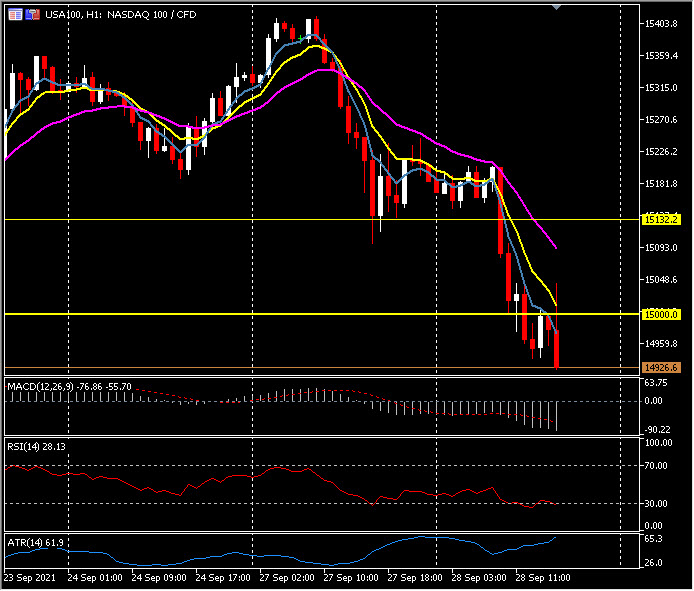

USA100, H1

Fed Chair Powell will testify (later today) that the economy continues to improve, according to his written testimony released Monday. He will add that the labour market has gained too, but the pace has slowed the last several months due to the rise in Covid. Meanwhile, supply constraints are restraining some activities. He added inflation is elevated and is likely to remain so in coming months due to the reopening of the economy and bottlenecks in some sectors. He acknowledged that these effects have been “larger and longer lasting than anticipated, but they will abate and as they do, inflation is expected to drop back toward our longer-run 2% goal.”

The advance indicators report revealed an unexpected widening in the August goods trade deficit trade deficit to $87.6 bln from $86.8 bln in July and an all-time high of $92.0 bln in June. August exports matched assumptions, but imports beat estimates by $3.6 bln, leaving a big downside net export surprise via a wider than assumed August trade balance.

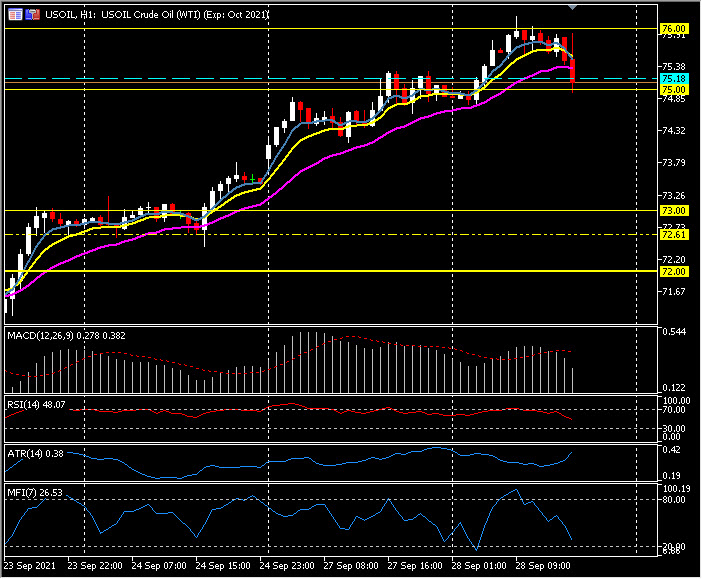

The rally in the USD continued in to the US Open with Cable being the biggest mover trading as low as 1.3530 from opening trades today at 1.3715, EM currencies came under the spot light too as USDTRY hit new all-time highs at 8.8876 and the Rand sank further as USDZAR hit 15.1100. US Yields were the main catalyst as the 10yr hit 1.54% and the 30yr broke over 2.00% and even tested 2.10%. This resulted in further selling of the interest rate sensitive technology sector as the USA100, sank under 15,000 and the main markets were all down over 1% at the US Open. USOil continued to rally on supply chain bottlenecks and inventory drawdowns and spiked over $76.00 earlier before cooling to $75.00.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.