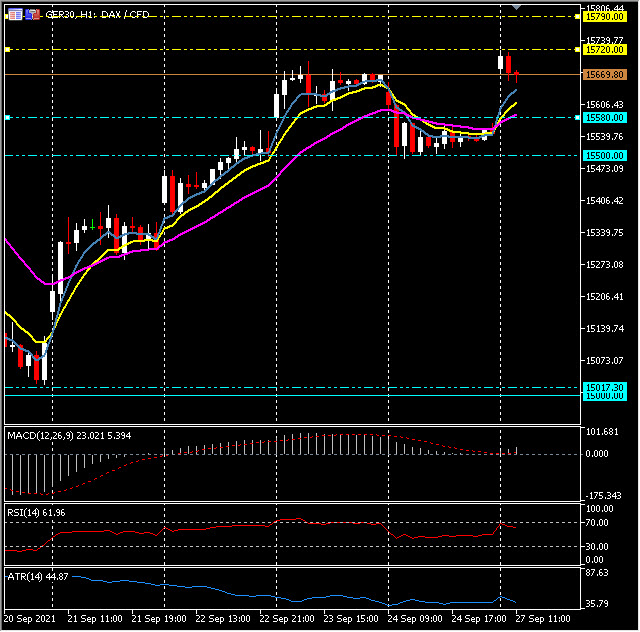

GER30, H1

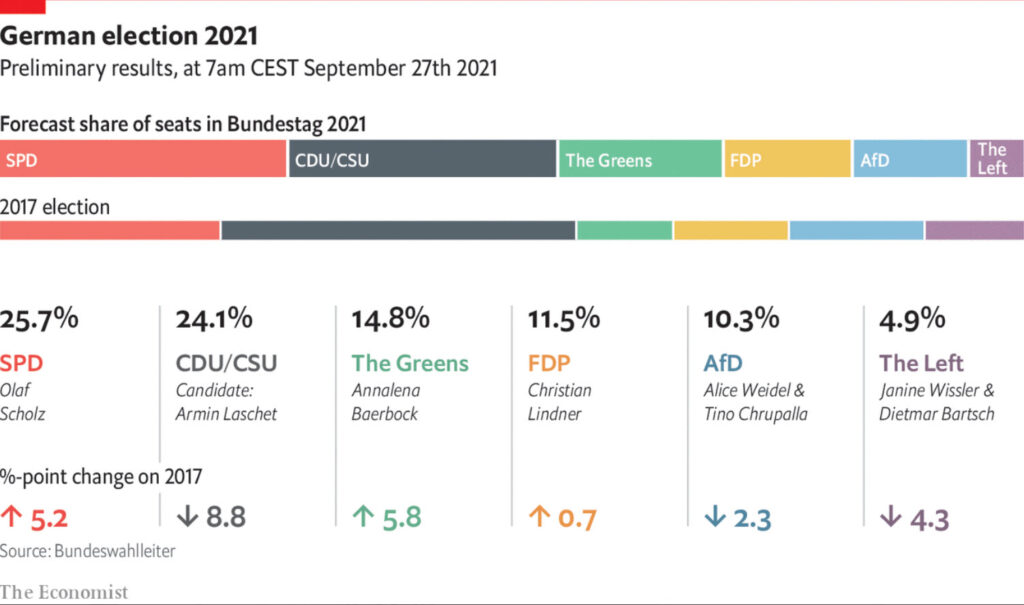

The German election brought a narrow victory for the Social Democrats (25.7%), but no outright majority, which means the country is now facing lengthy coalition talks. The Conservatives are pretty close behind (24.1%), but it was still a humiliating defeat that ends the Merkel era. As the Left Party failed to pass the 5% hurdle the only alternative to a repeat of the grand coalition between the CDU/CSU and the SPD are coalitions with both the FDP (11.5%) and Green Party (14.8%). Indeed, the liberals and the Greens together have more seats than either of the big two and it seems they will dictate the momentum now, with signs that they will first talk to each other before entering discussions with either the SPD or the CDU/CSU faction. The FDP clearly favours a pact with the conservatives, but ended similar three way talks after the last general elections in a huff and it remains to be seen what happens this time.

What is clear is that Germany is now facing lengthy coalition talks and any resulting three way coalition is likely to be a pretty fragile one. SDP leader Olaf Scholz talked of a Christmas target for completion of talks; what that means for the Eurozone and the EU remains to be seen, but Merkel’s departure has clearly removed one stability anchor – at least in the eyes of many investors. Still, if Scholz, who has been Germany’s Finance Minister over the past few years, becomes Merkel’s successor, that would mean stability in a way as Scholz has long been a big player also at the international stage.

In early trading today German Bunds are moving higher in tandem with US Treasuries, but while the German 10-year rate is down -1.1 bp at -0.24%, the UK 10-year has lifted 0.6 bp to 0.93%. European stock markets are broadly higher, with the German GER30 outperforming and up nearly 1%, despite the unclear election result. The final Monday of September is typically one of the weakest days of the entire year for equity markets, however, with US500.F higher at 4456 and the UK100.F holding 7,040, 10 pts above Friday’s close, this Monday may be a little different.

Technically, the GER30 fell on Friday, before finding support at 15,500, closing lower for the day at 15,545. Today the market gapped on open to post 15,720 highs. Initial support at the 21-hour EMA sits at 15,580 and below there the Friday low. Above today’s high the next resistance is at 15,790 and the September high at 15,928, shy of the all-time high at 15,986.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.