 1.2479.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.