BlackRock, Daily

BlackRock’s third-quarter earnings report is due on October 13, 2021. Considering the previous quarterly report, this guide will forecast the company’s third-quarter earnings report. BLK is the world’s largest fund managing company with a total of $9 trillion in assets. Strong fee growth and income from technology services helped BlackRock’s second quarter profits climb 28% to $10.03 per share. The company’s iShares exchange-traded fund now has $3 trillion in assets, up from $2.8 trillion in March.

Earnings increased to $1.55 billion in the second quarter on $4.82 billion in revenue. Last year, on revenue of $4.39 billion, BlackRock made $1.2 billion, or $7.77 per share [1]. Revenue from investment advisory, administration fees, and securities lending rose $165 million in the first quarter of 2021, owing to organic growth, the favorable impact of market beta and fluctuations in exchange rates on average AUM, and the effect of one extra day in the quarter, slightly driven by increases in yield-related fee waivers on certain money market funds [1]. Securities lending revenue climbed to $140 million in the first quarter of 2021, up from $127 million the previous quarter. Performance fees rose $228 million from the second quarter of 2020 to the first quarter of 2021, owing to higher income from liquid and illiquid substitute goods. Revenue from technology services rose $38 million in the second quarter of 2020, owing largely to increasing revenue from Aladdin service. It is an electronic wealth management system created by BlackRock back in 2013.

BlackRock announced $10.03 earnings per share (EPS) in the previous quarter, beating the analysts’ average of $9.33 by $0.70 [1]. BlackRock’s earnings are anticipated to rise 13.91% this year, from $38.24 to $43.56 per share. In addition, despite the Covid-19 issue, BlackRock’s earnings exceeded expectations in all four quarters of 2020

The company’s asset base has increased over the previous year, and this trend is expected to continue in 2021. In FY2021, total revenues are anticipated to reach $18.3 billion. For the third quarter of 2021, BLK’s net income margin is around the same level as in Q3 of 2020[2].

BlackRock Inc. Stock Analysis

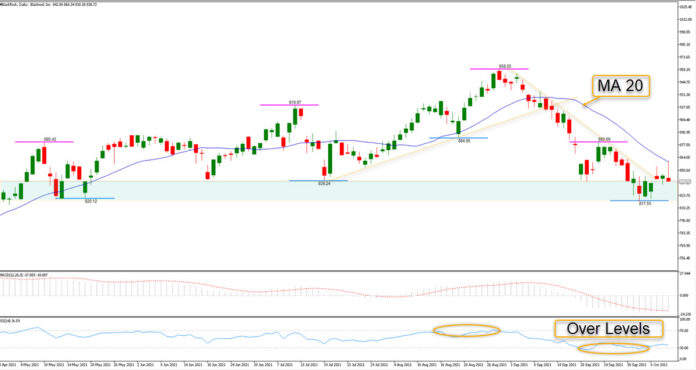

Although the stock did manage to gain some ground in the third week of September, it was a short-lived upside. The stock plummeted again during the last week of September, hitting a low of 818, which was previously seen in May. The stock price is below the 100-day moving average on the daily chart, and the MACD is showing a downward trajectory. This suggests a bearish trend. The next support for the stock lies around 817, a level which it hit in the first week of October. If the price falls below this level, it could deteriorate below the 800-mark. On the other hand, the stock’s resistance lies around 880, a level which it crossed late in September. If the price breaches this level, it could climb towards or even above the 900-mark [3].

Click here to access our Economic Calendar

Adnan Rehman

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.

- https://s24.q4cdn.com/856567660/files/doc_financials/2021/Q2/BLK-2Q21-Earnings-Release.pdf

- https://www.marketbeat.com/stocks/NYSE/BLK/earnings/

- https://finance.yahoo.com/quote/BLK/